Well, slap my wallet and call me bullish-the crypto market has decided to wake up from its nap! 🌞 After inflation data came in cooler than a polar bear’s freezer, Bitcoin and its altcoin buddies decided it was time to stretch their legs. Core inflation? More like snore inflation-it only rose 0.2% for the month and 2.6% over the year. Yawn. But hey, the market isn’t complaining. 📈

CPI Data: The Unlikely Hero of the Day 🦸♂️

Turns out, the stock and crypto markets are as fickle as a cat in a room full of laser pointers. The U.S. inflation data for December was about as exciting as watching paint dry-but in a good way! Prices rose slower than a sloth on a Sunday, giving everyone hope that the Federal Reserve might finally take a breather. 🧘♂️ Economists had their calculators out, but the numbers still came in slightly below forecasts. Who knew inflation could be so… underwhelming?

Excluding food and energy prices (because who cares about those anyway?), consumer prices did their monthly 0.2% jig and their yearly 2.6% waltz. Both figures were like, “Surprise! We’re lower than you thought!” 🎉 The Fed, meanwhile, is probably sipping their coffee and nodding approvingly, though they’re still more focused on core inflation-because apparently, that’s the real tea. 🍵

Including food and energy (yes, we’re back to caring about those now), prices rose 0.3% for the month, bringing the annual inflation rate to 2.7%. Right on the money, as they say. The Fed’s target is 2%, so we’re getting there-slowly but surely, like a tortoise with a GPS. 🐢

The Fed’s goal? Inflation at 2% a year. This report is like a gentle nudge in the right direction, though we’re still not quite at the finish line. But hey, progress is progress, right? 🏁

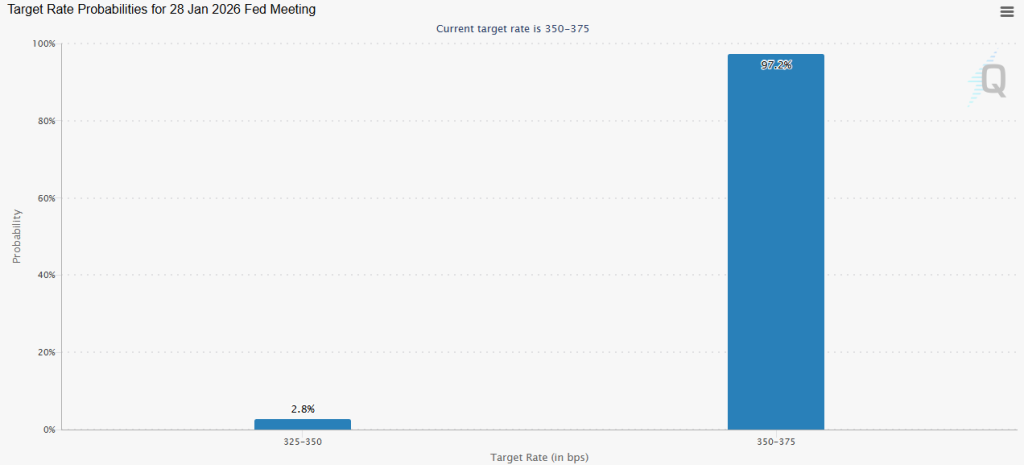

After the data dropped, stock market futures went full rocket ship 🚀, and investors were like, “Yeah, the Fed’s probably not touching rates this month.” June, though? That’s when the real party might start, according to CME Group’s FedWatch tool. Meanwhile, President Trump was busy tweeting-er, urging-the Fed to loosen up. Because of course he was. 🗣️

But let’s not get ahead of ourselves. The Fed’s still got its eyes glued to the labor market, so unless something wild happens, this inflation data isn’t going to shake things up too much. Business as usual, folks. 📊

Bitcoin and Ethereum: Back in the Spotlight 💃🕺

Crypto investors, meanwhile, were like kids in a candy store after the inflation news. Bitcoin jumped 1.7% in 24 hours, breaking above $93,000 like it was no big deal. Ethereum, not wanting to be left out, flirted with $3,200 and held strong above $3,000-despite sellers trying to rain on the parade all week. ☔

All this excitement led to $193.5 million in liquidations-mostly from short-sellers who probably need a hug right now. Short positions alone accounted for $120.3 million of that, according to Coinglass. Ouch. 😬

Meanwhile, U.S. stock markets were like, “Nah, we’re good.” The S&P 500 and Nasdaq Composite both took a little dip after opening higher on Tuesday. Guess they didn’t get the memo about the party. 🎉✨

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- USD CNY PREDICTION

- Silver Rate Forecast

- Asia’s Financial Rampage: Stablecoins and the Race for Supremacy

- Why Is Everyone Suddenly So Bullish About Stellar? 🚀 You Won’t Believe These 5 Price Targets!

- OKB PREDICTION. OKB cryptocurrency

- SOL’s Sky-High Gambit: ETF Dreams or a Crypto Mirage?

2026-01-13 21:38