In a move that makes even the most jaded financial analyst raise an eyebrow, corporate and institutional Bitcoin treasuries decided to play the stockpile game in August 2025. They added a staggering 47,718 BTC, bringing their total “hoard” to 3.68 million BTC. For context, that’s enough to buy every croissant in France and still have change for a espresso. 🥐☕

Bitcointreasuries.net Unearths 17 New Entities – Because Why Not?

The August frenzy added $5.2 billion at the month-end price of $108,695 per BTC, while the full 3.68 million BTC stash is now worth roughly $400 billion. That’s enough to make a small country weep with envy (or maybe panic). The categories? Public companies, private firms, governments, ETFs, and DeFi – which is just regular finance with more acronyms and less accountability. 🤷♂️

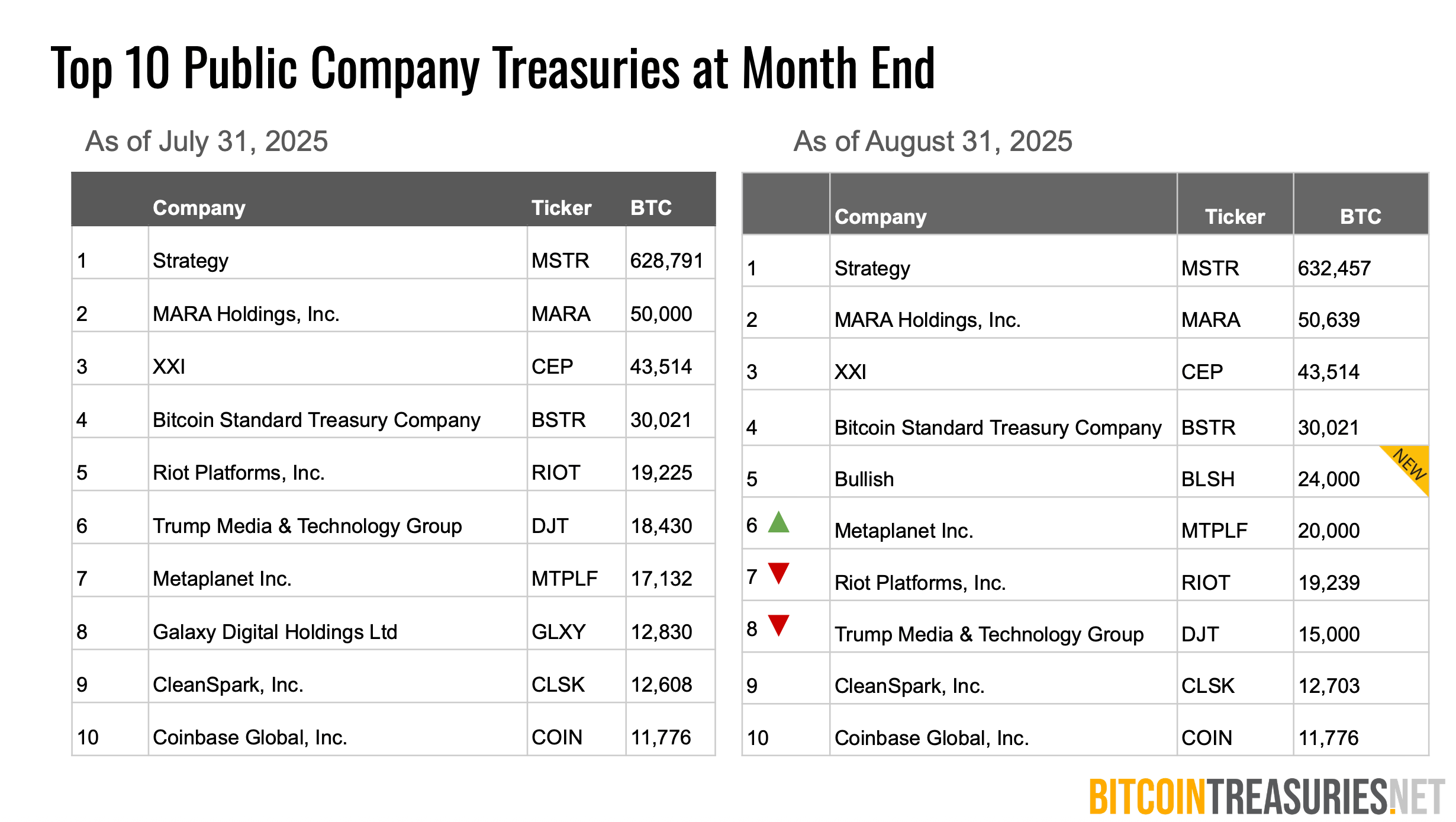

According to Bitcointreasuries.net, public company balances have roughly doubled since late 2024. Early September data showed public treasuries hitting 1 million BTC, valued at $111 billion. Corporate listings have nearly doubled since January as more firms throw caution to the wind and adopt Bitcoin treasury programs. Because nothing says “financial stability” like buying crypto. 💸

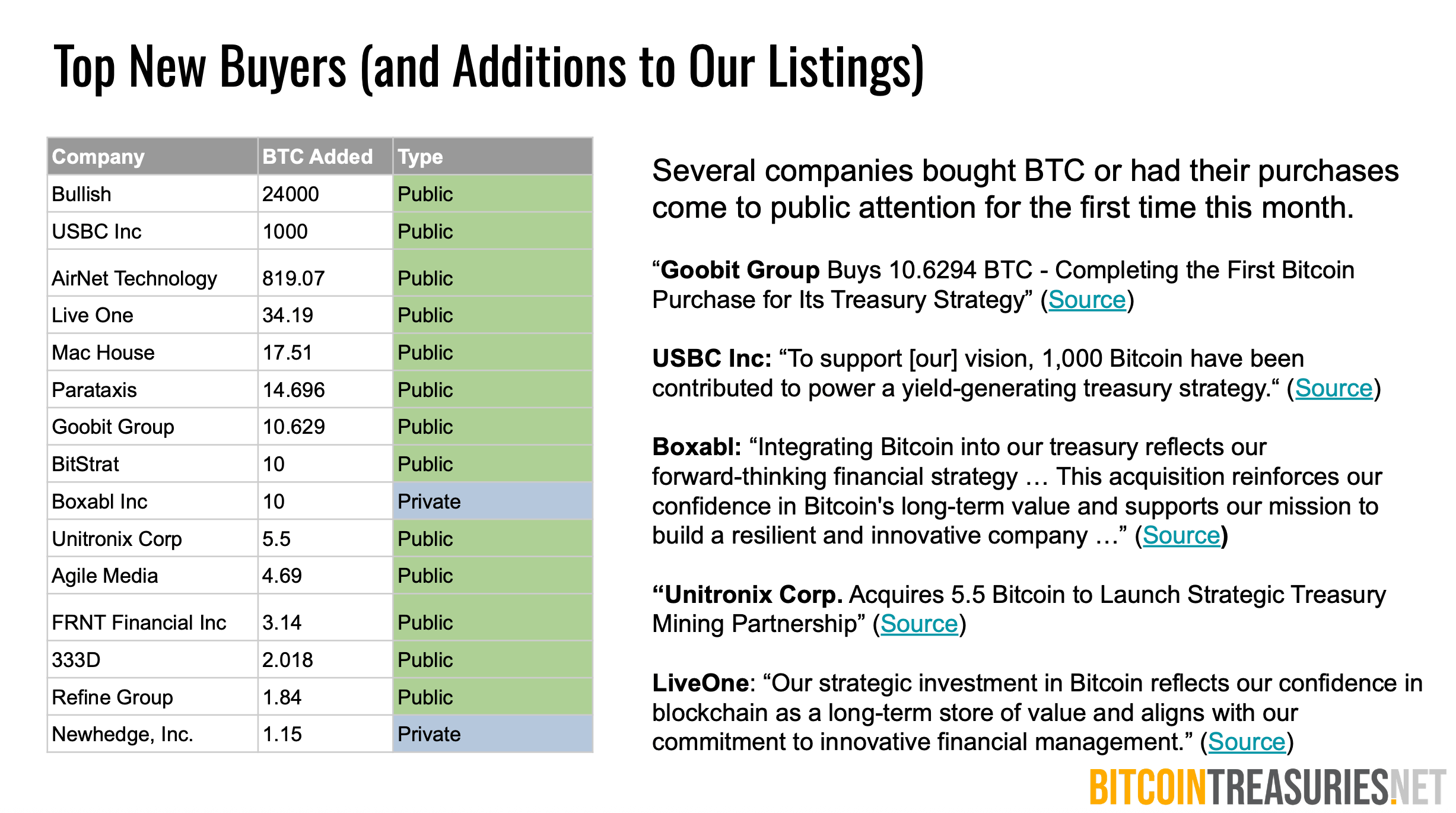

The month’s biggest splash? Crypto exchange Bullish, which added 24,000 BTC after its IPO. That’s enough to make your average startup founder faint. Other notable additions: KindlyMD (5,744 BTC), Strategy (3,666 BTC), Galaxy Digital (2,894 BTC), and Metaplanet (1,859 BTC). If you’re keeping score at home, you’re already confused. 🤯

Metaplanet, based in Japan, executed four transactions in August, boosting its holdings to 18,991 BTC. It’s now the sixth-largest public treasury. The company also announced plans to raise 555 billion JPY (about $3.7 billion) and another $880 million via an international share offering. That’s enough to buy a small asteroid belt, probably. 🌌

Fundraising plans went full-on Wall Street in August, with programs exceeding $15 billion. Strategy launched a $4.2 billion at-the-market program. KindlyMD is raising $5 billion to fund its Bitcoin obsession. Metaplanet is doing JPY stuff and share sales. And Parataxis is trying to pull off a SPAC deal that could add $640 million. Because why not? 🚀

Bitcointreasuries.net added 17 new entities, mostly public. Of the 174 tracked companies, 95 are crypto outsiders. Yet, crypto-native firms still hold three times as much Bitcoin as the newcomers. Go figure. 🤔

About 10 of August’s additions were U.S.-based or listed. Nasdaq’s new rules in September added a layer of “fun” with shareholder-approval hurdles for crypto-treasury funding. Strategy claims its activities are “unaffected,” but we all know that’s just corporate speak for “we’ll cross that bridge when we come to it.” 🚧

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- US Data Center Gold Rush: How AI Is Reshaping Power Markets with a Side of Humor!

- Ethereum’s $4K Comeback: A Tale of Desperation and ETF Tears 🚨

- 2025: The Year the World Went Crypto Crazy (And Everyone Loved It)

- Bitcoin Takes a Nosedive, Heads for Uplift? 😱📈

- XRP Price Tale: The River That Rises

2025-09-09 23:43