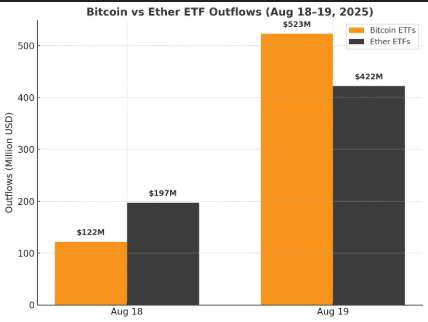

In a twist that could rival the most dramatic scenes from a Dostoevsky novel, crypto exchange-traded funds (ETFs) witnessed nearly $1 billion in redemptions on Tuesday. Bitcoin funds hemorrhaged $523 million, and ether ETFs were not far behind, shedding $430 million. Fidelity’s funds led the exodus, with no ETF managing to stem the tide of outflows.

The crypto ETF market, once a beacon of hope for digital asset enthusiasts, now finds itself under the shadow of investor caution. After Monday’s retreat, the redemptions deepened on Tuesday, Aug. 19, with nearly $1 billion exiting both bitcoin and ether ETFs combined. The trading floors, bustling with activity, could not hide the grim reality of capital fleeing the market like rats abandoning a sinking ship. 🐀🌊

Bitcoin ETFs endured a particularly brutal day, suffering a staggering $523.31 million outflow. Fidelity’s FBTC alone lost $246.89 million, the heaviest loss of the day. Grayscale’s GBTC followed with $115.53 million in exits, while Bitwise’s BITB bled $86.76 million. Ark 21shares’ ARKB lost $63.35 million, with smaller outflows hitting Grayscale’s Bitcoin Mini Trust (-$7.51 million) and Franklin’s EZBC (-$3.27 million). Not a single bitcoin ETF managed to register inflows. Despite strong trading volumes of $4.75 billion, net assets slid to $146.20 billion, a somber reminder of the market’s volatility. 💔📉

Ether ETFs fared no better, logging $429.73 million in outflows. Fidelity’s FETH led with $156.32 million in redemptions, while Grayscale’s ETHE saw $122.05 million leave. Grayscale’s Ether Mini Trust was hit with $88.53 million in exits, and Bitwise’s ETHW shed $39.80 million. Invesco’s QETH (-$7.44 million), Franklin’s EZET (-$6.29 million), Vaneck’s ETHV (-$3.03 million), and even Blackrock’s ETHA (-$6.27 million) closed the day in the red. No funds registered inflows. Trading volumes held steady at $2.76 billion, but net assets dropped to $25.94 billion, a stark contrast to the optimism that once reigned supreme. 🌬️💥

Back-to-back outflows suggest that investors may be locking in gains after last week’s historic surge. Whether this represents a brief cooldown or the start of a more prolonged correction will be closely watched in the days ahead. One can only hope that the market’s resilience will prove as enduring as the human spirit. 🙏💪

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Kraken & Deutsche Börse: A Match Made in Financial Limbo! 🦑💼

- TAO PREDICTION. TAO cryptocurrency

- Cristiano Ronaldo’s Meme Coin: A Scandalous 15-Minute Financial Farce 🤡💸

- XRP’s Big Week: SEC Drama, BlackRock Rumors & A Possible $6 Party 🚀

2025-08-20 18:57