Oh, what a sneaky new tax the United States has sprung on its poor, unsuspecting Bitcoin miners! 🧠💸 A 57.6% fee on machines from China and 21.6% on hardware from Indonesia, Malaysia, and Thailand-like a sly fox hiding behind a tree, waiting to pounce! The rates, which took effect on August 7, 2025, have left big-time Bitcoin mining firms trembling in their boots, facing potential liabilities that could make a dragon’s hoard look meager. 🐉

CleanSpark and IREN received invoices from the CBP, like a stern teacher handing out detention slips. CleanSpark fears a $185 million bill if the agency stays stubborn, while IREN is fighting back with the grit of a determined squirrel. Both are scratching their heads, trying to trace their supply chains through a maze of confusion. 🧩

Meanwhile, American Bitcoin Corporation is planning to buy 14 EH/s of Antminer U3S21EXPH machines from Bitmain-a $320 million deal! It’s as if Bitmain is building a fortress in the US to dodge the tariffs. 🏰✨

Network Hits Record Highs as Miner Profitability Drops

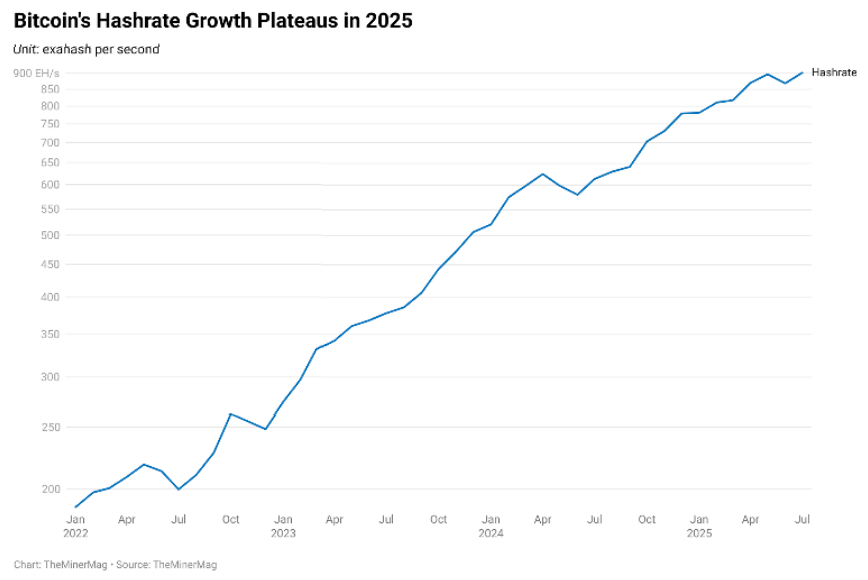

All these troubles for US Bitcoin miners come at a time when the network is flexing its muscles. According to recent data, the Bitcoin network hash rate has bounced back like a rubber ball, hitting a record seven-day average above 970 exahashes per second (EH/s) in early August. Mining difficulty? It’s as high as a mountain! 🏔️

Graphic of Bitcoin network hashrate vs time. Source: TheMinerMag

The network is now less than 3% away from hitting one zettahash-per-second-like a racehorse galloping toward the finish line. But the pace has slowed, and miner margins are shrinking faster than a snowman in summer. Hashprice stays below $60/PH/s, even as Bitcoin’s price soars to $120,000. It’s like trying to win a race while wearing socks! 🏃♂️🧦

Transaction fees for miners? They’ve dropped so low, they’re practically invisible. July’s fees were less than 1% of total block rewards-like finding a needle in a haystack made of feathers. 🧵

Bitcoin Miners’ Stocks Show Mixed Market Performance

Stock market performance is a wild rollercoaster! TeraWulf’s shares jumped 50% after a deal with Google-like a kid who just found a golden ticket. Bitfarms gained 23.3%, while IREN and Hut 8 rose 12.2% and 9.7%, respectively. But companies focused solely on Bitcoin mining? They’re taking a nosedive, like a deflated balloon. 🎈

The new tariff rules have added a sprinkle of chaos to the US Bitcoin mining scene. With hundreds of millions in potential liabilities, miners are scrambling to rethink their plans. It’s like building a house of cards in a hurricane. ⚠️

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- XRP’s Big Week: SEC Drama, BlackRock Rumors & A Possible $6 Party 🚀

- BlackRock & Stablecoins: A Most Convenient Arrangement 🧐

- 2025: The Year the World Went Crypto Crazy (And Everyone Loved It)

- Kraken & Deutsche Börse: A Match Made in Financial Limbo! 🦑💼

2025-08-21 00:46