Ah, the tormented soul of AVAX, wandering in the shadows of the market, its price a mere reflection of our collective despair and hope. As traders, those wretched souls, gaze upon the charts, they see not numbers, but the very essence of human folly and ambition. After weeks of consolidation-a purgatory of sorts-the market, like a fickle god, teeters near its critical support levels, leaving us to ponder: is this the dawn of a new era, or merely the prelude to further suffering? 🌪️

The Neutral Bubble: A Farce of Stability

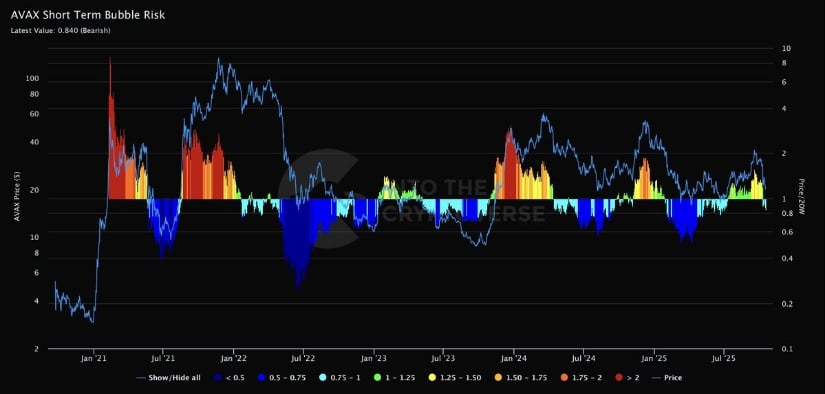

Behold, the latest chart from Into The Cryptoverse, a beacon of false hope, declares Avalanche’s short-term bubble risk indicator has turned neutral. Neutral, they say! As if neutrality were a virtue in this chaotic realm. This “cooling off” from overheated levels is but a temporary reprieve, a cruel joke played by the market upon the unsuspecting. Historically, such resets have lured long-term investors into the abyss, promising “attractive re-entry zones” only to dash their dreams upon the rocks of volatility. The indicator, dipping below the 1.0 threshold, whispers of stability, yet we know better-it is but the calm before the storm. 🌋

Should sentiment continue its charade of stability, AVAX might stage a rebound, a fleeting moment of triumph before the inevitable plunge. A recovery to $25 to $27? Ah, the sweet delusions of the bullish! Yet, in this theater of the absurd, even the most optimistic must tread carefully, lest they be consumed by the whims of the market. 🦄

Undervalued, They Say? A Comedy of Errors

Modern Day Investing, those purveyors of half-truths, proclaim AVAX to be “severely undervalued” near $20. Undervalued, indeed! As if value were a fixed concept in this madhouse of speculation. This price, they claim, aligns with historical accumulation ranges, a narrative as old as time itself. Yet, who are we to trust in a world where charts lie and indicators deceive? The demand zones of 2023 and 2024, they say, reinforce its long-term potential. But potential, my friends, is a mirage, a siren’s call leading us to the rocks. 🧭

A recovery above $24 to $25? Ah, the sweet dreams of the bulls! Yet, volatility, that ever-present specter, looms large, ready to shatter illusions. If market conditions improve-a big if-this undervalued range might serve as a launchpad. But for now, we remain in the grip of uncertainty, prisoners of our own greed and fear. 🕳️

Bearish Momentum: The Dance of Despair

Recent market action, a tragic ballet, sees AVAX slipping below the 20-week SMA and the mid-Bollinger Band. Near-term momentum, they say, remains soft. Soft? It is a knife to the heart of the bulls! The price, testing the $19 to $20 zone, clings to life, but for how long? The $15 level, a precipice, awaits, a final act in this drama of decline. 🩸

Should AVAX revisit the lower Bollinger Band near $15, it would mark the final stage of this corrective leg. A close above $25 to $26? A mere fantasy, a desperate grasp at straws. Participants, those poor souls, remain cautious, watching, waiting, hoping. Yet, hope, in this game, is a dangerous thing. ⏳

Technical Analysis: The Charts Lie, But We Listen

AVAX, breaking below its $20.72 support, clings to existence, a testament to the resilience of the human spirit-or perhaps its folly. EmilioBojan’s chart, a labyrinth of lines and numbers, shows a range between $14 and $23, a prison of consolidation. Upside targets at $28.5, $31.5, and $34.7? Ah, the dreams of the bulls! Yet, should $18 to $20 fail, a decline to $12 to $14 awaits, a descent into the abyss. 🌀

A reclaim of $24? A tilt back in favor of the bulls, they say. But for now, we watch, we wait, we wonder. Will this consolidation mature into a base for the next upward push, or is it merely a prelude to further despair? The market, that cruel mistress, holds the answer, and we are but pawns in her game. 🎭

The Falling Wedge: A Glimmer of Hope, or a Final Taunt?

AVAX, trading within a falling wedge pattern, teases us with the possibility of a reversal. CryptoPulse’s 2-week chart, a map of potential, highlights downside retests near $14, the wedge’s lower boundary. A bounce from that zone? Targets of $28 to $30, even $35+? Ah, the sweet dreams of the bulls! Yet, should the wedge breakout confirm, the bulls might regain control, turning correction into rally. But in this theater of the absurd, nothing is certain. 🌠

Final Thoughts: The Crucible of AVAX

Despite near-term weakness, AVAX stands at a crossroads, a moment of truth. Oversold conditions, undervaluation signals, wedge support near $14 to $15-all point to a possible accumulation phase. Yet, in this game of shadows, nothing is as it seems. If the broader market steadies and Avalanche holds its ground, the next rally might reestablish bullish dominance, with targets of $28 to $35. But a confirmed breakout above $30? Ah, that would reignite the flames of hope, a bullish AVAX Price Prediction. Until then, we remain in the grip of uncertainty, prisoners of our own making. 🌩️

Read More

- Gold Rate Forecast

- BNB PREDICTION. BNB cryptocurrency

- Brent Oil Forecast

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- 🤯 Korean Banks in Crypto Tryst! Stablecoin Scandal Revealed!

- USD TRY PREDICTION

- Silver Rate Forecast

- Crypto Heists: $142M Vanishes! 😱

- Bitcoin’s September Doom: Will the Fed Save the Day? 🤔💸

- Bitcoin’s Agony and Ecstasy: A Tale of Two Coins and a Doomed ETF Massacre 🚀💔

2025-10-19 00:00