Bitcoin Price is Losing a Crucial Support Level: Time to Worry or Buy the Dip?

The burning question everyone’s asking: Is this the beginning of the end? Or is it just the classic “buy the dip” moment we’ve all been waiting for? 🤔

The burning question everyone’s asking: Is this the beginning of the end? Or is it just the classic “buy the dip” moment we’ve all been waiting for? 🤔

Our dear hero, Justin Sun, gazed into the crystal ball and perceived the disquieting murmur of growing fees, which had begun to gnaw at user activity like a hungry mouse at a forgotten crumb. After all, who wouldn’t resent feeling like a bank teller in this age of doubled TRX values since the dawn of 2024? Stablecoin transfers, particularly Tether’s USDT, clutching onto the daily traffic like a child to its beloved teddy bear, faced the threat of *elevated costs*. We must ask ourselves: must we sacrifice our comfort for mere profit?

According to SoSoValue, the Ethereum ETFs have attracted a princely sum of $4.04 billion, while the Bitcoin ETFs, in a display of financial modesty, have managed to shed $628 million in August. One might say it’s a tale of two cryptos-though one is clearly more popular at the party.

One wonders if this entire enterprise isn’t rather akin to building castles from quicksand, but the present fall – Bitcoin shedding 3.56% in a day, a whole 7.61% in the week – has ignited a fresh wave of doubt. Ethereum fared hardly better; a 4.31% tumble adding to seven days of woes. A most distressing state of affairs, wouldn’t you agree? 🙄

In missives sharp as a winter wind, ZachXBT laid bare his reasoning. “I extend no aid to the XRP flock,” he wrote, “and shall delight in ridiculing any soul foolish enough to darken my DMs.” His scorn did not end there. Oh no. He deemed Ripple’s devotees unworthy of support, branding them as mere “exit liquidity for those who dwell in gilded boardrooms.” A harsh indictment, indeed-but who dares argue with the man who has unmasked more frauds than a jaded magistrate?

Thanks to a first round of funding-because nothing screams “we mean business” like €20 million handed over-they’re ready to start buying Bitcoin faster than you can say “blockchain buzzword.” And because ambition clearly runs in their veins, more money will be raised from the public later. Popcorn, anyone?

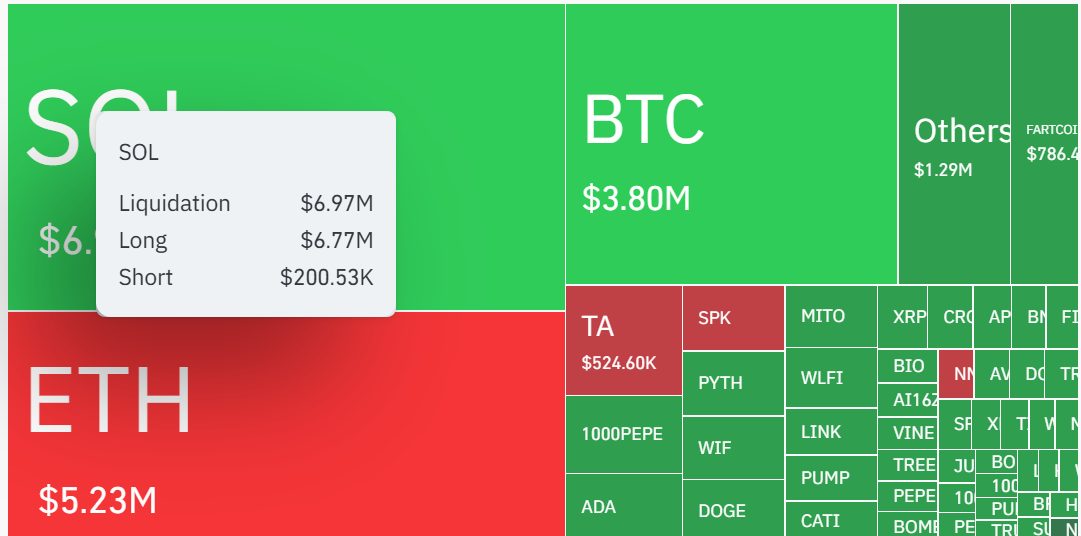

Data from Coinglass – because who doesn’t love staring at numbers that make you question your life choices – shows a colossal, one-sided liquidation party over the last hour. Spoiler alert: the bulls were not invited. Or rather, they were, but kicked out faster than you can say “wallet wipe.”

From the cryptic realms of blockchain data, a certain analyst named Maartunn-a seer of sorts for the crypto faithful-reports that despite Ethereum’s bruised state, a torrent of buying surged through all exchanges, as if half a billion dollars could drown out the wailing of pessimists. Yes, dear reader, in less than an hour, $557 million worth of ETH changed hands, a fleeting fireworks display amid the gathering darkness on August 29.

“I post what I see. I assume strong opinions always weakly held. I am wrong as often as I am right. If you are offended by my charts, then that is your problem

The chart of XRP is potentially very negative”

Gumi, backed by the ever-ambitious SBI Group, has chosen Ripple’s XRP as its shiny new crypto bauble. On Aug. 29, the company announced this acquisition with all the fanfare of a royal wedding, declaring its intention to accumulate more of the token over the coming months. One might wonder if they’ve also considered buying up Monopoly money while they’re at it. But no, this is serious business. Earlier this year, Gumi purchased 80,352 Bitcoin (BTC) for $6.7 million, which they’ve been staking on platforms like Babylon. Clearly, they’re building a portfolio as eclectic as a thrift store’s finest offerings. 🛒✨