Will Ethereum Hit $6,500? Or Is It Just a Pump and Dump? 😂

Whales are waking up, folks! Balances are dropping faster than my patience at a family BBQ. Traders are probably gearing up for a rocket – or a really expensive fumble.

Whales are waking up, folks! Balances are dropping faster than my patience at a family BBQ. Traders are probably gearing up for a rocket – or a really expensive fumble.

In their very humble press release, the firm mentioned they had boosted their cash reserves to $389 million (up from a measly $305 million) while casually stating that they plan to acquire 5% of Ethereum’s circulating supply. Well, nothing says “confidence” like buying up all the ETH in sight, right? 🤑

Donald Trump, never one to mince words (or facts), recently declared that while he wouldn’t invite Cuomo to a backyard BBQ, he’d still pick him over Mamdani, whom he compared to a “used car salesman for the Bolsheviks.”

This experiment was part of Brazil’s Drex CBDC project, basically the blockchain version of “Netflix and chill” between Brazil’s Drex network and Hong Kong’s Ensemble platform. 🌐✨ Think of it as a dating app for blockchain networks-except instead of swiping left, they’re swiping data.

In a dramatic twist worthy of a Parisian opera, the SEC now contemplates the Grayscale Hedera Trust ETF. 📜🎭 Rumor has it Paul Atkins, that architect of standards, might wave his wand by November 12! 🪄📅 But let us not forget: in this theater, hope is the lead actor, and reality? Merely a stagehand. 🎭💸

Followed by a series of tepid attempts to regain charm-oh, the tragedy of $0.205 rejected-our dear meme coin seems content to shuffle back and forth like a no-good actor in a play nobody asked for. Technical analysts, those hopeful prophets, whisper tales of grandeur once this slow decline finally, mercifully, ends. Or so they pretend. 🤷♂️

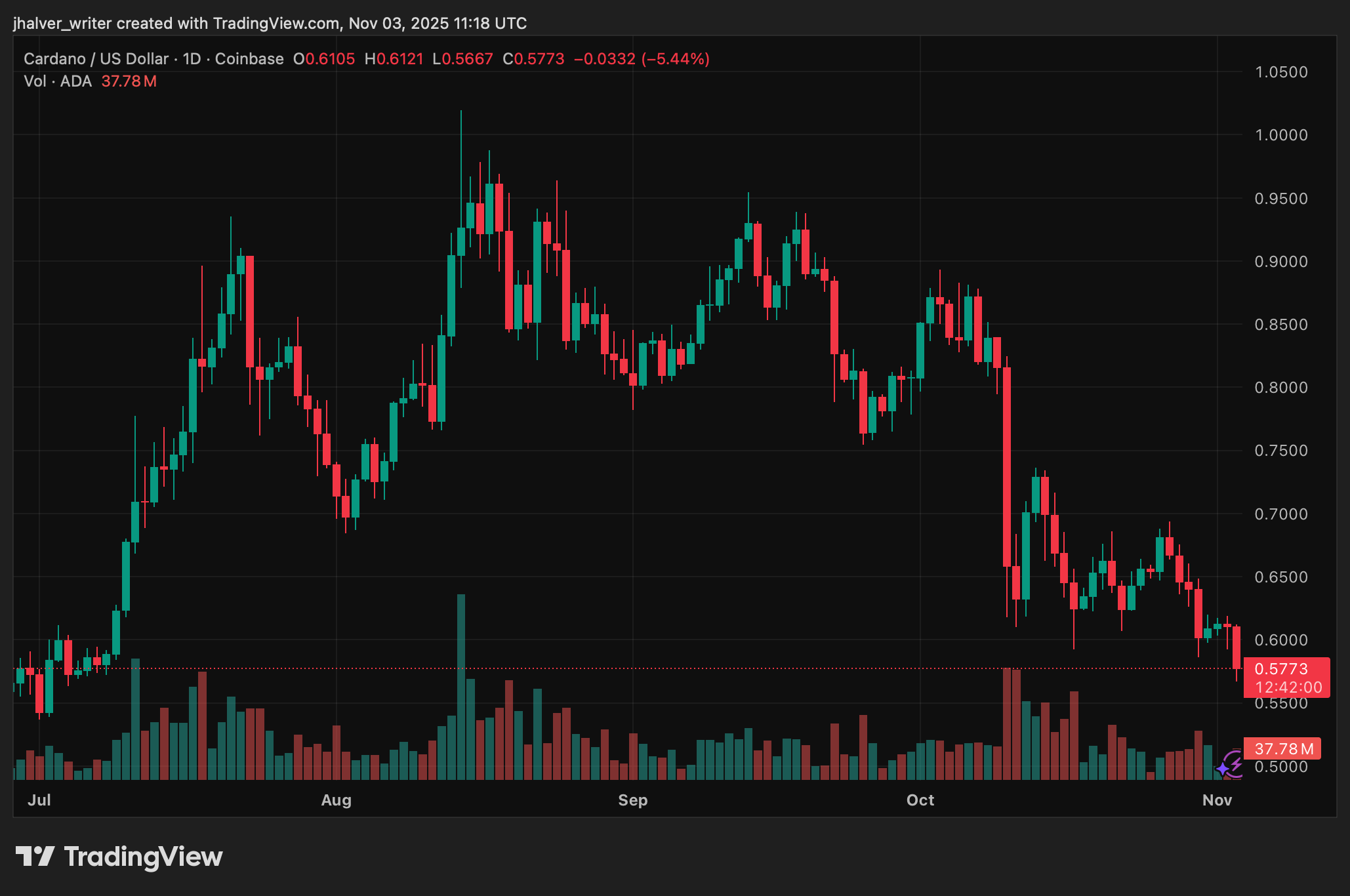

The market is feeling particularly bearish, folks. According to CoinGlass, the long-to-short ratio for ADA is now sitting at a dismal 0.75, the lowest we’ve seen this month. That means more traders are betting on ADA to fall further-because who doesn’t love a good underdog story, right? 😒

🚨 Crypto alert:

[#XRPUSDT] Near Horizontal Support (1h)

Yes, you read that right. Balancer, the platform that was supposed to be the Fort Knox of DeFi, has reportedly been breached. The hacker didn’t just grab a few spare coins; they went for the whole treasure chest. Nansen, ever the vigilant watchdog, noticed the unusual transfer and sounded the alarm. Meanwhile, the Balancer team is either busy investigating or practicing their “no comment” skills. 🤐

Ethereum (ETH) is holding firm around $3,604 as on-chain data shows the network processing a record $2.82 trillion in stablecoin volume this month. The surge underscores Ethereum’s dominant position as the settlement layer of choice for digital dollars, and could be a leading indicator of stronger demand for ETH itself. Or, you know, it could just be a bunch of bots arguing over fractions of a cent. Either way, it’s so 2021.