In the labyrinthine alleys of crypto, news stumbles like a drunken poet-

Bitcoin, the machine built for defiance and grand illusions, greets a new milestone, or perhaps another punchline in this endless cabaret.

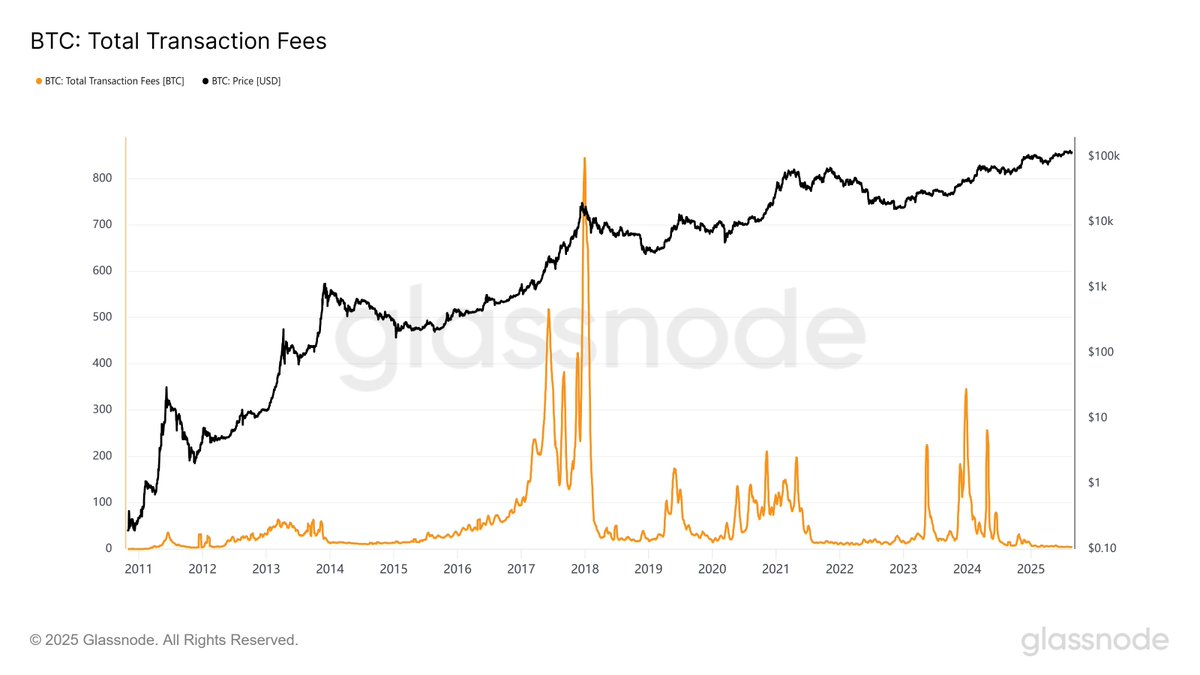

Transaction fees-once the proud badge of blockchain’s exclusivity-have swooned to their lowest since 2011.

Were it not for the Federal Reserve, which teases Rate Cut dreams like a magician pulling ever-more moth-eaten rabbits from his hat, one might suspect nothing at all is happening.

But the feverish crowd, whipped into delirium by Jerome Powell’s insinuations about a “shifting balance of risks,” seems hell-bent on chasing a top that may be as local as the bread in a Moscow bakery.

- Bitcoin fees now wallowing at 3.5 BTC daily-a number so modest it might shame a Soviet bureaucrat.

- Fed rate-cut mania now peaking-if euphoria were vodka, we’d all be on the floor.

- Exchanges bulging with 70,000 new BTC since June-someone’s clearly preparing for an epic garage sale.

Daily transaction fees, once the blood and sweat of miners, now barely register-3.5 BTC, whispers Glassnode, as if gossiping over stale tea.

The streets are abuzz not with revolution, but with the echoes of Powell’s Jackson Hole sermon, hinting at merciful rate cuts, surely to save us from our own foolish optimism. “Policy adjustments,” he muses. It’s enough to make a speculator swoon or sob, depending on his last buy-in.

Social sentiment reaches dangerous territory for bulls

The mob, blessed with the patience of a caffeinated squirrel, now chants “Fed,” “rate,” and “cut” so loudly across social media that Santiment declares: highest surge in eleven months.

This kind of mania, this delirium, is precisely the sign painted on the wall by history-a warning that tops approach, bulls prance, and reality sharpens its teeth.

Where euphoria rules, price usually finds a cliff to leap from. 🍾🐂

For the Bitcoin disciples, Glassnode offers a somber hymn: supply, clustering between $113,000 and $120,000, sits mostly in the hands of those who bought with the fever of July and now cling tighter than a prospector to his last nugget.

SOPR by Age-an index as ambiguous as the weather in St. Petersburg-waivers from 0.96 to 1.01. Recognition falters, as does faith.

Exchange inflows paint a worrying picture for Bitcoin

Exchange vaults overflow-Bitcoin supply swelling by 70,000 coins since June, as if someone opened the spigot in hopes of enough water to put out their flaming hopes.

Gone is the noble trend of cold wallets, exiled in icy isolation; now, the coins flock to exchanges, seeking warmth by selling fire.

This migration, history warns, usually comes before a deluge-coins dribble onto platforms, where they’re lined up for slaughter with the dignity of sausages at breakfast.

On-chain health, meanwhile, takes a neutral stance-neither sickly, nor vigorous-like a bureaucrat’s midday nap.

Daily active addresses and transaction volume wither, wilting from heights reached in dreams.

And, for the true believers, those seeking omens:

The long-term MVRV ratio sits at 18.5%. A risky zone, perhaps, but what’s risk to the brave miners and traders, who gamble fortunes with the glee of poets at a midnight feast? 🎲🤷♂️

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- SOL’s Sky-High Gambit: ETF Dreams or a Crypto Mirage?

- Meme Market Mayhem: DOGE’s $0.23 Saga Unveiled

- Why Is Everyone Suddenly So Bullish About Stellar? 🚀 You Won’t Believe These 5 Price Targets!

- Hong Kong’s Stablecoin Shenanigans: The Big Circus Begins! 🎪🚀

- Bitcoin Plunges: Is $70K the New Rock Bottom? 🚀💸

- USD GEL PREDICTION

- Bitcoin’s HODLers: The New Titans of the Digital Age 🚀💰

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

2025-08-24 18:21