Oh, dear readers, gather ’round and let me tell you a tale of Bitcoin, that cheeky little scamp who’s currently perched precariously on top of something called the Bull Market Support Band. 🤔 Now, this band isn’t just any old piece of elastic; it’s like the magical safety net that’s caught Bitcoin every time it tried to take a nosedive during past bull runs. It’s the place where Bitcoin goes, “Oops, I guess I’ll bounce back up now!” 😂

Why This Level Matters For Bitcoin’s Grand Adventure

In a recent post, the illustrious Daan Crypto Trades, a full-time crypto trader and investor with a flair for the dramatic, pointed out that our friend Bitcoin is currently sitting right atop this mystical Bull Market Support Band. This level has been hailed as one of the most trustworthy high-timeframe momentum indicators, kind of like the North Star for crypto traders. 🌟

Daan Crypto Trades noted that while Bitcoin has had its fair share of short-term wobbles at or slightly below this band, it has never wandered away for more than a week or two during a bull market. It’s like Bitcoin has a leash attached to this band, and no matter how hard it tries to run away, it always gets pulled back. 🐕

The broader market structure remains intact as long as Bitcoin keeps climbing those higher highs and higher lows on the larger timeframe. But, oh, if it does decide to take a little dip while still holding onto this structural integrity, it’s generally seen as a golden opportunity for investors to scoop up some discounted Bitcoin. 🤑

The Liquidity Jamboree: Will It Sink or Swim?

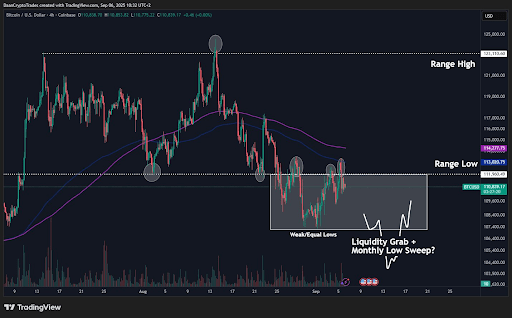

Now, here’s where things get a bit spicy. Bitcoin is showing the first bearish divergence against the Global M2 Money supply since the cycle lows began, which is a bit like spotting a dark cloud on the horizon. Saint Pump, a market expert with a knack for predicting the unpredictable, warns that a one-month liquidity pullback is expected in late September, just when the Federal Reserve (Fed) is anticipated to cut rates due to job weakness. 🌪️

This combination of a bearish technical signal and a macroeconomic liquidity event suggests that Bitcoin’s recent lackluster performance since July might continue, leading to a period of choppy price action. And just when you thought it couldn’t get any more exciting, October rolls around, marking the expected end of the four-year cycle, which historically brings a flurry of selling activity. 📉

But fear not, dear readers, because despite these headwinds, no major cycle top or euphoria signals are evident. Saint Pump hinted that the Trump Administration might just unleash a monetary bazooka through a Fed takeover to stimulate the economy before the midterms. If that happens, this cycle could extend all the way into late 2026, until inflation fears rear their ugly head once the Fed overdoes it due to political pressures. 🚀

From a technical standpoint, the best bid scenario in a sell-off lies between $93,000 and $98,000, which aligns with a retest of the weekly 55 Exponential Moving Average (EMA). This EMA has been the backbone of the bull trend since last year, so even though we’re in for some short-term volatility, the broader uptrend remains structurally sound. 🏗️

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- US Data Center Gold Rush: How AI Is Reshaping Power Markets with a Side of Humor!

- AI’s Dilemma: Will It Save Us or Sell Us Out? 🤖💸

- SOL’s Sky-High Gambit: ETF Dreams or a Crypto Mirage?

- Ethereum’s $4K Comeback: A Tale of Desperation and ETF Tears 🚨

- TAO PREDICTION. TAO cryptocurrency

2025-09-09 03:06