Well, it looks like Michael Saylor, the man with a serious obsession for Bitcoin, has officially made it onto the Bloomberg Billionaires Index. You know, the one that tracks the *super* rich people. He’s the strategy co-founder and executive chairman of MicroStrategy, and somehow, he’s now a billion-dollar man. Cue the applause! 👏

This surge in wealth just so happens to coincide with MicroStrategy’s relentless Bitcoin buying spree, and, of course, Bitcoin’s price going absolutely bananas in 2025. With 636,505 BTC tucked away in his company’s vault, he’s now holding the record for the *most* extensive corporate crypto stash. Eat your heart out, other billionaires! 😏

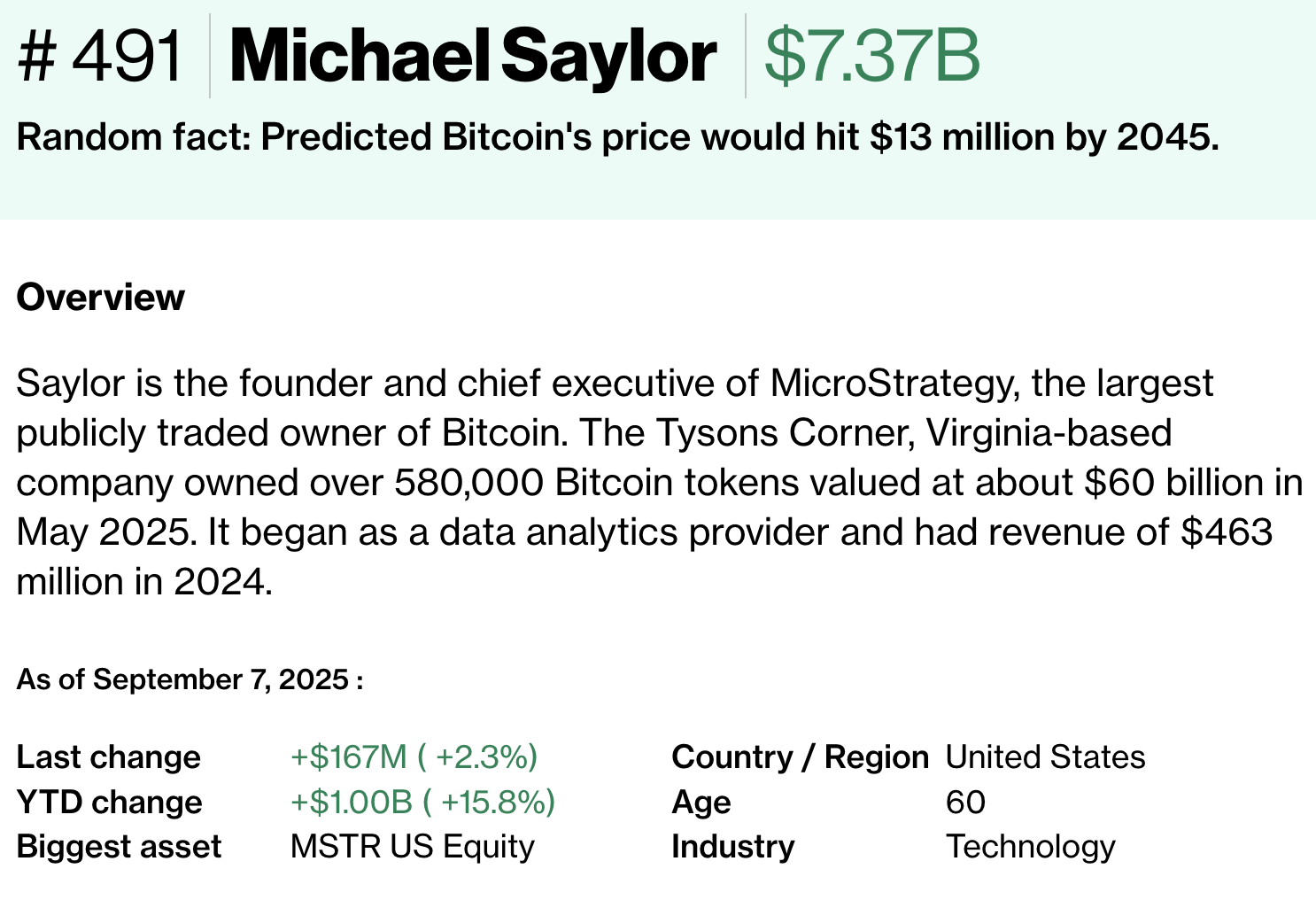

MicroStrategy, the company Saylor founded in 1989 (before Bitcoin was even a twinkle in Satoshi’s eye), now has $650 million in cash just hanging around, waiting to be spent, and a jaw-dropping $6.72 billion tied up in company stock. This is what happens when you keep putting all your eggs in the Bitcoin basket. 🥚💰

The most recent purchase? A mere 4,048 BTC, bought on September 2, at the average price of $110,981 per coin. That’s about $449.25 million spent on Bitcoin like it’s going out of style. But wait, it gets even better! Earlier purchases included a bunch of other BTC at prices ranging from $116K to $119K per coin. Someone’s feeling *very* bullish. 📈

As for Bitcoin’s performance? It’s currently trading at around $111,000, a tad bit down from its previous high, but let’s face it: Saylor doesn’t mind the little bumps in the road when you’re sitting on that much crypto gold. 💎

MicroStrategy’s Bitcoin Strategy Has Done Wonders for Saylor

With this much Bitcoin on the books, it’s no surprise that Saylor’s new ranking lands him among the elite of the crypto world. He’s rubbing shoulders with other crypto moguls like Coinbase’s CEO Brian Armstrong, who’s worth $12.8 billion, and Binance’s Changpeng “CZ” Zhao, who’s sitting pretty at $44.5 billion. The crypto billionaire club is growing, and Saylor just got his shiny new membership card. 🏆

Now, it hasn’t all been sunshine and rainbows. MicroStrategy’s strategy (yes, that’s right) has raised eyebrows, especially when the company got snubbed by the S&P 500 in August. Guess they didn’t want a crypto-loving giant messing up their vibe. Oh, and there’s that ongoing lawsuit with investors who think Saylor might’ve exaggerated the *slight* risks associated with betting the farm on Bitcoin. Whoops! 😬

In conclusion: Michael Saylor’s debut on the billionaire index is a nice little reward for his borderline obsession with Bitcoin. But who’s counting? Certainly not him. After all, he’s too busy accumulating Bitcoin like it’s the world’s most valuable currency. Spoiler alert: It probably is. 🤑

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- XRP Staking: A Tale of Tension and Tokens 🚀

- XRP Price Tale: The River That Rises

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- BNB: To $1,000 or Total Chaos? 🤯

2025-09-07 20:42