Bitcoin vs. the World: Will It Crash or Conquer? 🚀

Sentiment stays positive, but price discovery hinges on how risk assets trade this week. Spoiler: They’ll probably crash. 💸

Sentiment stays positive, but price discovery hinges on how risk assets trade this week. Spoiler: They’ll probably crash. 💸

So, Miami-based American Bitcoin Corp. (trading as ABTC)-which, by the way, is not just another tech startup but one with some serious Trump-family backing-has been building the foundation for America’s very own Bitcoin infrastructure. The company has just secured even more BTC through mining and some strategic purchases, and guess what? Some of them are even pledged under an agreement with Bitmain. 💼💥

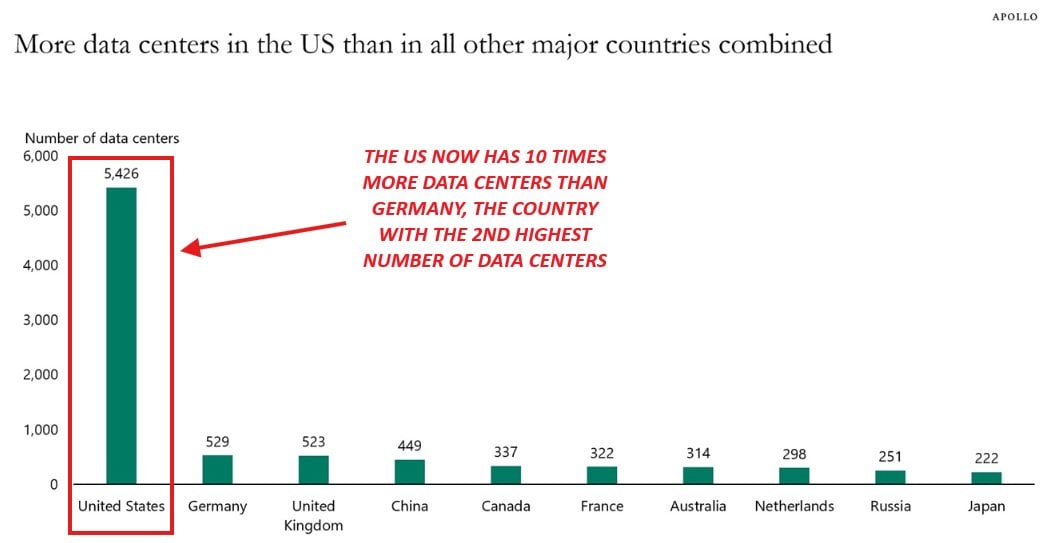

In a delightful thread posted to X, the oracle known as The Kobeissi Letter presented staggering figures that would make anyone’s head spin, even without the aid of vodka. It proclaimed that the U.S. now boasts an impressive 5,426 data centers-more than all the rest of the world’s major players combined. Now that’s what I call a robust collection of refrigerator-sized computer boxes! 😅

XRP’s fractal, a ghost from the past, hints at a 12% to 18% rally in November-a mere flicker of hope in the abyss of uncertainty. 🌌

So, XRP’s back at the crossroads, pretending it’s not obsessed with that $3 psychological level. The price action? Oh, it’s serving “I’m casually bullish” vibes, but we all know it’s plotting a full-on rally. Short-term weakness? Please, it’s just taking a dramatic pause before the grand finale.

This outfit aims to stay ahead of the game through their “minin’ operations” and what they call the “Trump Bump” – which, for all I know, might be a fancy way of sayin’ they’re gambling in the crypto wild west. But in these uncertain times, makin’ plans long-term is about as easy as catchin’ a greased pig at a county fair.

Why Hong Kong, you ask? Well, honey, it’s the new cool kid on the Web3 block, offering regulatory hugs where mainland China gives side-eye to crypto. 🇨🇳🚫 Ant Group’s like, “Oh, you want rules? We’ll take your rules and make them our runway.” Strutting into Hong Kong gives them a front-row seat to the stablecoin and tokenized finance party. 🎉🎟️

Now, hold onto your hats, folks! This brings their total stash to a mind-boggling 640,808 BTC, acquired at a mere pittance of approximately $47.44 billion. Yes, billion with a B! Feel free to take a moment to calculate how many trips to the moon that might fund 🛸. And all this was achieved at an average price of $74,032 per coin, which is totally a bargain unless you happen to own a time machine and can go back to pick up Bitcoin in its toddler years.

Should the current wave of optimism not sink under its own weight, LINK may soon aim its cannons toward $23.61 – perhaps even $46. Once again, the brave cry: “To the moon!” while others quietly sell at the shore. 🚀

The $0.29 resistance, a stage set for tragedy, has proven as reliable as a politician’s promise. Its recent rejection was a slap in the face to buyers, who now scurry like mice in the dark. Sellers, emboldened, guard their fortress with the zeal of a horde of caffeinated squirrels. The value area high, once a sanctuary, has crumbled faster than a house of cards in a hurricane.