In the shadowy tavern of the financial markets, Bitcoin sat tall and proud for years—now, the air changes. The Bitcoin Dominance Index (BTC.D), that grave barometer of crypto’s lawless land, tumbles by 6.30%. The king stumbles—just a little, mind you, but enough for the court jesters to sharpen their knives and the altcoins in rags to grin from their alleyways.

The scribes—called “technical analysts” by gentlefolk—whisper in cracked voices: “Altseason is nigh!” They mutter of 3–6 month timelines with the careful hope of gamblers at midnight, clutching metaphors in sweaty palms. Is this 1917 for Bitcoin? Or just another winter’s mirage?

When Bitcoin Dominance Slinks Off Into the Night…

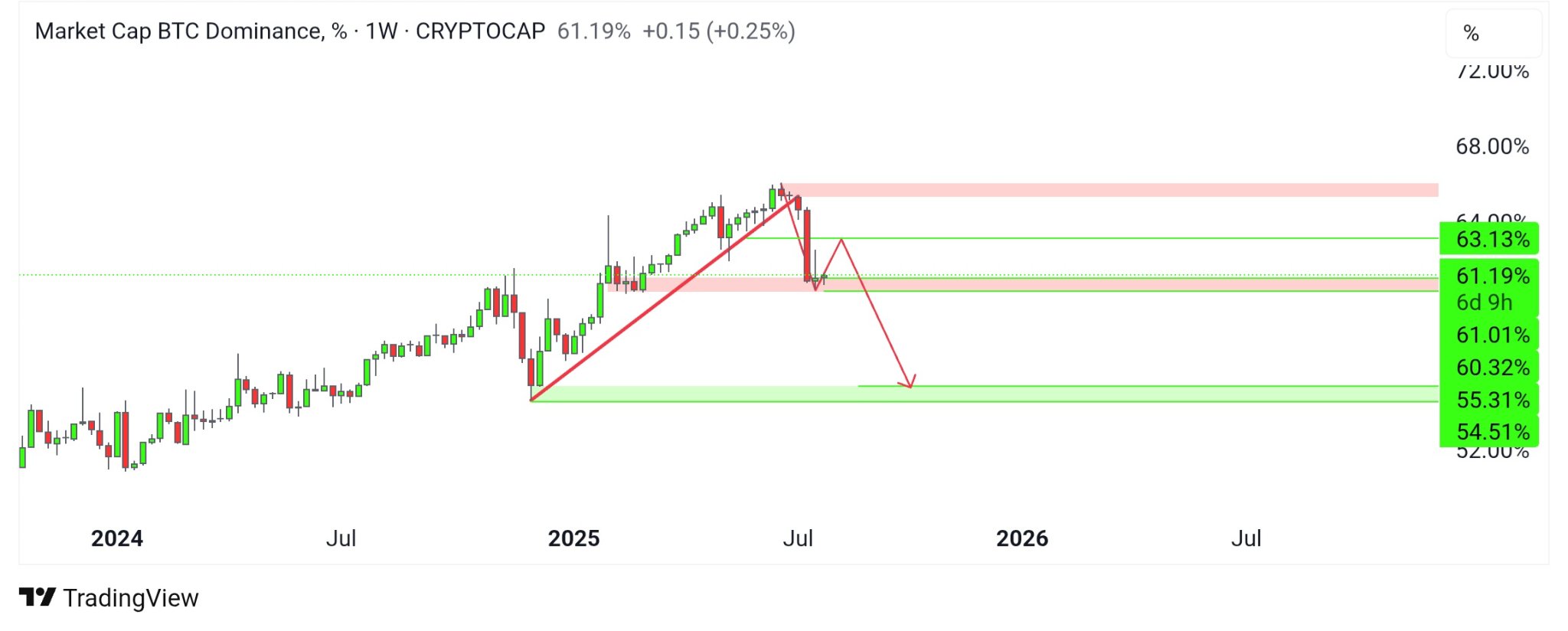

A motley parade of market prophets bark from their soapboxes: BTC.D isn’t what she was! Structural changes stalk her. New ‘bearish cross’ markings scrawl across the 3-week ledger—a foreboding sign! Even the most bullish Bitcoin maximalists are eyeing the exits (or at least the drinks cart).

Now, imagine: that steady uptrend line—three years in the making—crumbling like stale bread. No revolution is polite; this collapse, say the wise, signals the old guard’s strength waning, teetering atop its golden, digital throne.

“Bitcoin dominance has lost its 3-year uptrend. This is the biggest sign of an Altseason and upcoming parabolic pump,” croons Ash Crypto, a prophet with more followers than a stray dog in a butcher’s district.

Merlijn, a world-weary trader, claims we are reliving the grand tragedy of 2021: the “playbook” he calls it, though some would call it a farce. “Phase 4,” he intones—a stage for altcoins to pirouette into the limelight while Bitcoin limps backstage. Out with the bald king, in with the carnival!

Pundits gather around the battered ETH/BTC pair, huddled like peasants before a sputtering fire. Will Ethereum dance ahead? Fortune seems to be winking at Vitalik’s creation, while Bitcoin glances sideways, wondering where its youth went. Lower-cap coins beckon with the promise of riches or, at the very least, a faster way to lose your rent money.

The boy named Ted—part investor, part philosopher—declares with tragic optimism that in 3–6 months Ethereum and her clownish cousins may soar. Mind the “shakeouts” though; the market loves to throw weak hands overboard. There’s a cyclical rally coming, or so the winds and Ted’s gut suggest.

A Wall Stands in the Way (But Maybe It’s Made of Paper)

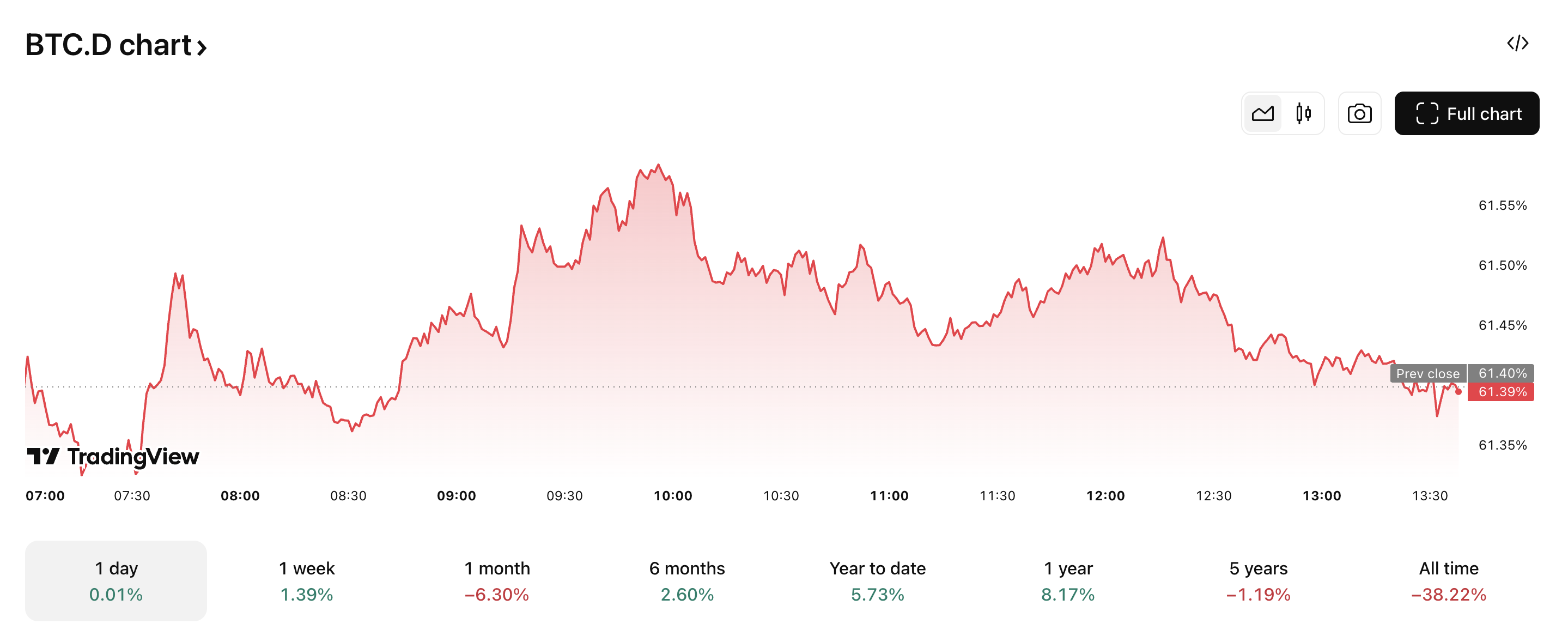

Yet dissenters wrestle and bicker in the marketplace. The 60–61% BTC.D demand zone—Bitcoin’s last redoubt!—stares down the ragged altcoin army. Some analysts clutch this statistic like a family heirloom, muttering of support levels while chewing their pencils.

Crypto Candy—analyst, fatalist, unrepentant snacker—warns: unless that demand zone fails, the altcoins might as well go back to sleep. “Momentum?” she says, as if the word’s a joke. “You’ll see none—just sideways shuffles and retracements, like drunks missing the last bus home.”

“As long as the 60-61% zone holds, we may not see proper momentum in alts. Also, in the meantime, we may see slow movement and retracement on alts,” the stoic Candy sighs.

So, bold investor, hitch up your boots—patience is the name of the game. Don’t expect a revolution before teatime. As the Bitcoin guards falter and the altcoins don carnival masks, we await the slow, glorious waltz toward chaos or fortune. Or, as the crypto crowd likes to call it these days: just another Tuesday. 🥃

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- USD GEL PREDICTION

- Silver Rate Forecast

- WalletConnect Dives into Stablecoin Mayhem with dtcpay in Asia! 🎉

- Is Dogwifhat’s $1.15 Dream Still Alive? 🐶💰

2025-07-29 11:14