Ah, the splendid spectacle of the modern financial circus: both crypto and stocks decide to take a collective nose dive on a Tuesday afternoon, with the sole upward trend being Bitcoin’s uncanny obsession with the S&P 500. Truly, the drama never ends. 🎭

Gloomier Than a Victorian Melancholy: Bitcoin and Stocks Plunge Hand in Hand

Bitcoin (BTC) dipped below $113K, a figure as elusive as a philosopher’s smile, while the stock markets were hardly better-completely turning crimson, suggesting an increasingly intimate bedroom relationship between our digital darling and your honest-to-God stocks. The S&P 500, Nasdaq, and Dow all went south, shedding 0.53%, 1.27%, and a negligible 0.01%. Meanwhile, Coinmarketcap reports a 3% tumble across the entire crypto realm-it’s almost poetic. 📉

Leading this tragic parade was Nvidia (Nasdaq: NVDA), who, in a bold move to secure their CEO’s vacation fund, sold over $27 million worth of shares, as detailed in a little fancy document called a filing-because nothing says “confidence” quite like cashing out during the show. Jensen Huang, the maestro, sold 150,000 shares last week. Bravo!🎩

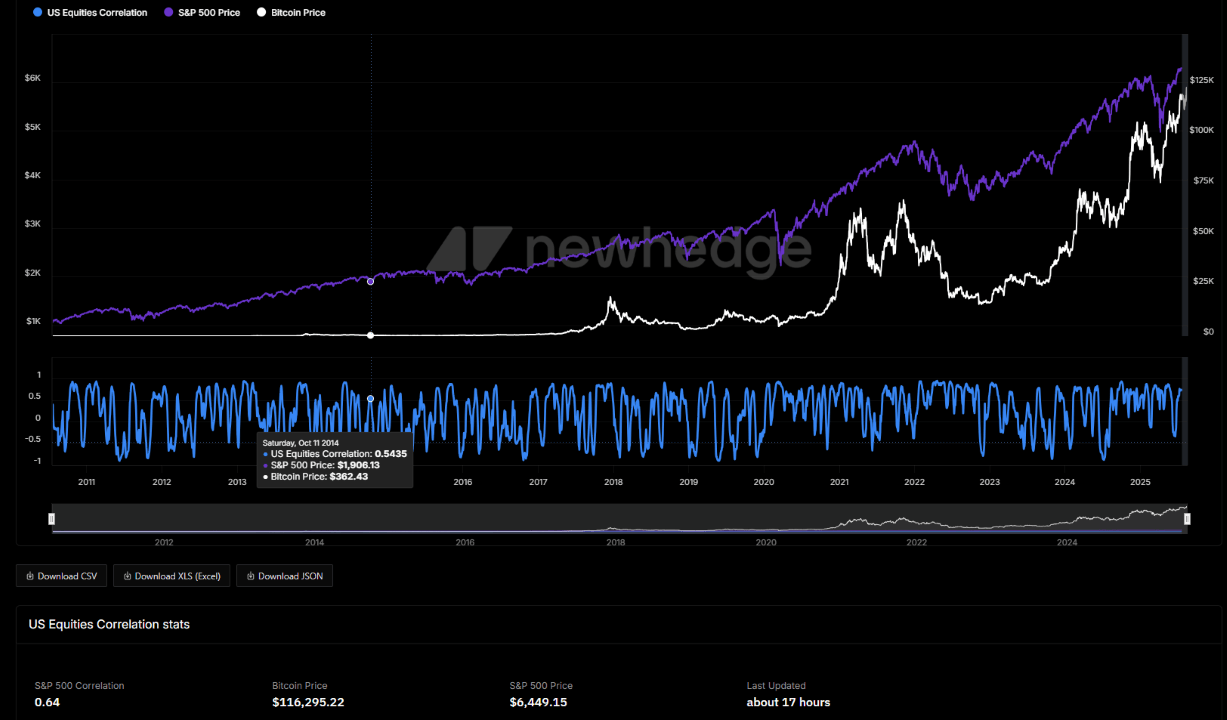

Not content to be the sole star of the decline, AMD (Nasdaq: AMD), Meta, and Tesla all decided to join the party, albeit at different speeds, with AMD taking a plunge of 5%. And wouldn’t you know it, Bitcoin, often heralded as an outsider’s hope, has instead become the awkward third wheel-clinging to a correlation with the S&P 500 soaring to 0.64 according to Newhedge. Looks like the crypto’s trying to be just as stale as the old guard. Indeed, the cryptocurrencies’ fall is as predictable as the sunrise-or a soap opera. BTC’s pricing drama unfolds accordingly.

The Market’s Miserable Overview

Bitcoin is currently hanging around $113,377.52-down 2.58% in the last 24 hours and 5.39% for the week. One might say it’s playing hard to get, dancing between $112,970.33 and $117,050.37. The trading volume over a mere day shrank by 3.15%, settling at a modest $69.06 billion, with the grand total market cap slipping away to $2.25 trillion. Bitcoin’s dominion holds steady at 59.82%, as if it were a stubborn monarch refusing to abdicate. 👑

Diving into futures, open interest plummeted 1.94%, now at a cool $81.24 billion. Liquidations remain spectacularly high, with total blowouts reaching $96.37 million since Monday, predominantly longs at $91.03 million-because, of course, who doesn’t love a good market massacre? Short positions are relatively modest, at $5.34 million, perhaps too afraid to even bother. 🤡

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- STX PREDICTION. STX cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- BNB’s Big Gamble: $160M Bet or Just Another Rich Kid’s Allowance? 💸🚀

- Fear and Greed Index Hits 5-Month Low as BTC Drops to $109K – Warning or Buying Opportunity?

- ETH to $7.6K? Really? 🙄

- Bitcoin’s $90K Dream: A Tale of Technical Traps 📉💥

- CNY JPY PREDICTION

2025-08-19 22:29