Ah, the human condition! In a world where the soul is bartered for fiat currency, Bitcoin emerges as the savior of the damned. According to a new Bitwise report, this digital Messiah may outperform every major asset over the next decade, boasting a 28% annual growth rate. 🌟 The firm, with a straight face, cites rising institutional demand, scarce supply, and the growing despair over fiat currency debasement as the holy trinity driving this rally. How divine! 🙏

- Bitwise, in its infinite wisdom, projects Bitcoin could grow 28.3% annually, potentially reaching $1.3 million per BTC by 2035. A mere trifle for the enlightened investor! 💎

- The drivers? Oh, just $1-5 trillion in institutional demand, 94.8% of the 21 million BTC already in circulation, and the U.S. debt ballooning by $13 trillion in five years. Nothing to see here, just the collapse of modernity! 🤡

- With a low 0.21 correlation to equities, Bitcoin stands as a beacon of hope in a sea of financial despair. Truly, the last lifeboat on the Titanic! 🚢

Bitcoin (BTC), that elusive phoenix of the digital age, may be poised for another grand leap, according to the soothsayers at Bitwise Asset Management. Over the next decade, they proclaim, BTC will outshine every major asset, with a compound annual growth rate of 28.3%. In a 24-page manifesto, Bitwise reveals its sacred thesis: institutional demand, limited supply, and the creeping dread of fiat money debasement. How Dostoevskian! 🖋️

The first factor, institutional demand, is a tale as old as time itself. Unlike private equity or credit, which wooed institutions first, Bitcoin’s rise was led by the unwashed masses-retail investors. Nearly 95% of all Bitcoin is already owned by these plebeians, leaving institutions with barely a crumb. But fear not! Now that the suits are finally taking notice, a tidal wave of demand is upon us. 🌊

“The World Bank believes that institutional investors control roughly $100 trillion in total assets. In the coming decade, we believe these investors will allocate between 1% to 5% of their portfolios to bitcoin, meaning they will need to buy $1 trillion to $5 trillion of bitcoin.”

-Bitwise, the modern-day Nostradamus 📜

By comparison, Bitcoin ETPs currently hold a paltry $170 billion. A drop in the ocean of what’s to come! 🌍

Scarce supply

Ah, scarcity-the siren song of the crypto world! Bitcoin’s supply is capped at 21 million, and 94.8% is already in circulation. New BTC is produced at a snail’s pace, with annual issuance dropping to 0.2% by 2032. Unlike gold or oil, Bitcoin’s supply cannot be inflated to meet demand. How poetic! 🖤

As Bitwise notes, the collision of institutional greed and limited supply is a recipe for financial euphoria. Simple economics, they say. But is it not also the stuff of existential dread? 🤔

Finally, Bitwise points to the specter of fiat currency debasement. The U.S. federal debt has swollen to $36.2 trillion, with annual interest payments reaching $952 billion. As interest rates soar, traditional currencies tremble. Bitcoin, they claim, is the lifeboat in this sinking ship. 🛳️

“The combination of these three factors-institutional demand, limited supply, and rising concerns about fiat debasement-allows bitcoin investors to benefit as bitcoin earns an increasing share of the store-of-value market.”

-Bitwise, the harbinger of financial doom 🦉

Valuation model

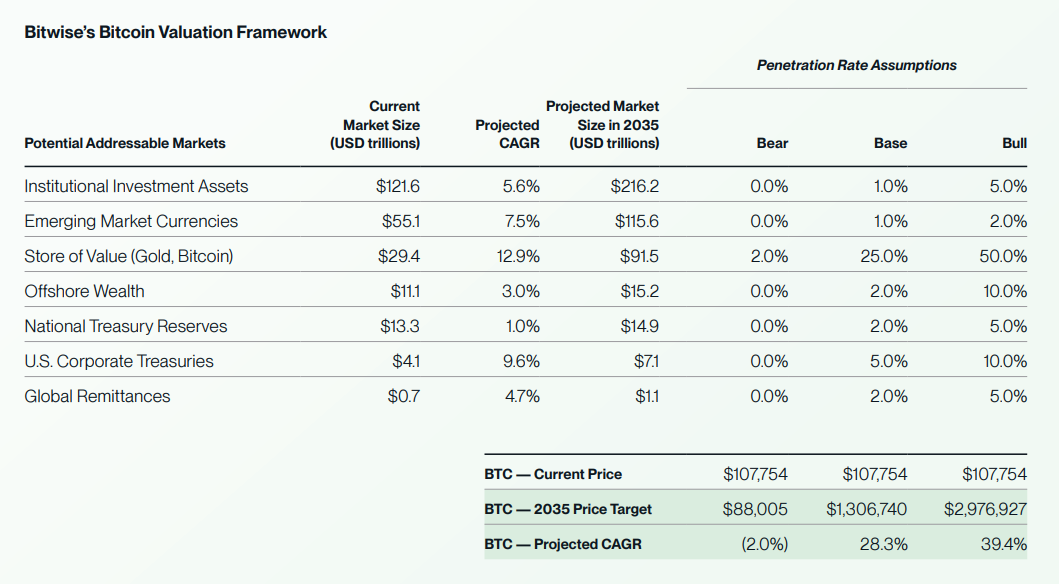

To divine Bitcoin’s future price, Bitwise employs a Total Addressable Market approach, gazing into the crystal ball of markets Bitcoin can conquer. Gold, corporate treasuries, offshore wealth-nothing is beyond its reach! 🌌

Based on conservative assumptions, Bitwise forecasts a 2035 bitcoin price of $1,306,740, a 28.3% CAGR. Bear and bull cases range from $88,005 to nearly $3 million. But remember, these are mere prophecies, not guarantees! 🔮

Bitwise simplifies Bitcoin’s value: it offers a service-storing wealth digitally without banks or governments. The more who desire this service, the more valuable Bitcoin becomes. If no one cares? Its value is zero. How existential! 🕳️

Four-year cycle is dead now

Bitcoin’s low correlation with other assets adds another layer of allure. Over the past decade, its average correlation to U.S. equities has been just 0.21. Even when equities plummet, Bitcoin rebounds like a phoenix from the ashes. 🦅

The blend of scarcity, institutional interest, hedging potential, and low correlation makes Bitcoin a siren call for long-term investors. Yet, Bitwise warns, the four-year cycle may be no more. The old gods are dead; long live the new! ⚰️

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- Bitcoin Plunges: Is $70K the New Rock Bottom? 🚀💸

- Cristiano Ronaldo’s Meme Coin: A Scandalous 15-Minute Financial Farce 🤡💸

- Kraken & Deutsche Börse: A Match Made in Financial Limbo! 🦑💼

- XRP Staking: A Tale of Tension and Tokens 🚀

2025-08-27 22:00