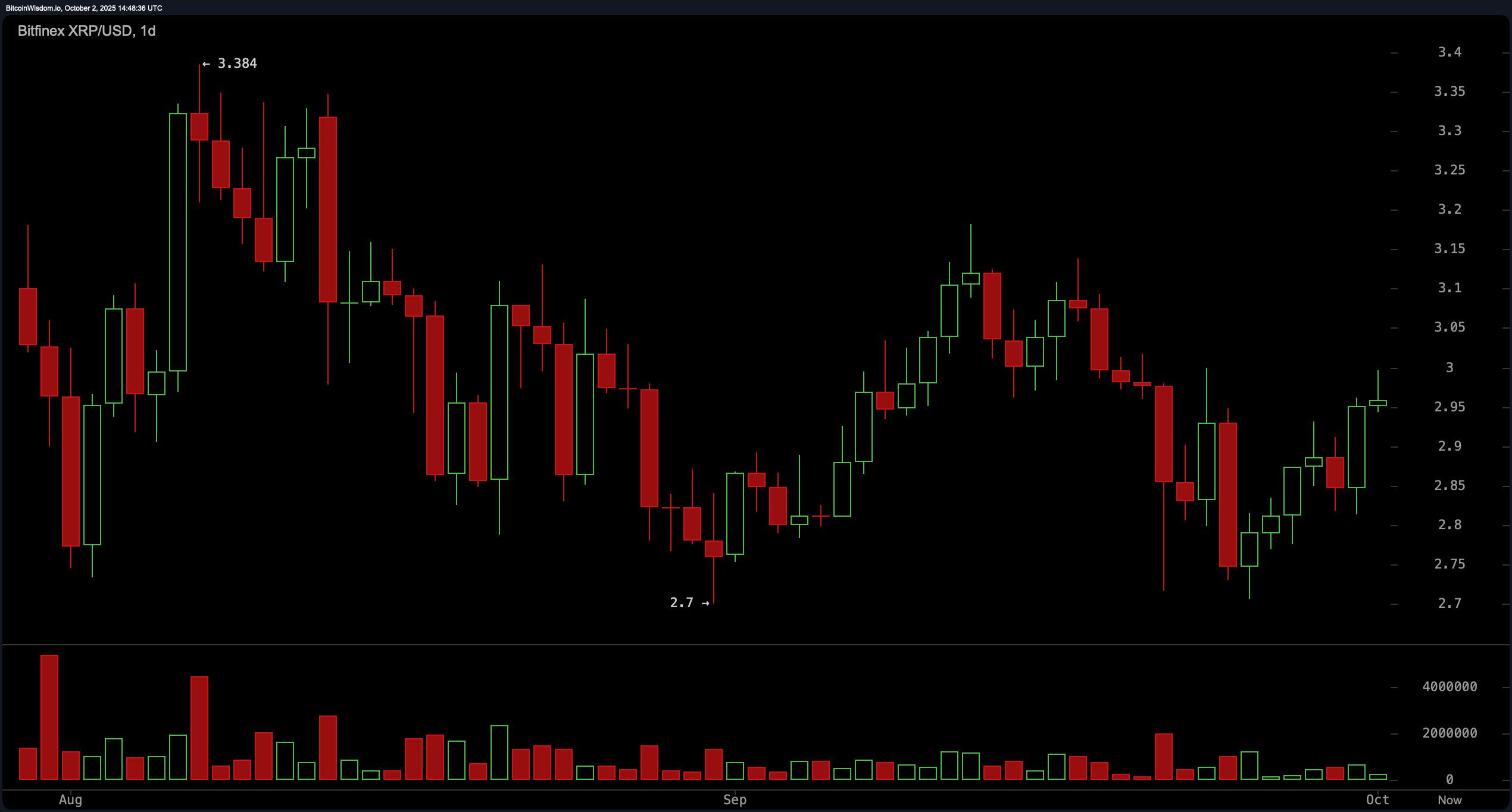

What the Dickens is Happening with XRP? A Tale of Bulls and Breakouts!

The market cap of our dear XRP sits proud at $178.2 billion, wearing its confidence like a Sunday suit, but let’s not mistake it for cockiness! Buyers are coaxing those candles upwards, trying to flip the $2.90s from a revolving door back to that dismal $2.80. Now there’s liquidity! Dips getting gobbled up like grandma’s pie at Thanksgiving, with folks choosing patience over panic-commendable! 🍰