Hut 8’s $330M Gamble: Bitcoin, Crypto, and a Gigawatt of Drama!

This article is from Theminermag, a trade publication for the cryptocurrency mining industry, focusing on the latest news and research on institutional bitcoin mining companies. 🧨

This article is from Theminermag, a trade publication for the cryptocurrency mining industry, focusing on the latest news and research on institutional bitcoin mining companies. 🧨

In a tapestry of words aired on the humble stage of the Paul Barron Podcast, our intrepid Mr. Kwok took to explaining, with the aplomb of a seasoned raconteur, that XRP is cradled by a vast coterie of devotees to the tune of swift and seamless transactions. Per the scrolls of Coinbase’s recent market soothsayings, this rambunctious Ripple joins the illustrious duo of Bitcoin and Ethereum in the narrative of most fervently sought-after cryptocurrencies. 🎭

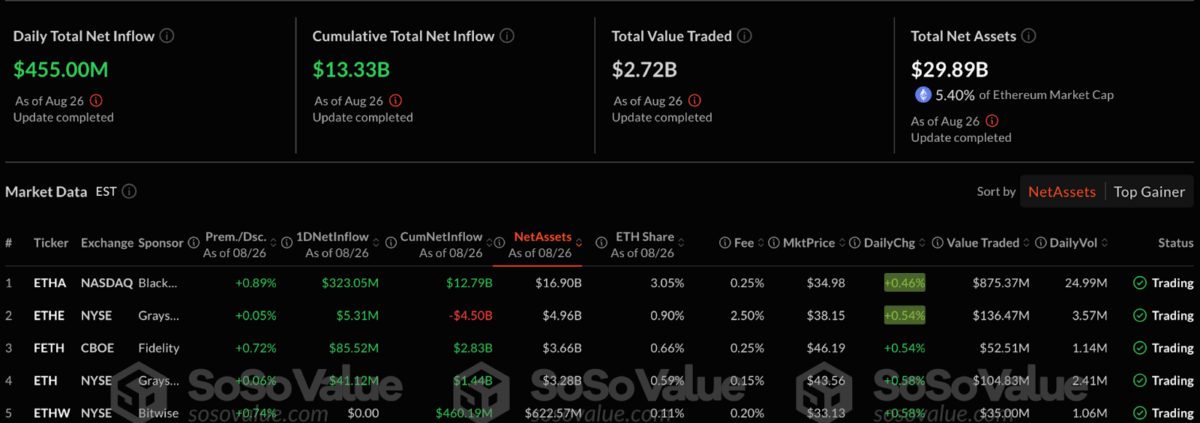

James Seyffart, that clever clog at Bloomberg ETF, quipped on X that advisers are “dominating the known holders” of Ether ETFs, piling in $1.3 billion-or 539,000 ETH-in Q2. That’s a 68% jump from last quarter, folks! One might say they’ve traded their top hats for crypto wallets. 🎩→👛

The idea is banks can use USDC to settle transactions but still pretend everything is normal with their good old fiat currencies. It’s like putting a tracksuit on a penguin. It’s still a penguin, but…slightly more hip? They say it cuts costs and speeds things up. I’m waiting for the part where *I* see lower fees. Just saying.

In the past 24 hours, SOL rose a cheeky 7%, nudging its price slightly above the $200 mark. Cue the confetti and champagne (or maybe just some sparkling water if you’re into responsible celebrations 🍾). This adds to its already impressive bullish momentum over the past few weeks.

At the very heart of this melodrama lies the claim that the Foundation’s most significant efforts are as invisible to the end user as a well-mannered ghost at a soirée. “The Cardano Foundation plays a critical ongoing role in maintaining key components, much like a polite butler ensuring the silverware shines for the dignitaries,” the post rather grandly declares.

But fret not dear reader, for a flicker of optimism glimmers among a cadre of analysts! They claim this consolidation is but a brief intermission before the next spectacular act-perhaps it is merely a catnap before a furious leap into positions unseen! Yes indeed, they argue that if XRP can linger near $3, it may just fancy itself a mighty upward journey into realms unknown. Would that not be splendid? Or perhaps laughable? 😂

The CME Group, which I imagine is run by a very serious man named Glenn who has never once laughed at a knock-knock joke, announced that their entire crypto… portfolio?.. bundle?.. menagerie?.. had surpassed thirty billion dollars. A sum so large it’s impossible to visualize unless you picture it as the number of times I’ve checked my own meager bank account this year. The real star of this deeply boring show was XRP, which apparently sprinted to the billion-dollar mark with the frantic, desperate speed of a man who just realized he left his child at a Buc-ee’s.

No one would say the amount, of course. Money talks, but it whispers its own name. Though the sources, those familiar ghosts, they told Reuters it reached into the double-digit millions. A significant step, they said. A step toward the big, fat American market, lush and green and ready for the plucking.

According to Bloomberg’s crystal ball, Goldman Sachs is not just a pretty face – it’s got $721 million worth of ETH, adding more than 160,000 ETH to its collection. Jane Street and Millennium are sneaking in with $190 million and $187 million like the cool kids at the party. Other heavy hitters? Capula, DE Shaw, HBK-basically the Avengers of Ethereum staking.