MEXC Unleashes AI-Powered Candlestick Chart Tool: Will It Save Your Crypto Trades?

Bitget’s GetAgent, Binance’s AI Token Report, Bybit’s TradeGPT-so many acronyms, so little time.

Bitget’s GetAgent, Binance’s AI Token Report, Bybit’s TradeGPT-so many acronyms, so little time.

What is this if not a symphony of connectivity? The appearance of SAPIEN on multiple Binance platforms is no mere listing; it’s a full-blown invasion into the very DNA of Binance’s vast ecosystem, where millions of your fellow users are already floundering, er, thriving. Picture it: SAPIEN slipping through the cracks of every corner of this digital bazaar. 🏪

But wait, it gets better. Our hero then upgrades to the glamorous status of “Oslo Norway.” No biggie, just a guy living his best jet-set life, changing locations faster than your grandma changes channels during a commercial break. 📺✨

The current market sentiment? It’s about as appealing as a flat tire-nothing but spitting and sputtering. But if your heart still beats for the bulls, and your conviction is thicker than molasses, then perhaps now’s the time to scuff up your shoes and wade in. The reason? Raoul Pal, that macro wizard, says the big wigs are pouring money into the system-trillions of dollars, enough to make your head spin. With so much debt to roll over, it’s like throwing another log onto the fire. The number go up. Seems simple enough, doesn’t it? 🔥

Ethereum ETFs have recorded a six-day streak of net outflows. On November 5, they lost $119 million. And who’s leading the charge? BlackRock’s ETHA, which saw a sharp drop of $147 million, while other players barely made a ripple. Can’t win them all, huh?

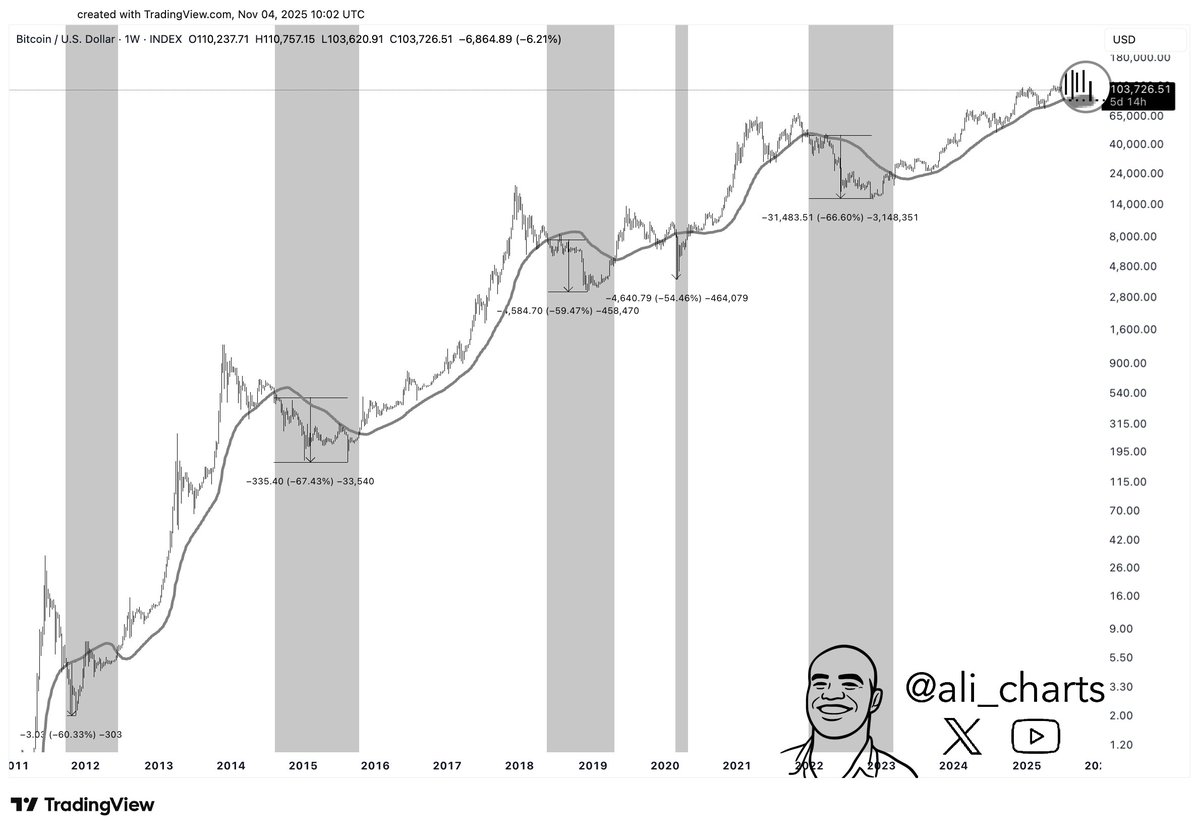

At the hour of this scribbling, the fanciful asset clings to $103,000, boasting a paltry 1% gain in the last 24 hours. Yet, in the span of a week, it has tumbled 7%, with daily trades nearing $61.7 billion. A modest decline, you say? Nay, it is but the first act in a comedy of errors! 😱💰

“We do not have an IPO timeline,” Long told Bloomberg, as if explaining why you don’t need a roadmap to find your way out of a dating disaster. “No plan, no timeline.”

US President Donald Trump is probably the most “pro-crypto” president in the world, if “pro” means “I’ll tweet about it until it’s not.”

I’m sorry to be the bearer of bad news, but XRP holders are getting the coattails treatment. Only 65% are in the profit lane, while the rest are left panting in the ozone layer-or rather, scuba-diving for bubbles. Meanwhile, Ripple’s churning out the Wall Street magic show funded by their own XRP stash.

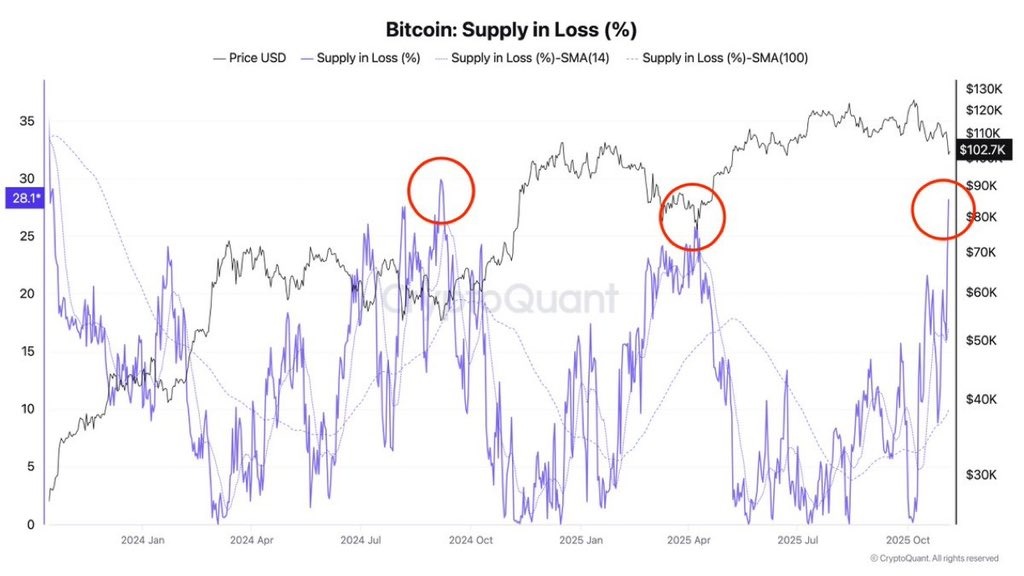

Meanwhile, the crypto market is snoozing through its own party, with altcoins playing dead 🙉. Investors? Pacing the floorboards since BTC dipped below $100K like it’s a haunted house. But hold onto your wallets, folks-because the real drama’s hiding in the numbers.