On a dreary Wednesday, as the world seemed to hold its breath, the U.S. central bank, like a weary general, decided to nudge its federal funds rate downward by a mere 25 basis points-its first attempt this year.

BTC Surges to $117K in a Market That Reacts Like an Overcooked Stew

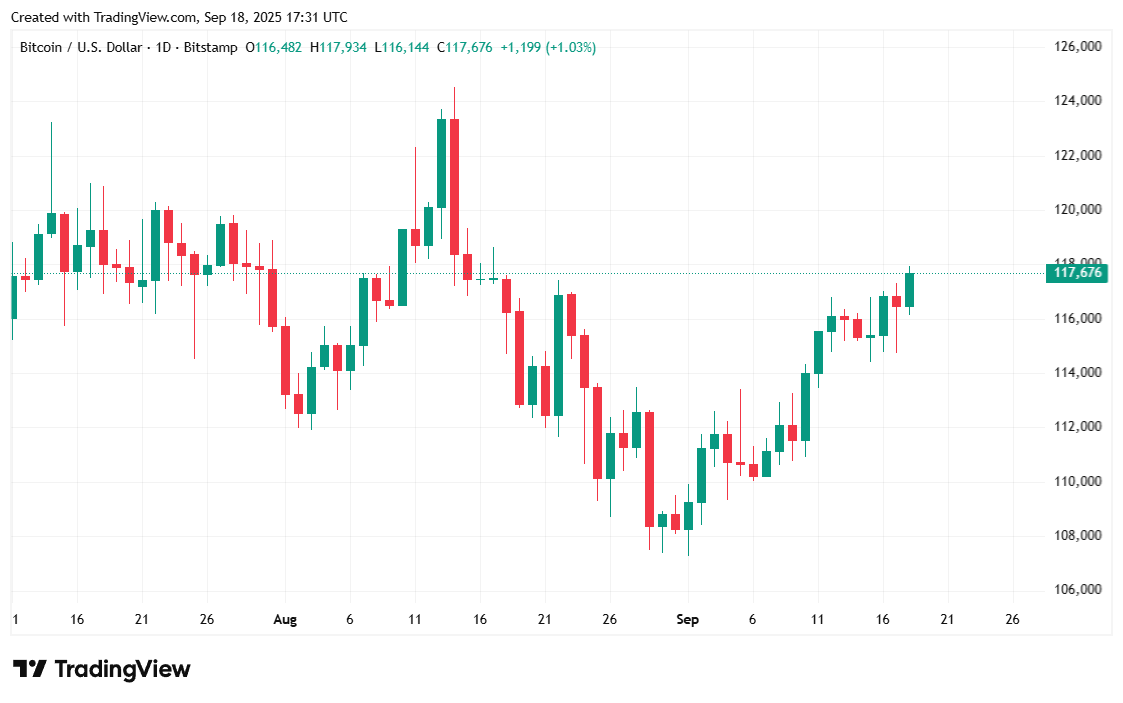

Many found themselves in a state of puzzled melancholy when bitcoin (BTC) wavered to $115K, as if the cryptocurrency were shy and reluctant to embrace the Fed’s generosity. By Thursday morning, however, it had galloped back to $117K with the determined absurdity of a horse sensing a carrot, echoing the hesitant yet resilient movements of stocks, which also appeared to awaken from a prolonged stupor.

//static.news.bitcoin.com/wp-content/uploads/2025/09/fed-dot-plot-9-2025_nwmk.png”/>

The so-called “dot plot,” a quarterly chart of anonymized circles in the SEP, suggests that interest cuts may continue serenely into 2027, potentially bottoming at 3.1%. One imagines bitcoin investors staring at these dots as though they were ancient runes, slowly nudging their spirits toward cautious optimism before waking today with slightly puffed chests and brighter eyebrows.

Market Musings and Metrics

Bitcoin was trading at $117,740.20 at the time of writing, a modest 1.77% rise over 24 hours and a 2.9% lift over seven days. Coinmarketcap reveals the digital steed’s price wandered between $114,794.97 and $117,860.80 since yesterday-clearly indulging in a nap now and then.

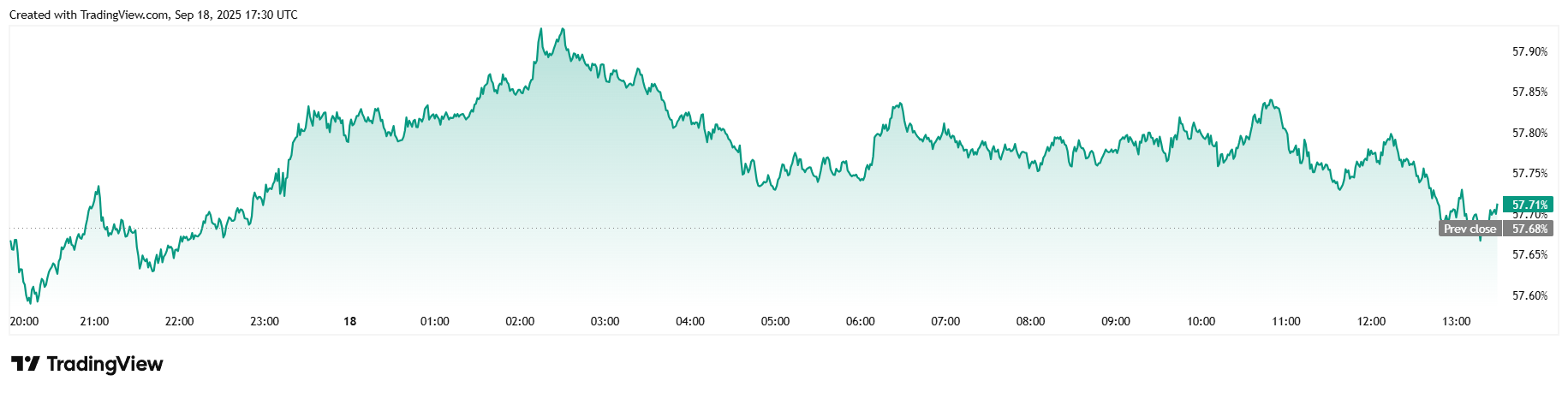

Twenty-four-hour trading volume galloped 32.73% to $64.81 billion. Market capitalization inched upward to $2.34 trillion, and bitcoin dominance, though mostly flat, edged up 0.02% to 57.71%-like an elderly cat stretching after a nap. 🐱

Total bitcoin futures open interest soared 5.01% since yesterday to $87.29 billion, while liquidations jumped to $105.42 million. Short sellers, caught like deer in headlights, contributed $79.82 million, leaving the remaining long liquidations at a comparatively humble, yet still melodramatic, $25.60 million. 🦌💸

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- ATOM PREDICTION. ATOM cryptocurrency

- BNB PREDICTION. BNB cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

- Bitcoin’s Ballyhoo: Bulls Tiptoe While Bears Nap 🐻💤

2025-09-18 21:28