Well, hello there! Bitcoin just decided to throw a party and invited everyone over $124k, because why not, right? 🎉 It’s all thanks to the whispers of a Fed rate cut in September, which got a little boost from July’s U.S. CPI report. Who knew inflation could be so… exciting? 🤷♀️

- Bitcoin hit a record high of $124,000, and it’s like, “Who even needs a Fed rate cut when you’ve got me?”

- Spot Bitcoin ETFs have been more popular than a puppy at a dog park, pulling in over $1 billion in net inflows in just five sessions. 🐾

- The BTC 4-hour chart is looking like a staircase to heaven, with an ascending channel pattern forming. 🏺

According to crypto.news, Bitcoin (BTC) soared over 8.5% in the past week to $124,128 on Friday morning in Asia, setting a shiny new all-time high. It’s now hovering around $123,197, still up 32% since the start of the year and over 62% from its lowest point this year. Not bad for a digital coin, huh? 🤑

Bitcoin’s latest surge happened right after the U.S. released the July CPI report, showing inflation staying steady at 2.7%. It’s like the economy’s saying, “Sure, let’s keep things chill.” The report also noted that consumer prices only went up 0.2% from the previous month, a bit slower than June’s 0.3% increase. 📊

The CME FedWatch, a fancy tool that predicts what the Fed might do, showed a 95.8% chance of a rate cut in September after the CPI numbers came out. A rate cut means cheaper loans and more money floating around, making risky investments like Bitcoin look even more appealing. 🤑

And let’s not forget about those ETFs. SoSoValue data reveal that 12 spot BTC ETFs have attracted over $1 billion in net inflows over the last five trading days, while Ethereum ETFs pulled in a similar amount on Tuesday alone. It’s like a crypto love fest out there. 💕

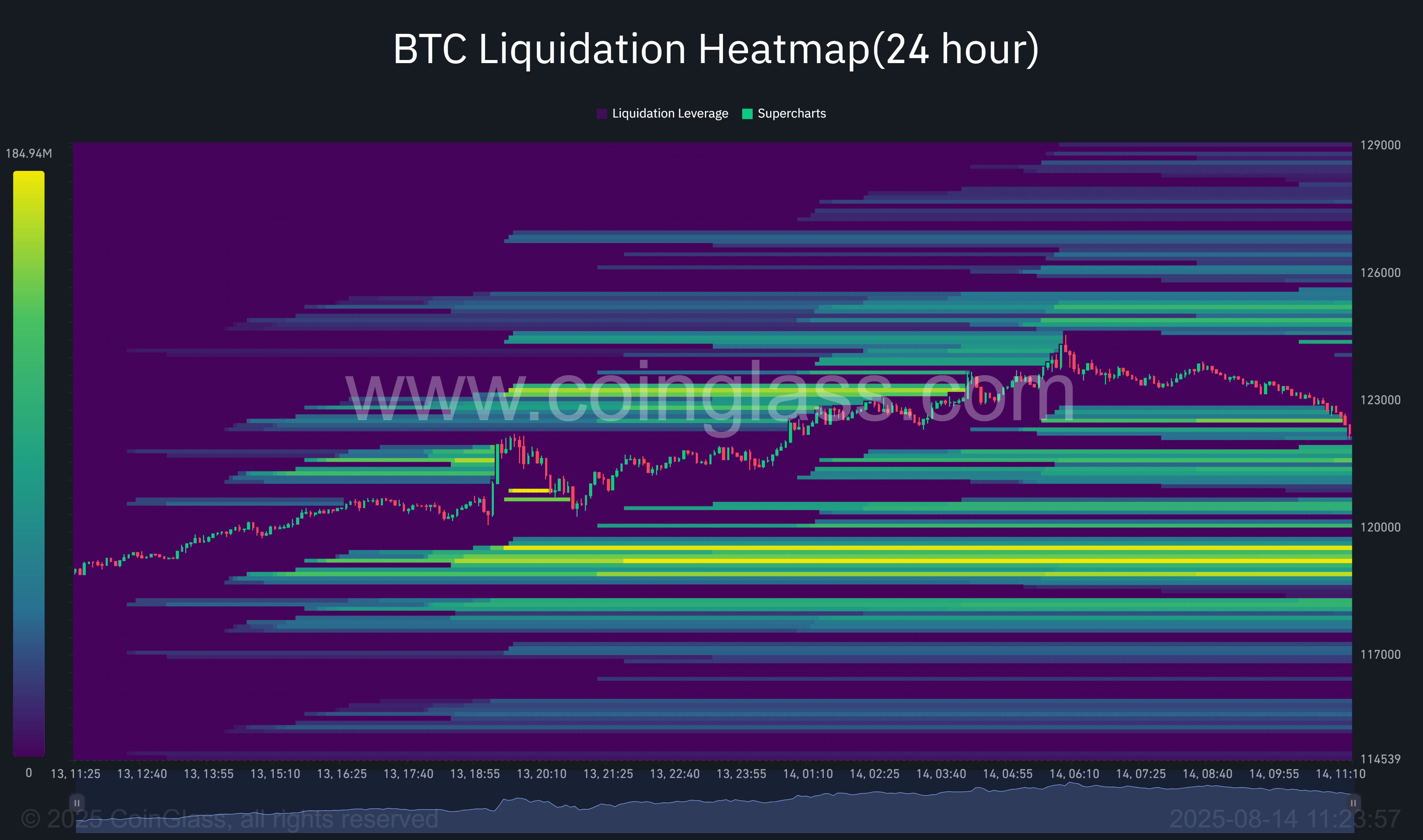

CoinGlass’ BTC liquidation heatmap shows that Bitcoin’s latest high was accompanied by a wave of short sellers getting squeezed out, especially in the $124,000-$126,000 range. These short coverings probably gave the price a nice little push. 🚀

But wait, there’s a catch! The chart also shows a bunch of long liquidations clustered around $120,000-$121,000. If the price dips back into this zone, it could trigger a wave of forced selling, sending the price tumbling. 📉

BTC Price Analysis

Bitcoin seems to have formed an ascending parallel channel pattern on the 4-hour chart, with higher highs and higher lows within two upward-sloping lines. This usually means the uptrend is here to stay. 📈

The price is currently taking a breather after hitting the channel’s upper boundary. It might dip down to around $120,500 by the end of today, but if it holds strong, it could bounce back to $127,000. Just keep your fingers crossed and maybe light a candle or two. 🕯️

The 50-day moving average crossing above the 200-day moving average is a good sign, suggesting the trend is still very much in Bitcoin’s favor. So, sit back, relax, and enjoy the ride! 🎢

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Japan’s Yen Stablecoin: Genius or Financial Disaster? 🤔

- Dogecoin’s 45% Crash: Whale Sell-Offs & Meme Coin Mayhem 🐕💸

- Bitcoin Flees, Ethereum and Friends Throw a Wild Party 🎉💸

- Roald Dahl’s Take on the Spooky Crypto Expiry!

- Trump’s Fed Shake-Up: Bitcoin’s Hilarious Reaction You Won’t Believe! 😂

- XRP’s Wild Ride & Bitcoin’s Drama: A Crypto Circus 🎪

- Crypto’s Grand Ball: Who Shall Lead the Dance in 2025? 🎩💃

2025-08-14 10:07