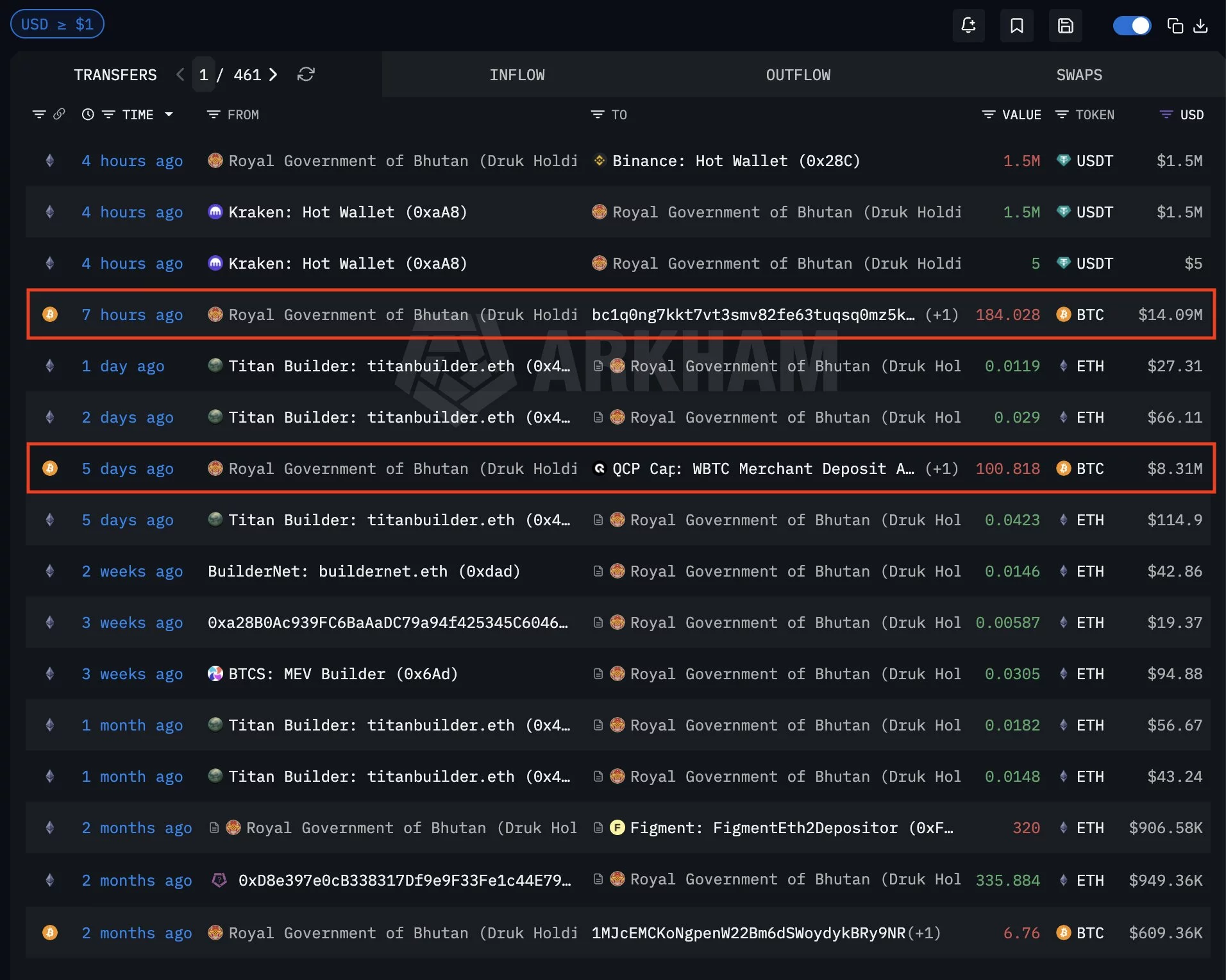

In a stunning turn of events that has absolutely nothing to do with the latest celebrity gossip, Bhutan-linked wallets, courtesy of Druk Holding & Investments (DHI), decided to shake things up by moving over 284 bitcoins. That’s right-$22 million worth of digital currency vanished faster than a magician’s rabbit last week, according to the oh-so-reliable Arkham Intelligence.

- In a shocking twist, Bhutan moved over $22 million in Bitcoin this week-this included a single transfer of $14 million that practically screams, “We’re serious about our portfolio management!” And let’s not forget the earlier $8.3 million transaction that was just chilling there, waiting for its moment to shine.

- Arkham claims Bhutan has a penchant for structured selling, often offloading Bitcoin in neat little bundles of around $50 million. It seems they had a busy season in mid-to-late September 2025, though we’re still waiting for a postcard confirming any sales from their latest escapades.

- Oh, and did we mention Ethereum and USDT movements? Just to keep things spicy, these suggest Bhutan is not just hoarding but actively managing its treasury like a financial ninja-making them one of the few governments playing the crypto game thanks to state-backed mining operations.

This activity has put a fresh spotlight on the Himalayan nation, which is rapidly stepping up as a serious player in the sovereign Bitcoin holder arena. Who knew that amidst all that stunning landscape and yaks, there would be such a financial strategy brewing?

Bhutan’s Biggest Transfer: More Than Just Pocket Change

Just seven hours ago, Bhutan graced the Bitcoin world with its largest transaction yet, moving a staggering 184.028 BTC valued at around $14.09 million. Talk about an extravagant lunch break!

And last Friday, they casually transferred another 100.818 BTC, approximately $8.31 million, to what appears to be a QCP Capital WBTC merchant deposit. Because, you know, that’s just how they roll-with institutional crypto infrastructure eating out of their hands.

While the transfers don’t officially confirm any Bitcoin sales (because who needs to sell when you can just move it around?), deposits to merchant or intermediary-linked addresses often hint at some clever liquidity management or asset repositioning. That’s right, folks-this is the adult version of rearranging your sock drawer.

The activity comes amid market volatility that has Bitcoin under pressure-putting the ‘fun’ back in ‘fundamental analysis.’ Sovereign-linked movements tend to attract attention because everyone wants to know if Bhutan is about to flood the market with their holdings.

Interestingly, it appears Bhutan’s Bitcoin stash has dwindled from a whopping 13,295 BTC in October 2024 to a mere 5,700 BTC at press time. But hey, who’s counting?

According to Arkham, Bhutan’s Bitcoin movements follow a pattern that could put clockmakers to shame.

“From our observations, Bhutan periodically sells BTC in clips of around $50 million,” Arkham noted. Their heavy selling spree in late September 2025 has folks speculating if they’re running a retirement fund for yaks.

Not Just Bitcoin: Ethereum and Stablecoin Shenanigans

But wait, there’s more! Bhutan-linked wallets also recorded several small Ethereum (ETH) transactions during this wild ride through the cryptocurrency jungle.

Perhaps most intriguingly, within hours, $1.5 million in USDT shuffled between exchange-linked wallets and Bhutan-associated addresses. These flows suggest active treasury operations-not just some casual crypto-holding party.

Bhutan: The Unexpected Crypto Powerhouse

Bhutan’s Bitcoin reserves are believed to come from state-backed mining operations powered by good ol’ hydroelectric energy. This makes them unique, unlike other governments whose holdings typically stem from seizures or some high-stakes poker games gone wrong.

The latest transfers shine a light on Bhutan’s continued engagement with crypto markets, proving that sovereign involvement in digital assets is becoming harder for the rest of the world to ignore. So, watch out, Wall Street-Bhutan just might take your lunch money!

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- DeFi’s Wild Ride: From Yield Fever to Utility Sanity 🤠💰

- Whizz-Pang: The 75/25 Crypto ETF Circus Hits the S&P

- BTC’s $93k Gamble: A Bull Cycle’s Last Dance 🐆💸

- Tokyo’s Top Man Blesses Digital Devilry! 😈💰

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- 🤑 Crypto Scams & AI: Steinbeck’s Guide to Not Getting Rug-Pulled 🤑

- Shiba Inu’s SHIB: To Break or Not to Break? 🎭

- Is XRP Being Silenced by Big Banks? The Shocking Truth Revealed!

2026-02-05 12:26