Ah, the eternal dance of Bitcoin. Once a towering giant, now stumbling through the streets like a tired, old man clutching his walker. But today, November 18, it found a moment of calm. Investors, with pockets perhaps deeper than their sense of reason, swooped in to buy the dip, as they always do. They wait with bated breath for the upcoming FOMC minutes and Nvidia earnings, as if those are the answers to life’s deepest questions.

- The price of Bitcoin has crashed to its lowest level since April. Not a sight for the faint of heart.

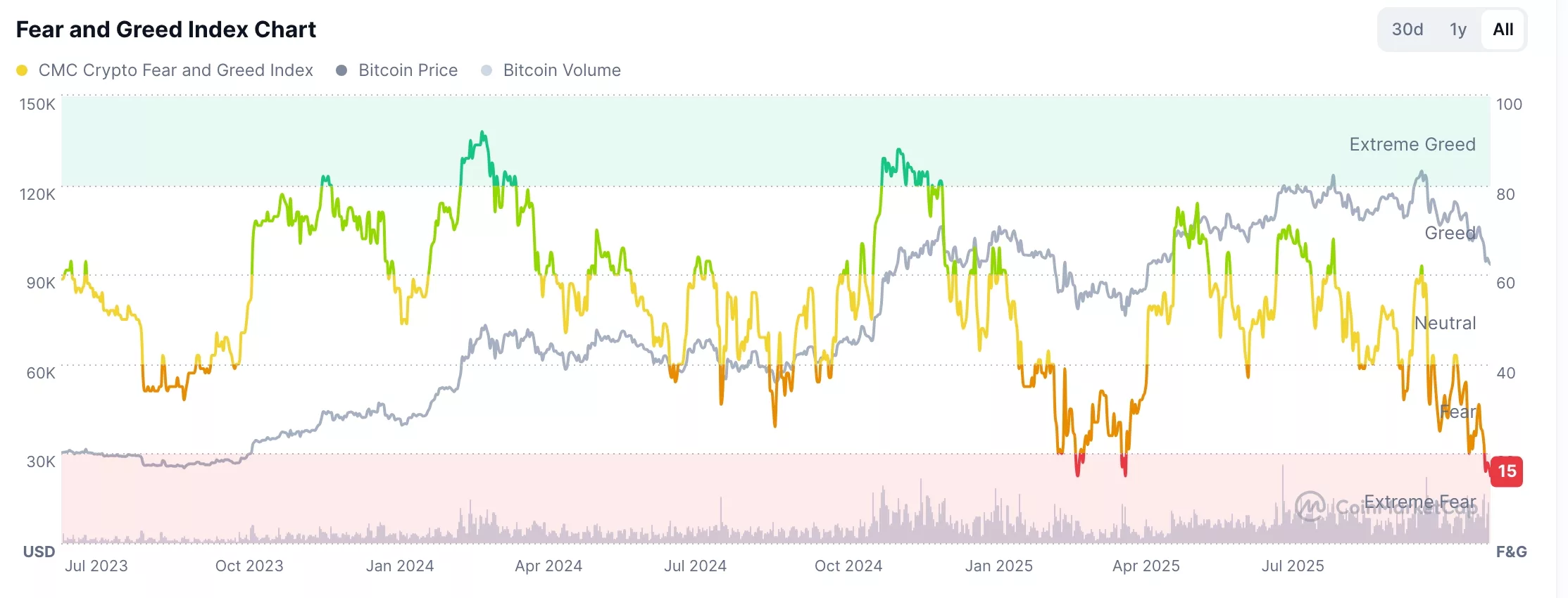

- The Crypto Fear and Greed Index is now flailing in the “extreme fear” zone, as if it too has lost its will to live.

- Technical analysis suggests that Bitcoin is about to hit rock bottom. Or, perhaps, it’s already there. Who knows?

Bitcoin (BTC) staggered its way back to $93,700 today, up from this week’s low of $88,790. Still deep in the bear market, with its value plummeting by nearly 26% from its peak this year. The situation is grim. The doom-laden whispers of financial ruin echo in the halls of crypto. Or maybe not. It’s hard to tell.

Crypto Fear and Greed Index

And so, the great crash continues. Fear grips the market as if the world is coming to an end (or maybe just another cycle of wild volatility). The Crypto Fear and Greed Index, which is a rather peculiar thing to rely on for your life’s decisions, has plunged into the “extreme fear” zone. At a dismal 15, it’s the lowest we’ve seen since April. And you know, April was just a few months ago, so really, who can blame us for thinking this is all a bad dream?

The Crypto Fear and Greed Index calculates its value based on a blend of Bitcoin price momentum, altcoin madness, market volatility, derivatives market chaos, and the ever-dodgy relative value of Bitcoin. Because when you’re feeling this uncertain, the best solution is a highly complex algorithm, right?

Meanwhile, the CNN Money Fear and Greed Index has plunged to an appallingly low 12-its lowest since, yes, April. Every sub-index (market volatility, put and call options, safe-haven demand, junk-bond demand, stock price strength) has plunged into the abyss of extreme fear. So, really, if you’re looking for hope, perhaps this isn’t the place to find it. Or maybe it is, if you believe in Bitcoin’s power to turn things around in the most improbable of ways. Stranger things have happened.

And let’s not forget history-Bitcoin often rises like a phoenix when the Fear and Greed Index hits these depths of despair. Just last year in July, the Index hit 26, and Bitcoin surged to $54,000. Fast forward a few months, and it broke the $106,000 barrier. And just when you thought the saga couldn’t get any stranger, the Index dropped to 19, and Bitcoin soared to $79,000. Fast forward again, and-voilà!-it hit a record high of nearly $109,000. You can practically hear the dramatic music building to a crescendo in the background, can’t you?

Bitcoin Price Technical Analysis

But, oh, what do the charts say? Does Bitcoin have a future, or is it destined to remain a shadow of its former glory? Technical analysis, that scientific art, suggests there might still be hope. The Relative Strength Index (RSI), that little number cruncher of doom and hope, has dropped to 30-oversold territory, dear friends. A low that whispers of possible rebounds. The Percentage Price Oscillator (PPO) has also tumbled to the lowest level this year. Surely, a sign of… something, right?

At least we’ve hit the double-bottom target of $92,000. A hammer candlestick pattern has emerged-no, not the kind you use to hammer in nails, but the kind that suggests a reversal might be on the horizon. The target? The sacred $100,000, of course. That number that makes everyone’s heart beat a little faster. But-and here’s the kicker-if Bitcoin dips below this week’s low of $88,790, well… all bets are off. And here we are, waiting, praying, hoping.

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- ATOM PREDICTION. ATOM cryptocurrency

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

- BNB PREDICTION. BNB cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- GBP CHF PREDICTION

2025-11-18 22:10