Twain’s Twist: Chainlink’s Capers as Bitcoin’s Grip Slackens!

Source – X, the land where traders whisper into invisible earpieces.

Source – X, the land where traders whisper into invisible earpieces.

Now, Bitcoin-bless its heart-has dropped below the ever-important $100,000 mark for four consecutive days. One can only wonder how long this downward spiral will last. If the trend continues, and who are we to argue with fate, it might not only continue to stoke the fires of panic but could very well lead to a full-blown market collapse. Who needs stability when you can have chaos, right?

Japan’s Financial Services Agency (FSA), because nothing says “innovation” like a government body approving a project that’s basically just a digital version of a paper clip, has given the green light to a pilot program for yen-backed stablecoins, led by three of the country’s biggest banks. These are the same banks that once tried to explain the concept of “interest rates” to a toddler and were met with a blank stare.

In an 80-page treatise titled “Network-Based Detection of Wash-Trading,” which remains unreviewed by peers, the researchers uncovered a labyrinth of wash-trading on Polymarket starting in July 2024. That month, they discovered that nearly 60% of the platform’s total trading volume was… well, fake. 🤡

The so-called “Quantum Doom Clock” ticks ever closer to March 8, 2028, at 11:23 a.m., the moment when qubits, those mischievous particles of the future, may achieve the density required to shatter Bitcoin’s cryptographic fortress. Shor’s algorithm, a name now whispered with dread, threatens to lay bare the private keys, rendering elliptic-curve encryption as fragile as a maiden’s vow. ⏳🔓

In a post that left the crypto community both stunned and skeptical, Cantonese unveiled Grok’s AI analysis about Dogecoin’s future. According to Grok, if this is the beginning of wave 3 (oh, the waves!), Dogecoin could surge between $4.48 and $5.76, provided it hits the “standard 1.618 extension”-whatever that means. And hold onto your hats, because if this thing gets crazy enough to hit the “2.618 extension,” we could be talking about a price between $37.76 and $48.55. 🚀

Ether’s profitability metrics have descended to depths that, in the annals of history, have heralded local bottoms. 🌊

Behold, the prophecy of yore was true! Paradigm’s HYPE hoard, a near-billion-dollar sonnet, crowns them as the sovereign of this digital realm. One might say they’ve penned a cheque for the future, all while the market yawns. 🧙♂️

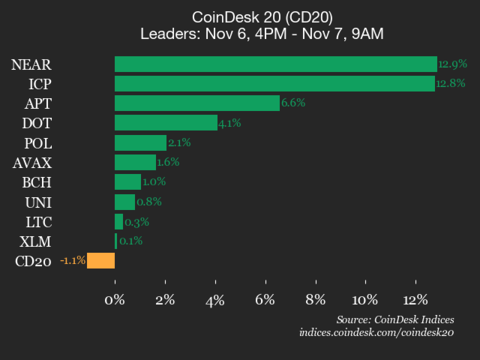

Ah, the market! What a glorious, unpredictable mess it is. Today, CoinDesk’s numbers are as cryptic as ever, offering a rare glimpse of the chaos at the heart of the CoinDesk 20 Index.