Well now, here come the white-shoe riverboat gamblers over at Citigroup, polishing their brass spittoons and tip-toeing into the crypto saloon like a deacon invading a dice game-except they’re aiming to be the house that counts everybody else’s chips. You heard right, friend: Citi’s fixin’ to wrestle the “beloved” Coinbase bulldog for the keys to the stablecoin vault where a cool 280 billion in digital doubloons jingle around. 🤑

If you reckon that sounds like an old Southern river tycoon buying up every paddle-wheel boat on the Mississippi just so he can charge tolls for waves, well, that’s because it is. Citi’s global head of fancy partnerships-one Mr. Biswarup “I’ve-got-more-titles-than-an-English-library” Chatterjee-gave a chin-wag to Reuters and said, in the blandest banker-speak this side of lukewarm grits:

“Providing custody services for those high-quality assets backing stablecoins is the first option we are looking at.”

Translation: “We’re sick of watchin’ Coinbase eat all the pie, so we aim to pluck that plate right out from under its snout.”

Beyond simply babysitting pixels masquerading as money, they’re whispering about using stablecoins for lightning-quick border-hoppin’ wire transfers-faster than a preacher can chase a bourbon bottle on Sunday. Already they’ve got some private blockcahin “tokenized” dollars flitting between New York, London, and Hong Kong, making traditional SWIFT look like a three-legged mule hauling cement uphill. 💸✈️

When Regulators Smile, Politicians Dance, and Bankers Count the Cash 💰

Sure as catfish bite in muddy water, Citi’s swagger is courtesy of President Trump’s freshly inked GENIUS Act (because if you name a regulation “GENIUS,” who’d dare vote against it?). The law demands stablecoin issuers pack their coffers with crisp Treasuries and cold cash, which to Citi is like finding a picnic next to an ant hill-they can’t wait to carry the lemonade.

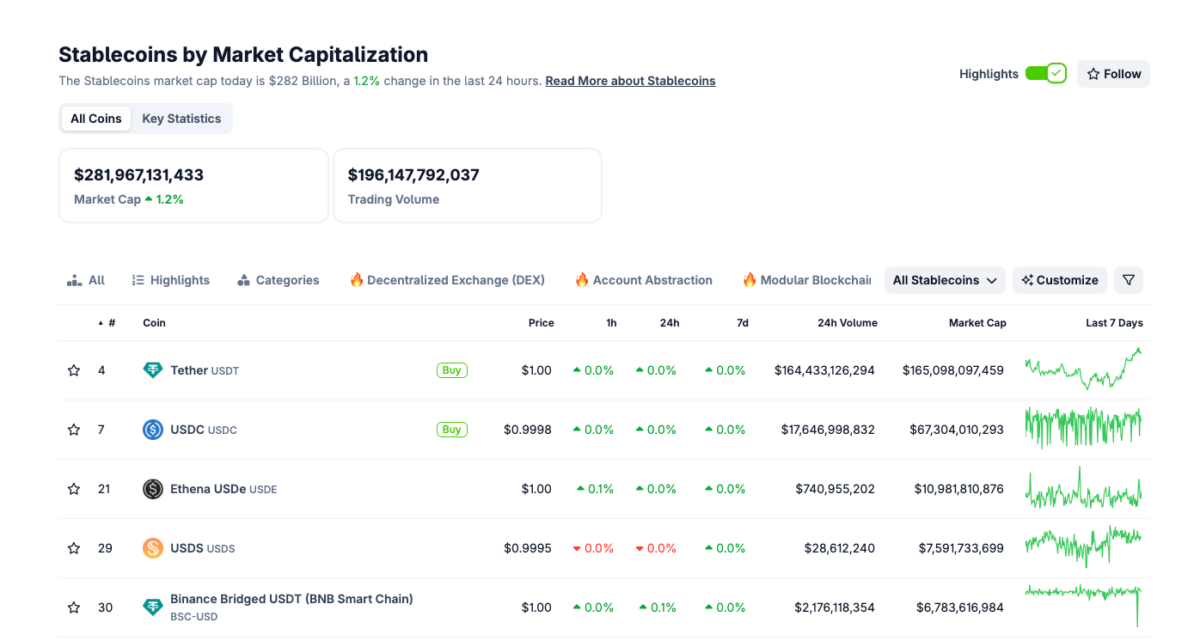

And while those snappy three-piece suits polish their Bibles and blockchain pitch decks, the stablecoin circus swells past 280 billion-more money than even ol’ Sam Clemens ever lampooned in print.

Crypto Aggregate Stablecoin Market Cap | Source: CoinGecko

Meanwhile the ETF hucksters need digital bullion on deposit like a steamship needs coal, and Citi’s angling to shovel it-only with the aristocratic snort that comes when you’ve been “too big to fail” since before Satoshi was knee-high to a laptop.

Fast-talkin’ Wallet Presale Rides Citi’s Tailwind 🐎

Now let us all pause, tip our hats, and watch the Best Wallet buckaroos gallop along, waving their 14-million-dollar presale like a banner they snatched from a barn dance. They promise lower fees, high-APY staking, and front-row seats to the DeFi rodeo-basically everything a trail-weary retail investor could want, minus the spittoon.

Best Wallet Presale

Heck, toss your saddle on their official corral before the next price hike rides over the hill-because nothing says “prudent investment” like chasing a stagecoach labeled “Next Stop: Lambo.” 😉

So there you have it, folks: old-money banks and slick-wallet startups wrasslin’ in the same muddy yard. All that’s missing is a banjo and someone yelling, “Place your bets, gentlemen-and try not to lose the sawbones’ fee!” 🎣

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- 🇯🇵 Yen Stablecoins: Japan’s New Digital Samurai Sword? 🗡️💰

- Big Ether Moves: ETH Strategy Attracts 12K ETH, BTCS Plans $2B Fundraise

- Japan’s Yen Stablecoin: Genius or Financial Disaster? 🤔

- Dogecoin’s 45% Crash: Whale Sell-Offs & Meme Coin Mayhem 🐕💸

- Bitcoin’s Wild Ride: Will It Hit $150K or Crash Harder Than Your Ex’s Texts? 🚀💸

- XRP’s $10 Leap: Analyst’s Wild Forecast or Digital Gold Rush? 🚀💸

- Dogecoin’s Descent: Will It Hit $0.13? 🐕💸

2025-08-15 07:25