Oh, the plight of the Bitcoin miners! They were suddenly struck by a 6.31% surge in difficulty, as if the blockchain itself had decided to play a cruel prank. Now, their hashrate roars like a dragon with a sore throat, barely keeping up with the 10-minute block rhythm. 🐉💸

Bitcoin Miners Face the Squeeze Despite Modest Revenue Increase in October 🤯

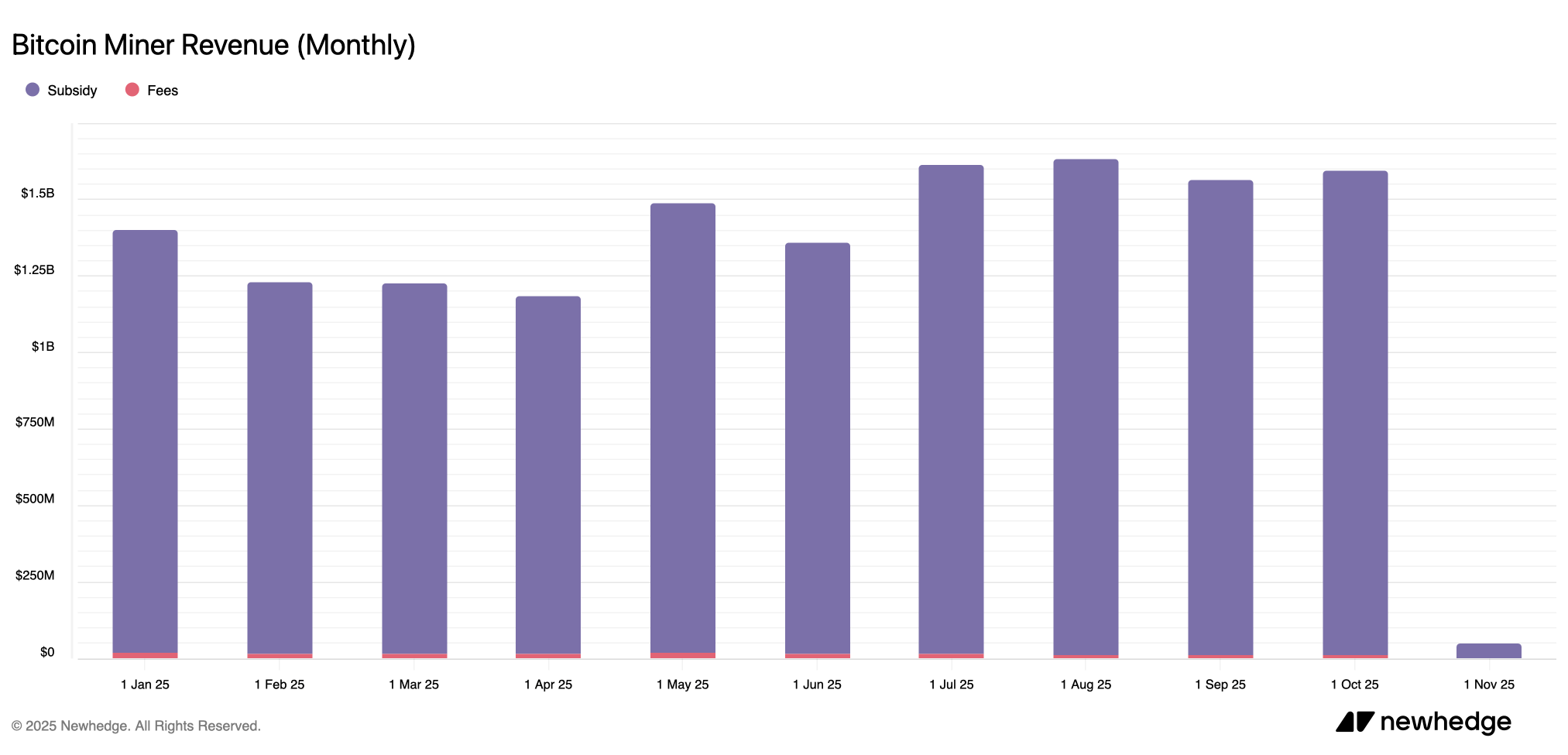

October treated bitcoin miners with a meager $1.595 billion in revenue – a mere pittance compared to their dreams of wealth. Most of it came from the block subsidy, as if the blockchain were a miserly landlord. 🏠💸

This is a modest upgrade from September’s $1.564 billion haul, giving miners an extra $31 million to smile about. Overall, October’s paycheck was looking fresh – up 13.77% compared with January 2025’s take-home. Fresh? More like a stale bagel with a side of despair. 🥯😩

As of Saturday, Nov. 1, network stats from hashrateindex.com show the hashrate is cruising at a breezy 1,110.86 EH/s, but it’s like trying to run a marathon in a swamp. With bitcoin’s price dipping and difficulty climbing 6.31%, miners are feeling the squeeze. 🚪💨

This latest difficulty hike ranks as the third biggest of the year, trailing only the difficulty retargets from July 12, 2025, and Apr. 5, 2025. Meanwhile, bitcoin’s price has slipped this week, and hashprice – the estimated worth of one petahash per second (PH/s) of mining power – has lost some shine since last month. 🌫️📉

Thirty days ago, a PH/s fetched about $50.66, but today it’s closer to $44.67. Transaction fees? Still, the unreliable side hustle they’ve seen since last year. On average, less than 1% of each block reward’s value comes from onchain fees – basically pocket change in miner terms. On Saturday, the average fees in block rewards amount to 0.75% of the net value accrued when finding a block. 🧾💸

Miners are likely crossing their fingers that things even out soon – with bitcoin’s price climbing back to friendlier levels and hashprice following suit. After all, profitability hinges on a delicate balance between difficulty, energy costs, and market value. Two out of three of those are not playing nice. 🤷♂️⚡

If prices rebound and hashprice recovers, miners could finally breathe a little easier and keep their rigs humming without sweating every block. For miners, much like traders eyeing the charts with sweaty palms, it’s a waiting game – though in mining, patience doesn’t just cost nerves, it burns electricity and cash. 💸🔥

FAQ ❓

- What is Bitcoin’s current mining difficulty?

Bitcoin’s mining difficulty recently increased 6.31% to 155.97 trillion, marking the third-largest jump of 2025. A true test of endurance for the digital serfs. 🧙♂️ - How much did bitcoin miners earn in October 2025?

Miners pulled in about $1.595 billion in October, with nearly all of it coming from block subsidies. A pittance for those who thought they’d strike gold. 💸 - What’s happening to Bitcoin’s hashprice?

Hashprice has fallen from around $50.66 per PH/s a month ago to roughly $44.67 today. A cruel joke for those who bet on a rising tide. 📉 - Why are miners under pressure now?

A tougher difficulty, weaker bitcoin prices, and low onchain fees are squeezing miner profits. The blockchain is a fickle lover. ❤️💔

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Telegram’s Blockchain Gambit: From Messengers to Billion-Dollar Unicorns!?🤯

- When a $300 Bet Turns Into Millions: Binance’s Coin Outshines Banks and Whales Wake Up! 🐋💸

- How Low Will XRP Price Crash?

- Solana’s October Drama: Bulls, Whales, and ETF Teases 🍿

2025-11-01 18:28