In a display of financial theatre worthy of a Bond villain’s monologue, Bitcoin has ascended once more beyond $68,000, a figure so mundane it could only excite a 1.8% gain. One might imagine the market as a drawing-room conversation-polite, predictable, and punctuated by the occasional whisper of structural intrigue. For beneath this modest ascent lies a subplot of whale-sized proportion: the great reaccumulation gambit. After months of the crypto aristocracy siphoning off their spoils with the subtlety of a tax auditor at a champagne bar, the leviathans have returned, reversing their post-October retreat with all the coordination of a well-rehearsed farce. This is not mere accumulation; it is a ballet of absorption, performed to the tune of corrective weakness.

The pressing question, dear reader, is no longer whether $68,000 will hold. That is the equivalent of wondering if a footman will remain standing at a ball. The true drama lies in whether this reaccumulation marks the prelude to a structural breakout-a crescendo in a symphony of speculative excess, or merely a minuet in the grand folly of blockchain.

Whale Accumulation Returns: And It’s Strategic (If You Ignore the Absurdity)

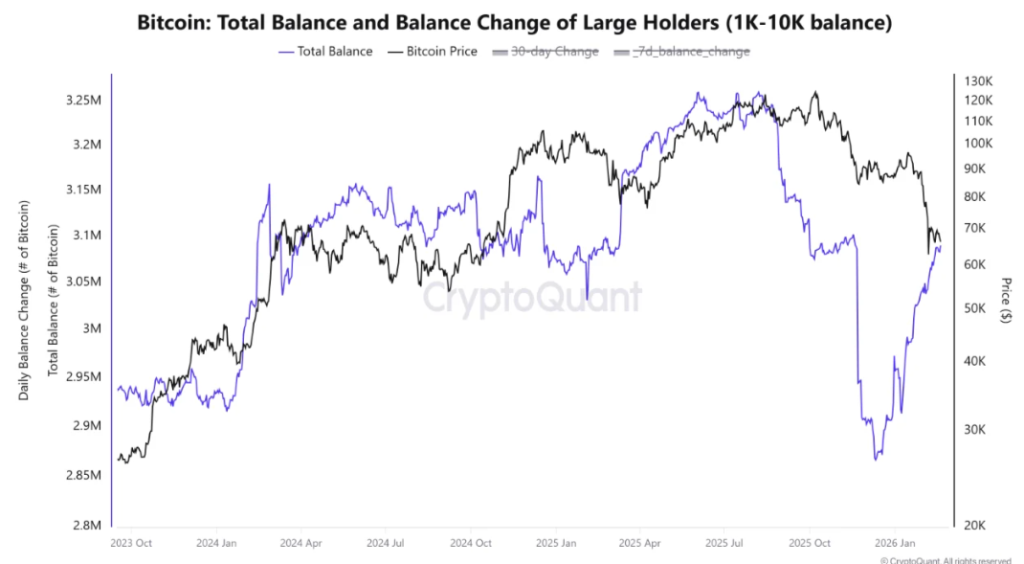

Those wallets brimming with 1,000 to 10,000 BTC-crypto’s equivalent of landed gentry-have added a tidy 200,000 BTC in a month, a feat akin to a Victorian baron acquiring an entire village. On-chain data, that modern-day scryer’s crystal ball, reveals a V-shaped recovery in reserves. Such symmetry suggests not chaos, but a plot. The previous drawdown, a tiresome phase of market exhaustion, now appears fully retraced, as if the whales had merely paused to sip their sherry before resuming their machinations.

This reversal is significant for two reasons. First, history whispers that whale distribution often heralds local tops. Their current behavior-accumulating during consolidation-is less a defensive maneuver and more a declaration of intent, like a general redeploying troops before a siege. Second, the flow is spot-driven, a preference for large transactions over retail’s chaotic flailing. Such behavior stabilizes markets like a butler steadying a wobbling tray. When 200,000 BTC vanishes into strong hands in a month, the market’s sensitivity to demand becomes as delicate as a teacup in a hurricane.

Bitcoin Price Channel Breakout: A Descent Into Ascension?

On the 1-hour chart, Bitcoin has escaped a descending channel-a geometric prison of lower highs-that had caged it near $69,800. This breakout, a technicality as thrilling as a footman’s bow, suggests short-term momentum has been neutralized. Yet, in the parlance of chartists, this matters because descending channels are merely “corrective pauses” within broader uptrends. A breakout, they claim, signals a “renewed impulse leg,” provided resistance is cleared. One imagines the technicians cheering like children at a fireworks display, though history suggests they may yet be proven wrong with the elegance of a deflated balloon.

The $69,500-$70,000 range now looms as the first supply cluster, a fortress of liquidity. Meanwhile, $71,200 remains a psychological battleground, where bulls and bears clash with the fervor of a Victorian duel. Should Bitcoin cling to $67,000, it may yet avoid the ignominy of a $65,000 retreat. But hold your breath-if you dare-for the real test lies in clearing $70,000, the threshold to $74,000-$76,000, where historical ghosts whisper of concentrated liquidity.

Sharpe Ratio Resurgence: A Return to Normalcy or Naivety?

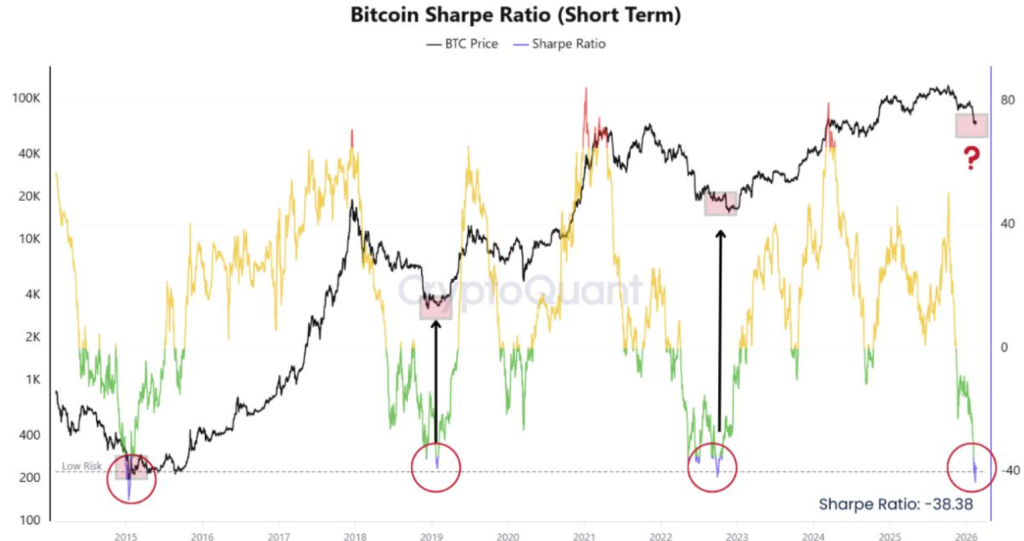

Bitcoin’s Sharpe ratio, that curious alchemy of risk and reward, has rebounded from compressed levels, suggesting the recent correction was merely a “volatility reset.” One might call it a return to normalcy, though in crypto’s world, “normal” is a concept as fluid as a sandcastle at high tide. Past troughs aligned with accumulation phases, not cycle tops-a detail one hopes the optimists remember when the next crash arrives with the subtlety of a meteor strike.

This improvement in risk-adjusted returns, coupled with controlled funding and whale accumulation, suggests normalization. Or perhaps it is merely the market’s way of saying, “We’ve learned nothing and we’re sorry.” Either way, the backdrop is “healthier” than before, though one wonders if “healthier” is merely a euphemism for “less reckless.”

Bitcoin’s Next Move: A Tragedy in Five Acts

Holding above $68,000 is not merely technical-it is symbolic, a gesture as meaningful as a white flag in a war of algorithms. With 200,000 BTC added to whale wallets, the post-October distribution has been reversed, like a clockwork orange rewinding to its most convenient state. As long as Bitcoin clings to $66,000-$67,000, the accumulation continues, a silent pact between the leviathans and the market. The pivot at $70,000 remains the crux: a weekly reclaim could align supply and technicals in a dance of bullish optimism. Failure, meanwhile, may extend consolidation, but with large holders now entrenched, downside pressure seems less a threat and more a formality.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- Dogecoin’s Descent: Will It Hit $0.13? 🐕💸

- DOGE PREDICTION. DOGE cryptocurrency

- Bitcoin Flees, Ethereum and Friends Throw a Wild Party 🎉💸

- Japan’s Yen Stablecoin: Genius or Financial Disaster? 🤔

- Dogecoin’s 45% Crash: Whale Sell-Offs & Meme Coin Mayhem 🐕💸

- 🇯🇵 Yen Stablecoins: Japan’s New Digital Samurai Sword? 🗡️💰

- Bitcoin’s Big Sigh: ETFs Flee as Miners Outpace Demand! 🐢💸

2026-02-20 15:43