Morgan Stanley’s Crypto Gambit: Ethereum ETF or Just Another Rich Man’s Toy? 🎩💰

Behold, the Key Highlights of this financial farce:

Behold, the Key Highlights of this financial farce:

Morgan Stanley, the financial giant that’s basically a superhero in a suit, has just filed an S-1 with the SEC for its Ethereum Trust! 🦸♂️💰 Following in the footsteps of Bitcoin and Solana ETF submissions, because who doesn’t want to jump on the crypto bandwagon? 🐍🚀 The $1.8 trillion firm will hold ETH directly, stake … Read more

This isn’t your average ‘influencer’ flexing on yachts and private jets-nope. She’s pled guilty to 38 counts of pretending to be 38 different people on the government’s dime. Who knew identity theft could be so trendy? 🙄

Points clés en spectacle

Bybit, hailed as the crypto arm wrestling champ by trading volume, has unleashed its “2026 Crypto Outlook.” This report seems to be scrambling to find meaning in an era where central banks are the new gold standard (pardon the pun) and institutional investors are running the show. Goodbye halving as our market compass, hello Federal Reserve and those cryptic options books-because reading them was our old hobby anyway. 😒

It’s still sittin’ pretty within a pattern, though. But, this little jump suggests buyers are gettin’ bold, takin’ charge, so to speak. That is, until reality sets in… 😒

So, SUI Group Holdings Limited (NASDAQ: SUIG) just dropped the bomb that Brian Quintenz-yes, that Brian Quintenz, the one who also moonlights as a16z’s crypto Global Head of Policy-has joined as an independent director starting Jan 5, 2026. Talk about a glow-up! ✨ And wait for it… he’s also hopping on the audit committee train! Now, that’s what I call multi-tasking! 🚂

Now, don’t go getting your monocle in a twist-this new unit doesn’t fiddle with XAU₮’s structure or its solid-as-a-rock physical backing. The gold, my dear chaps, remains snug as a bug in secure vaults, with on-chain proof to boot. No funny business here, just good old-fashioned reliability with a dash of modern flair. 🏦✨

It is said that fortune favors the bold, and indeed, a report shared on the grand social stage known as X (formerly Twitter) proclaimed that applications birthed from the loins of Solana amassed a staggering $2.39 billion in revenue. This sum reflects a delightful 46% increase year-over-year, achieving a new heights of all-time high – an ATH worthy of a sonnet!

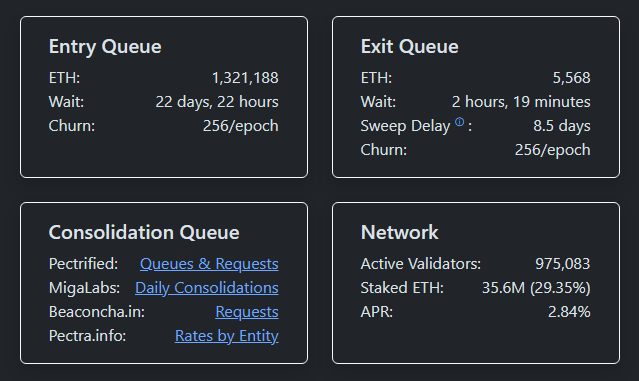

They claim this lack of a queue reduces “nervous selling.” Nervous selling! As if digital assets are prone to fits of anxiety. They earn rewards while waiting, you see. Rewards! Like a gilded cage. Though a badly behaved validator risks penalties. Oh, the indignity! But the bottleneck, that insidious delay…it has evaporated. Poof! As if conjured by a particularly inept magician.