Well, I say, old bean, the AVAX price is in a bit of a pickle, what? Technical setups and on-chain shenanigans are all pointing in the same direction, but the market, bless its cotton socks, is as split as a pair of Bertie Wooster’s trousers after a hearty lunch. Some chaps are betting on a jolly good rally, while others are muttering about resistances thicker than Aunt Agatha’s disapproval. 🧐📈

AVAX Price Retests the Breakout Zone, By Jove!

Old Walter White, the chap with the keen eye, points out that AVAX has toddled back to its breakout area, testing the $27 to $28 range like a nervous debutante at her first ball. If it holds, we’re in for a spot of resistance-turned-support jollity. But if it fails? Well, it’s downhill faster than a Jeeves-driven getaway car. 🚗💨

Structurally speaking, defending this zone could pave the way to $32, with the $36 to $37 double-top liquidity area as the next port of call. But if the sellers get their way and the price slips below $27, it’s a slippery slope to $25 to $24, where the next support cluster awaits, as sturdy as a Wodehouse plot twist. 🕵️♂️💎

Whale Accumulation: A Splash of Confidence

Marc Shawn Brown, the fellow with the inside track, reports that a whale has gobbled up more than $17 million in AVAX. This purchase, timed as neatly as a Jeeves intervention, came just as the price was steadying above $27, underscoring the importance of this support level. Whale accumulation at such moments has historically been the stuff of higher runs, removing circulating supply like a butler clearing a cluttered drawing room. 🦈💼

If AVAX can keep its head above $27 to $28, this positioning suggests the buyers are gearing up for a jaunt towards $32 and beyond. But let’s not count our chickens before they’re hatched, what? 🐔🚀

Break Above $27 Keeps $37 in the Frame

ItzStr8Luck, the chap with the lucky streak, emphasizes that the $27 breakout was a structural shift for AVAX. Holding this level keeps the bullish case as lively as a Drones Club dinner. The immediate resistance is $32, with $36 to $37 as the measured breakout target. But lose $27, and it’s a trend reversal quicker than Bertie Wooster changing his mind about a girl. 💔📉

The weekly chart shows AVAX building higher lows since June, but losing $27 would negate this trend faster than Gussie Fink-Nottle can say “newts.” Volume is the name of the game, old sport. Sustained inflows on a defense of $27 would confirm momentum and send AVAX soaring higher. 📊✈️

AVAX/BTC Pair: A Bigger Reversal in the Offing?

RebornAli3N, the fellow with the eagle eye, shares the AVAX/BTC monthly chart, which shows a breakout forming after months of compression. The pair has been grinding higher from its lows, and the falling wedge structure is resolving upward, often a sign of trend reversal. The RSI has bounced back from oversold levels, and the Stoch RSI has crossed upward, hinting at improving momentum. It’s all as promising as a visit from Jeeves with a spot of tea. 🌟☕

Holding the breakout zone around 0.00028 to 0.00030 BTC could confirm the reversal and allow upside pushes towards 0.00050 BTC and later 0.00090 BTC. For USD pairs, this aligns with earlier ranges, where $32 is the first test and $36 to $37 sits as the bigger resistance cluster. A clean break above these would shift the AVAX price prediction towards the $45 to $50 zone, by Jove! 🎯💰

Fundamentals: The Wind in AVAX’s Sails

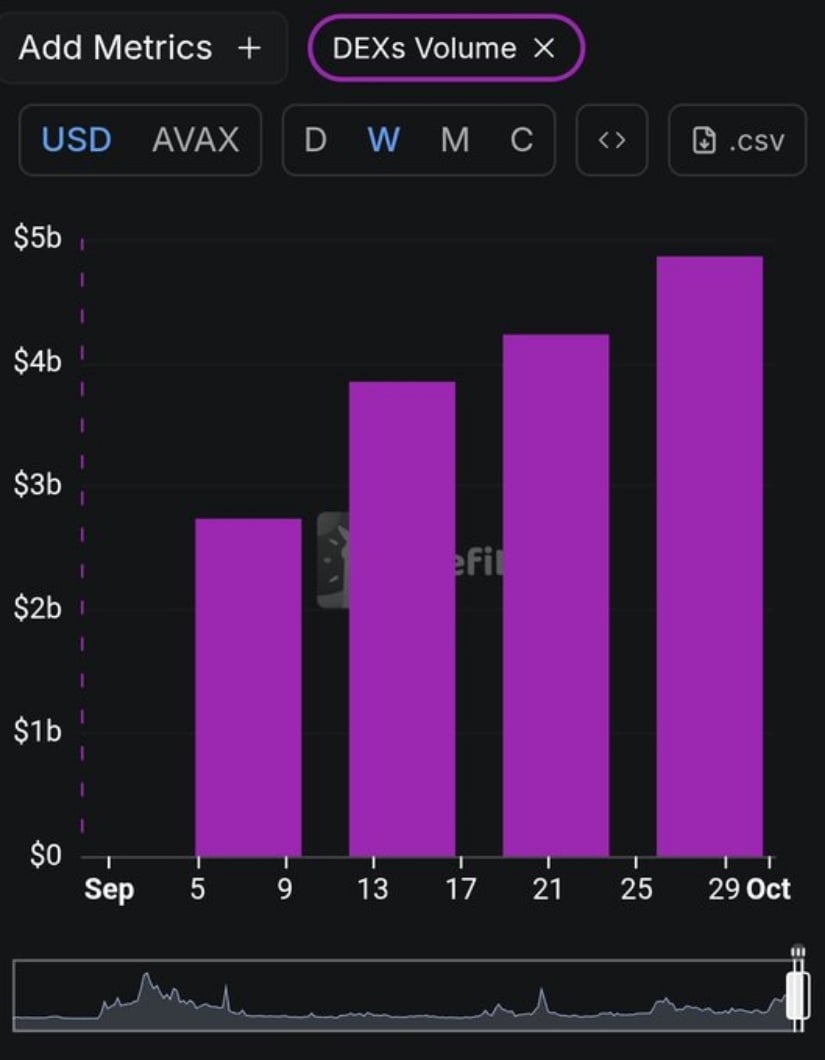

Fundamentals are also looking up, old bean. Avalanche’s DEX volume nearly doubled in September, jumping from roughly $2.7 billion to over $5 billion. This rise in liquidity and user activity signals growing demand across Avalanche’s DeFi ecosystem, as robust as a Wodehouse punchline. 💱🚀

Rising network usage strengthens the case for long-term growth and provides a cushion against near-term volatility, much like Jeeves providing a solution to Bertie’s latest scrape. 🛡️📈

Final Thoughts: The Battle for $27

AVAX price action now hinges on the $27 to $28 support zone, as crucial as a well-timed quip from the Drones Club. A successful defense would keep upside targets of $32 and $37 in play, while a breakdown risks sending the token towards $24. With whales accumulating, AVAX showing strength against Bitcoin, and DEX volumes climbing, the bulls have a strong case. Yet until $27 proves itself as a firm floor, the sellers remain in the game. The battle between these levels will determine whether AVAX breaks out towards $37 or faces another period of consolidation, as unpredictable as a Wooster engagement. 🦬🎢

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- ATOM PREDICTION. ATOM cryptocurrency

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

- BNB PREDICTION. BNB cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- GBP CHF PREDICTION

2025-09-27 23:50