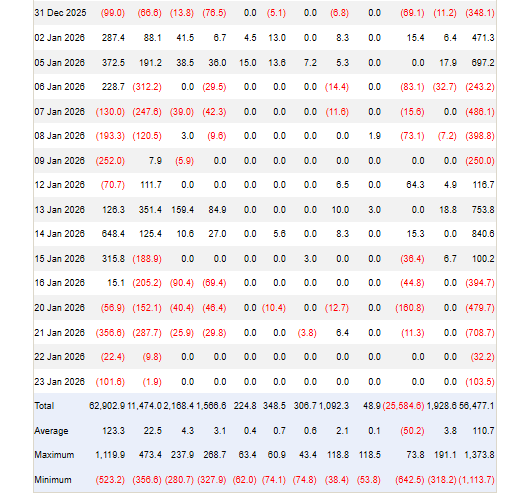

In the grand and tragic manner of all human endeavors, the American spot Bitcoin exchange-traded funds continued their sorrowful exodus, as though fleeing the specter of some unseen calamity. For five consecutive trading days, the funds trickled away-first in hesitant drips, then in a torrent-until, by Friday, the sum of their departure had swelled to a staggering $1.72 billion, as recorded by the diligent scribes of Farside.

Bitcoin itself, that restless digital specter, lingered near $89,160-far from the lofty heights of $100,000, which it had briefly glimpsed in November before descending once more into the mire of mortal uncertainty. And so, like peasants abandoning a failing harvest, investors withdrew, their faith shaken by the capricious winds of fortune.

The Great Exodus: Who Dares to Sell?

ETF flows, much like the shifting moods of a Russian nobleman, are often studied as a measure of collective sentiment. Yet, as with all things in finance, the truth is rarely so simple. The great outflows may signify not the panic of common men, but the cold calculations of institutions-rebalancing their ledgers, adjusting their strategies, as indifferent to the plight of small traders as a landowner to his serfs.

The American market, interrupted by the observance of Martin Luther King Jr. Day, compressed its sorrows into fewer sessions-perhaps amplifying the despair, much like a winter storm condensed into a single, brutal night. Yet, whether spread across days or concentrated into hours, the loss of over a billion dollars remains a spectacle worthy of Tolstoyan melancholy.

The Darkening Mood and the Flight to Metals

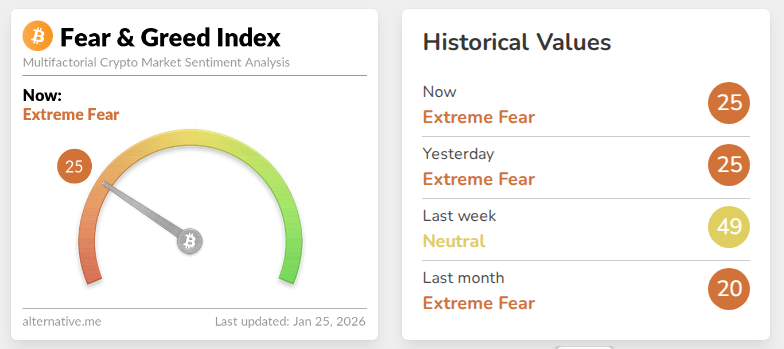

The broader sentiment had soured, as though the very air had turned bitter. The Crypto Fear & Greed Index, that solemn judge of human frailty, declared an Extreme Fear score of 25-a number as grim as a Siberian winter. Observers whispered that retail traders, those humble souls, were retreating, their attention drifting toward the solid comforts of gold and silver, those ancient relics of stability.

And indeed, metals flourished. Gold traded near $5,000, silver approached $100-while Bitcoin, that restless revolutionary, languished, excluded from the rally that had lifted its stodgier cousins. Was this not proof, some muttered, that the world still preferred the weight of tradition over the ephemeral promises of the new?

The Restless Dance of Bitcoin

Bitcoin, ever the fickle protagonist, stumbled through the past week like a man unsure of his footing. Prices dipped below $89,000, then wavered, as traders-those nervous actors upon the stage of history-reacted to geopolitical whispers and the specter of trade wars. Only when tensions eased did the price stabilize, as though the market had sighed in collective relief.

Yet this brief respite was driven not by resolution, but by the shifting winds of political rhetoric-for markets, like Tolstoy’s characters, rarely respond to events themselves, but to the stories men tell about them.

Signals Amidst the Noise

These fluctuations revealed Bitcoin’s true nature-not as a shelter from the storm, but as a fellow traveler with risk, rising and falling with equities like a ship tossed upon the same turbulent sea. The current patterns spoke of caution, as traders weighed fleeting political dangers against the slow, inexorable tides of macroeconomics.

Yet, faintly, there were whispers that the worst might be passing. On-chain data and the murmurs of social chatter suggested, if not hope, then at least a dwindling of panic-like the first hesitant thaw after a long winter.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- BONK PREDICTION. BONK cryptocurrency

- Crypto Heists: $142M Vanishes! 😱

- Crypto Leverage: Uh Oh ⚠️

- Of Course a Digital Token I Don’t Own Is Suddenly the Belle of the Ball

- Brazil’s Drex CBDC: Just Kidding, We Still Love Blockchain! 🤪

- XRP: A Most Disappointing Turn of Events! 📉

- RLUSD Rival PayPal USD Jumps 216% in Key Supply Metric

- Bitcoin Breaks Trendline? 94% Rate Cut Odds! 🚀

2026-01-25 14:12