So, Bitcoin‘s hovering around $112,000. Which, let’s be honest, is a staggering amount of digital nothingness. It’s been…well, not doing very much, really. Just sort of existing. Like a slightly anxious houseplant. And everyone’s nervously watching to see which way it’ll wobble next. 🤷

Bitcoin Holds the Line (For Now)

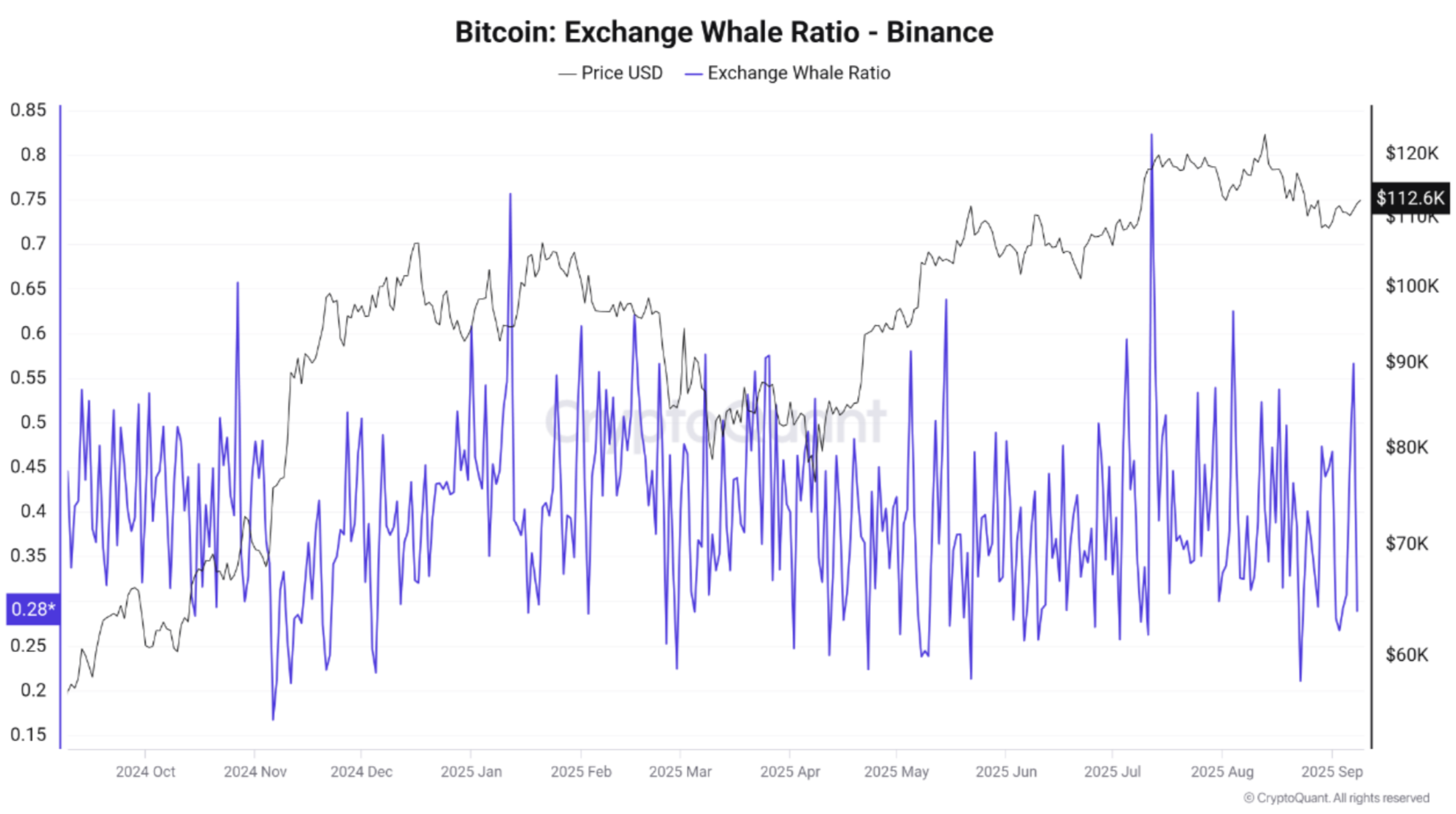

Apparently, a bunch of “whales” – people with enough Bitcoin to seriously disrupt things – were shuffling around on the Binance exchange a few days ago. This caused a little tizzy, measured by something called the “BTC: Exchange Whale Ratio” (honestly, who comes up with these names?). It spiked to 0.55, which, according to the experts, is a bit like noticing a very large shark circling your inflatable pool. 🦈

But then! The whales…stopped. Or did something else. The ratio plummeted to 0.28. And the price? Remained stubbornly at $112,500. Which is to say, all that frantic activity amounted to very little. It’s a bit like a frantic ant colony building a sandcastle only for the tide to come in.

Analysts at CryptoQuant (who presumably get paid to stare at these ratios all day), are saying this is “a positive short-term signal.” Which, translated from Analyst-speak, means “things aren’t actively getting worse.” Still, they warn that these whales are a capricious bunch and could decide to empty their wallets at any moment, causing a bit of a panic. Because why wouldn’t they?

“Frequent whale fluctuations highlight that major players are still moving large volumes – meaning risks remain…”

“We have no idea what’s going to happen.” They also admit that the whale ratio isn’t always reliable, because apparently, crypto whales are more unpredictable than actual whales.

Apparently, if the whale ratio goes above 0.5 for *days* – and people start sending Bitcoin to exchanges – we could be looking at a drop to $108,000. Which, you know, is still a lot of money, but not quite as impressive. Historically, September is apparently uneventful and gives whales an opportunity to wreak havoc. Lovely.

Is This the Top? (Don’t Ask Me)

Bitcoin is currently a depressing 10% below its recent peak. But some “experts” – and I use that term *very* loosely – think it could go as high as $200,000 – $290,000 in 2026. This is, of course, based on absolutely nothing concrete, just a lot of hopeful speculation. 🔮 At the moment, it’s trading at $112,639, which is…down 0.1% from yesterday. Riveting, isn’t it?

So, to recap: Bitcoin is expensive, volatile, and largely driven by the whims of anonymous individuals with too much money. And no one, *absolutely no one*, knows what’s going to happen next. But hey, at least it’s interesting. Sort of. 😅

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- 2025: The Year the World Went Crypto Crazy (And Everyone Loved It)

- US Data Center Gold Rush: How AI Is Reshaping Power Markets with a Side of Humor!

- ETH PREDICTION. ETH cryptocurrency

- Steinbeck’s Take on Dogecoin’s Wild Ride 🐶🚀

- AI’s Dilemma: Will It Save Us or Sell Us Out? 🤖💸

2025-09-10 06:06