Well, well, well. Looks like Bitcoin decided to take a little tumble off its shiny pedestal. The top cryptocurrency fell below $105,000 faster than a cat on a hot tin roof, wiping out a casual $1.36 billion in leveraged trades in just 24 hours. And you thought your investments were risky! Bitcoin’s “Uptober” streak? Gone. Just like your last five bucks after a trip to the casino.

According to CoinMarketCap, Bitcoin (BTC) was trading at around $104,003 after dropping 2.56% in just one day. Bitcoin trading was so frantic that the volume surged to $79.2 billion. Hold on to your hats, folks, the crypto market is having one heck of a ride! The total market value took a 3.26% hit, dropping to $3.47 trillion, while overall trading volume spiked a ridiculous 63% to $224.87 billion. If this were a roller coaster, we’d be screaming for a seatbelt!

Market Under Pressure

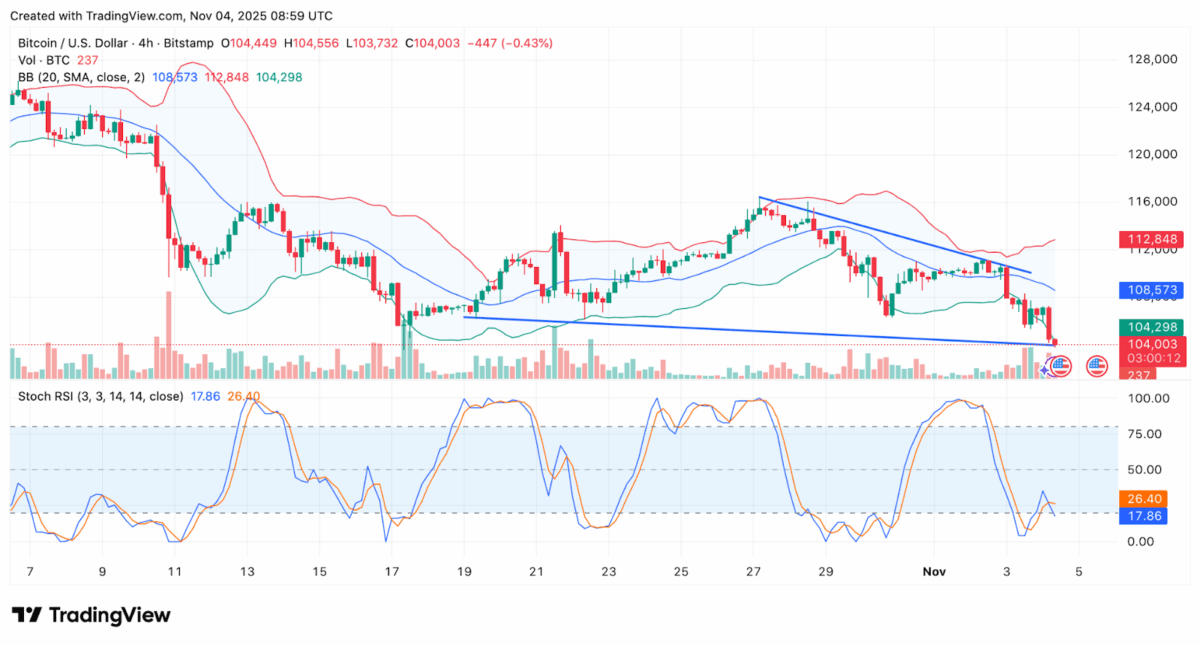

Bitcoin’s technical charts are looking like they’ve seen better days. Trading at a modest $104,000, the cryptocurrency has been desperately trying to break through $108,500 like a toddler trying to escape timeout. Spoiler alert: It ain’t happening. The Bollinger Bands are expanding, signaling that prices are about as volatile as a popcorn kernel in a microwave. Traders, get ready for a wild ride!

Now, here’s where it gets even juicier. The Stochastic RSI Indicator is showing that Bitcoin’s been oversold at 17.86. If you’re not familiar with this, think of it like your favorite restaurant offering a 2-for-1 deal, but nobody’s biting. That means Bitcoin could rebound a bit, but if buyers don’t hop back in soon, the downward spiral could continue. Yikes!

Massive Liquidations Shake the Market

Hold onto your wallets! A whopping 336,000 traders found themselves liquidated in the past 24 hours, losing $1.36 billion like it was Monopoly money. And the real kicker? The majority of these folks – $1.22 billion to be exact – were betting on prices going up. Guess who’s laughing now? Not them, that’s for sure.

The biggest liquidation took place on HTX, where a Bitcoin-USDT trade worth a jaw-dropping $47.87 million vanished into thin air. Oh, and don’t forget about the $400 million that disappeared in just four hours. It’s like watching a magic trick… if the magic trick was you losing all your money.

Analysts Explain Market Behavior

Some experts, like Crazzyblockk from CryptoQuant, believe Bitcoin’s current behavior is all about the Realized Cap metric. In simpler terms, long-term holders have been selling off, and short-term folks are just trying to ride the wave. But when prices dipped? They hit the sell button quicker than a kid avoiding broccoli on their plate. Looks like everyone’s in a bit of a panic, folks!

Understanding Market Behavior Through Bitcoin Realized Dominance

“Has been the pattern in recent months: long-term investors selling to take partial profits, while new market entrants accumulate and hold for longer periods.” – By @Crazzyblockk

Link ⤵️

– CryptoQuant.com (@cryptoquant_com) November 4, 2025

Oh, and don’t forget the whale sightings. One whale, who hasn’t moved funds in six years, suddenly decided to deposit 2300 BTC to Paxos. That’s about $3 billion worth of Bitcoin. But hey, maybe it’s just a “let’s stir the pot” move!

Despite all the chaos, Crazzyblockk thinks the correction is nearing its end. Maybe. If buyers come back, Bitcoin could bounce. If not, well, it’s going to be a rough ride, folks.

Macro and Market Dynamics

This whole fiasco comes on the heels of the “Red October” incident, which was heavily influenced by the U.S. Federal Reserve’s announcement on quantitative tightening. They said, “We’re done with tightening,” but then promptly added, “Oh wait, no rate cuts for now,” which basically made investors feel like they were riding a bike with no handlebars.

And let’s not forget about the geopolitical drama. While tensions between Trump and Xi have cooled (thanks to a truce and a pause on tariffs), analysts still believe structural selling is weighing on Bitcoin’s price. So, the market’s still on edge, with no clear signs of when it’ll calm down.

Instead of looking at Bitcoin long-term holder distribution/spending, I like to look at the other side of the trade.

Is there enough demand to absorb the supply at higher prices? Since a few weeks ago, the answer is no, and that’s why we see prices declining.

On a longer term…

– Julio Moreno (@jjcmoreno) November 3, 2025

Long-term holders have been dumping Bitcoin like hot potatoes, and we’ve seen about 400,000 BTC sold off in the last 30 days. That’s nearly 2% of the supply! If Bitcoin can stay above $100,000 while all this whale selling is happening, then you’re going to want to grab your popcorn, because when demand finally kicks in, it’s going to be a wild ride.

Why This Matters

So what does all this mean? Bitcoin’s drop below $104,000 shows just how quickly the market can go from euphoria to panic. But hold your horses! Some signs suggest the prices could bounce back, if buyers come back to the table. Confidence hasn’t completely disappeared – but with all the global uncertainty, expect more twists, turns, and rollercoaster moments ahead.

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- OKB PREDICTION. OKB cryptocurrency

- Silver Rate Forecast

- Bitcoin Signals Recession…” but then contrast with the data. Also, mention the potential upside. Let me check character count. “Bitcoin Signals Recession, But Data Says Otherwise – Bullish Opportunity Ahead?” That’s 78 characters. Maybe shorten “Bullish

- AVAX PREDICTION. AVAX cryptocurrency

- Tether’s U.S. Debut: Trump’s GENIUS Act & a Stablecoin Saga 🤖💸

2025-11-04 14:42