Ah, Bitcoin! The digital gold that promises fortunes faster than a gossipy aunt can spread rumors! Sadly, our dear miners have found themselves in a rather sticky situation. Since November 2025, like a once-promising play that falls flat, the Bitcoin hashrate and mining difficulty have been sliding downwards, leaving many miners to ponder their life choices.

According to the astute folks at Coinspeaker, a treasure trove of data from MacroMicro reveals a dreadful net-negative difference of over $8,000 between the average cost to mine Bitcoin and its current market price as of this bleak January 19, 2026. To put it simply, in the time it takes to brew a cup of tea, mining 1 Bitcoin is now costing approximately $101,000, while the cryptocurrency itself is being traded at around $93,000. Quite the pickle, isn’t it?

Bitcoin average mining costs and price as of Jan. 19, 2026 | Source: MacroMicro

“Through observing consumption of electricity and daily issuance of bitcoin, provided by Cambridge University, we can find out the average mining costs of bitcoin. When mining costs are lower than bitcoin’s market value, more miners will join. When mining costs are higher than a miner’s revenue, number of miners will decrease,” wrote MacroMicro, sounding suspiciously like an economist at a dinner party trying to impress everyone.

Mining Bitcoin is akin to a grand game of chess-only with fewer knights and more computing power. The more players there are, the tougher it gets to snag that precious block, driving costs through the roof. Oh, the irony! Yet, in a twist worthy of a Chekhovian tale, some miners may cling to their dreams of profit, betting on a future rise in prices, while others might be packing up their gear like tourists fleeing a rainstorm.

Bitcoin Mining Difficulty and Hashrate Drop

In a delightful plot twist, CoinDesk informs us that Bitcoin’s network hashrate-the total computing power guarding this digital fortress-has plummeted by roughly 15% since its October 2025 peak. It took a dive from approximately 1.1 zettahashes per second (ZH/s) to around 977 exahashes per second (EH/s). This sharp decline feels a bit like watching your favorite soap opera character get written off the show: widespread miner capitulation is upon us!

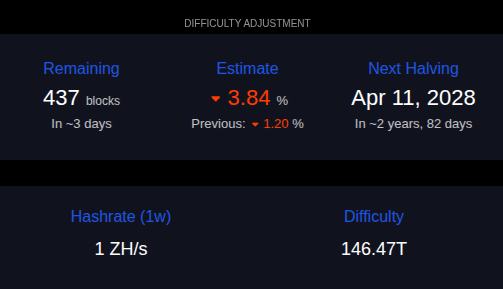

As if that weren’t enough drama, Bitcoin’s mining difficulty is set for another downward adjustment of about 4% on January 22, 2026. This marks the seventh negative adjustment in just eight periods! It’s almost as if the universe is conspiring against our beleaguered miners!

Bitcoin mining difficulty adjustment and hashrate as of Jan. 19, 2026 | Source: mempool.space

Interestingly, Glassnode’s Hash Ribbon indicator, which tracks miner melancholia by comparing short- and long-term hashrate moving averages, turned upside down on November 29, 2025. This indicates that miners are selling off their holdings like they’re having a spring cleaning sale, adding even more pressure to an already beleaguered market.

Yet, amidst this chaos, a ray of hope emerges! Michael Saylor hints at potential new purchases for his Bitcoin treasury company Strategy, as if he were a brave knight preparing for battle. Institutional interest seems to be bubbling back up, like a poorly made soda that refuses to stay down. Just last week, crypto inflow surged to its highest levels since October-now, that’s a plot twist worth celebrating! 🎉 Moreover, Blockspace Media acquired the onchain data analytics platform Bitcoin Layers, integrating its talents to enhance their Bitcoin-centric media offerings.

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- BNB PREDICTION. BNB cryptocurrency

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- USD TRY PREDICTION

- DOGE PREDICTION. DOGE cryptocurrency

- ATOM PREDICTION. ATOM cryptocurrency

- Coinbase Revolutionizes Web3 with Base App: Is This the Next Big Thing or Just Another Mirage?

2026-01-19 23:19