There it sat, the darling of the digital realm, Bitcoin, as inert as a country parson at a cocktail party, on a Thursday morning that promised nothing but the usual ennui. Three days had elapsed since its latest triumph, a new zenith reached with all the fanfare of a damp firework.

The Institutional Waltz: A Frenzy of Fiddling While Rome Trades Sideways

Behold, DDC Enterprise Limited (NYSEAM: DDC), or as it was once quaintly known, “DayDayCook,” pivoted with all the grace of a drunken ballerina from its Asian culinary farce to the high altar of bitcoin treasury, clutching a $528 million dowry. Yesterday, in a move that smacked of desperation masquerading as foresight, it announced a $124 million equity frolic to further its obsession with the digital darling. 🤑 Moral of this tawdry tale? Institutions, those stalwart guardians of the status quo, remain as bullish as a bull in a china shop, even as bitcoin takes a modest siesta from its record-breaking antics.

Norma Chu, the indefatigable chair and CEO of this financial phoenix, founded her brainchild in 2012 and dragged it, kicking and screaming, into the public eye in November 2023. The firm, a veritable hemorrhage of capital, teetered on the brink of delisting, its shares halted after a 95% plunge in April 2025. Yet, with the tenacity of a terrier and the vision of a myopic seer, Chu steered her ship into the choppy waters of bitcoin treasury, starting with a modest 21 BTC. Today, DDC flaunts 1,058 BTC, a hoard worth over $130 million, with ambitions as boundless as its past losses. 🌟

“This financing round,” trilled Chu, “contributes not only capital, but also substantial strategic value and momentum as we advance DDC’s position as a global leader in the institutional Bitcoin space.” One can almost hear the champagne corks popping in the background. 🥂

Bitcoin treasury firms are not alone in their bullish bacchanalia. Bitcoin exchange-traded funds (ETFs) now hoard a staggering $168 billion, or nearly 7% of the entire BTC market cap, according to the ever-reliable Sosovalue.com. Blackrock’s Ishares Bitcoin Trust (IBIT) has ascended to the 19th spot among U.S. ETFs, its assets under management hovering just shy of $100 billion. In short, the smart money is betting on bitcoin with the fervor of a religious zealot, daily price fluctuations be damned. 📈

A Glimpse into the Market’s Maddening Metrics

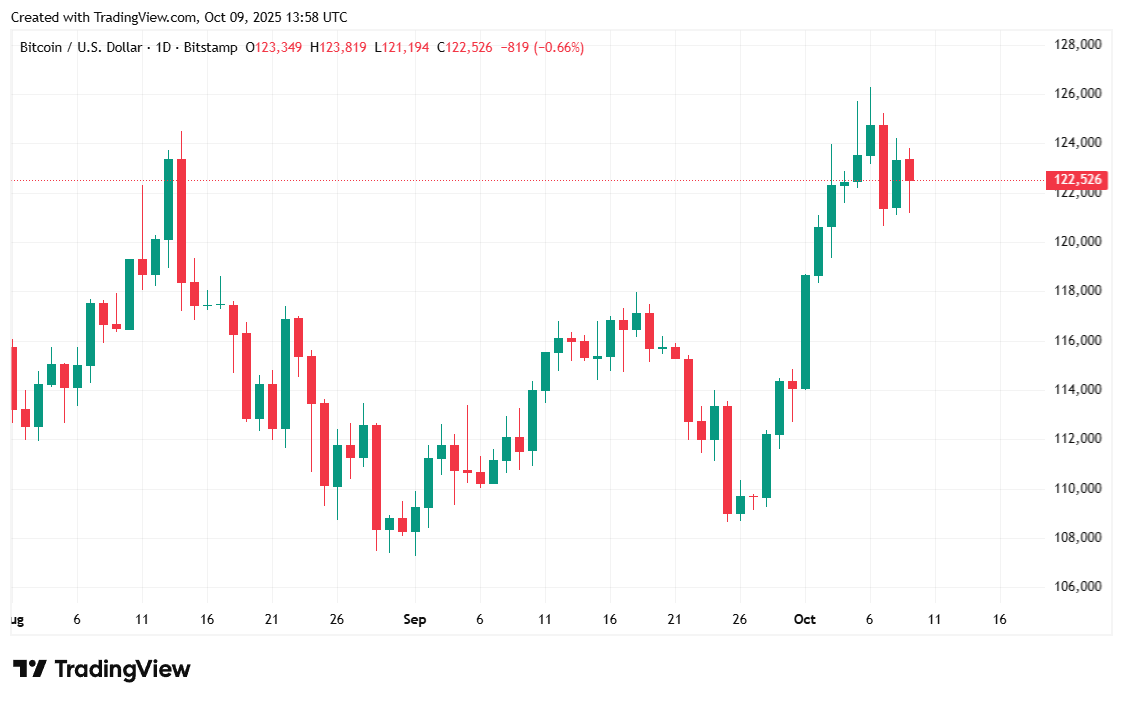

Bitcoin inched up a paltry 0.31% to $122,732.44, according to the oracles at Coinmarketcap. The cryptocurrency, ever the wallflower, also managed a 2.18% weekly gain, trading between $121,191.40 and $124,167.09 since yesterday. A thrilling spectacle, no doubt. 😴

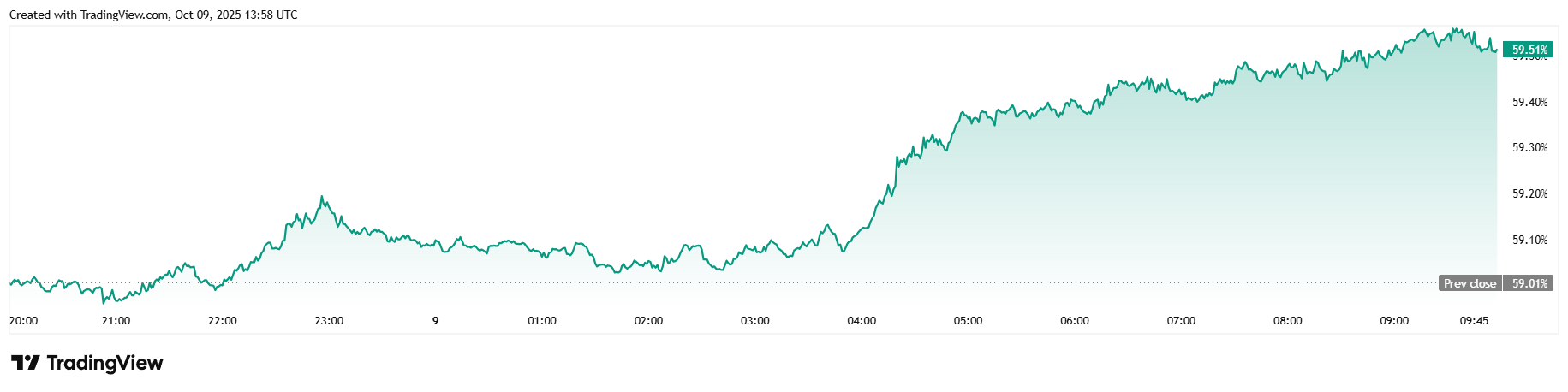

Twenty-four-hour trading volume plummeted 23.73% to $61.13 billion, while market capitalization crept up 0.11% to $2.44 trillion. Bitcoin dominance, ever the show-off, jumped 0.85% to 59.52%. 🦹♂️

Total bitcoin futures open interest dipped 0.91% to $89.73 billion, courtesy of Coinglass. Liquidations, ever the drama queens, totaled $144.69 million, with short sellers losing $79.55 million and long investors $65.14 million. A veritable bloodbath, if one squints hard enough. 🩸

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- OKB PREDICTION. OKB cryptocurrency

- Silver Rate Forecast

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- Cristiano Ronaldo’s Meme Coin: A Scandalous 15-Minute Financial Farce 🤡💸

- AVAX PREDICTION. AVAX cryptocurrency

- Hong Kong’s Stablecoin Shenanigans: The Big Circus Begins! 🎪🚀

2025-10-09 18:01