3 Altcoins That Can Hit All-Time Highs In September 2025

Well, worry not, dear reader. BeInCrypto has meticulously dissected three top altcoins that seem to be holding their own-and might just have a shot at a glorious new ATH in September.

Well, worry not, dear reader. BeInCrypto has meticulously dissected three top altcoins that seem to be holding their own-and might just have a shot at a glorious new ATH in September.

Ethereum, meanwhile, is having a moment. A long-time Bitcoin holder recently sold 4,000 BTC (which is roughly the weight of a small asteroid in crypto terms) and converted it into 96,000 ETH. This isn’t just a lunch break purchase-it’s the crypto equivalent of a wizard selling all their gold coins to buy a library of spellbooks. That wallet now holds over 837,000 ETH, which is enough to make even a dragon blush.

But, dear reader, while this digital Hecate cavorts in the abstract, in the realm of cold, hard cash, AI is decidedly less insidious-more like a benevolent librarian, if librarians wielded algorithms. Money management, that Herculean task now fraught with apps that malfunction, accounts that refuse to transfer, and fees that appear as if conjured by dark magicians-it’s enough to make you wanna toss your phone out the window.

According to CoinMarketCap-because who else are we going to trust these days?-Dogecoin is now trading at $0.2159, which is a 1.04% dip in the last 24 hours. What a tragedy! It once reached the lofty height of $0.2196 before the inevitable correction. And, spoiler alert, it’s not just a temporary blip. The poor thing has shed 2.07% in the last week. Oh, the humanity! 📉

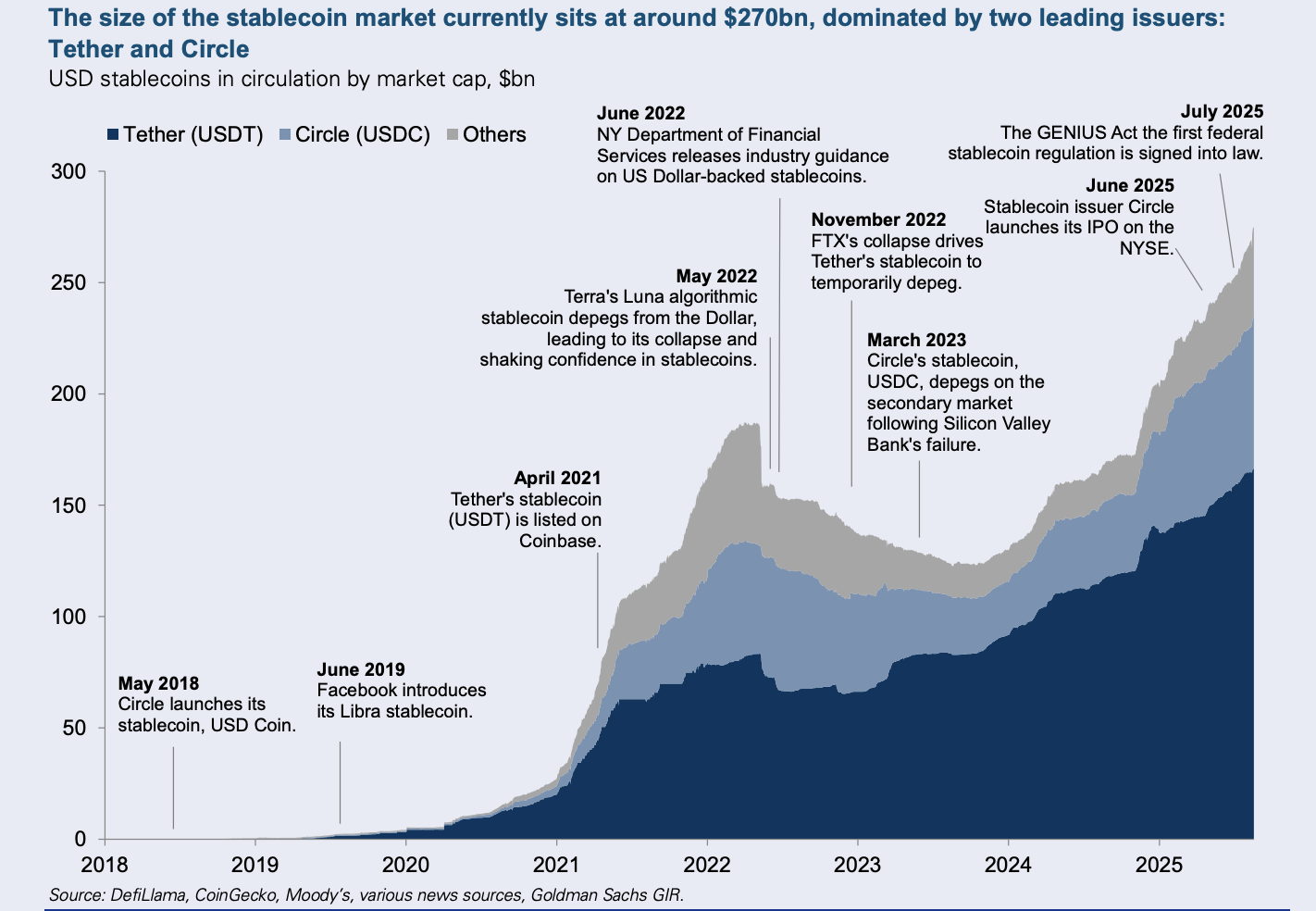

In a chat with the Financial Times, the learned professor from the Toulouse School of Economics laid it on thick. He reckons that if people lose faith in the reserves backing these stablecoins, we could see a mad dash for the exits-forcing governments to shell out big bucks to keep the show on the road. 💸

Remember when Bitcoin’s price swings made a rollercoaster look like a stroll in the park? Those days are as gone as a wizard’s hat in a hurricane. 🌪️ Now, thanks to corporate hoarders like Michael Saylor’s MicroStrategy, Bitcoin’s price behaves more like a sleepy tortoise than a hyperactive hare. 🐢💤 Companies from Tokyo to Timbuktu are stockpiling Bitcoin like it’s the last pie at a Discworld feast, and the result? Volatility has been shackled faster than a troll in a library. 📉🔒

CoinGlass, that omniscient oracle of the crypto realm, reveals a spectacle: WLFI’s trading volume, a grotesque $3.95 billion, has ballooned by 530% in the past 24 hours, while open interest, that fickle mistress, has climbed 60% to $931.9 million. Ah, the theater of it all! And for what? To unlock a mere 20% of tokens from the earliest purchase rounds, priced at a laughable $0.015 and $0.05. These tokens, a paltry 5% of the total supply, are the prize for which early investors-those poor souls-may only sell one-fifth of their allocations. A cage gilded with digital promises. 🦜💰

It is the ‘digital gold’ that has captured the hearts and wallets of institutions, governments, and retail investors alike. But, dear reader, despite its regal stature, Bitcoin cannot fulfill the grand visions of a truly global, programmable financial system. It is, after all, primarily a store of value, a fortress against the uncertainties of the modern economic landscape. 🤔

Now, you might think, “More Bitcoin, more money, right?” Wrong, my friends! Over the past month, Metaplanet’s stock has been as stable as a wobbly chair, and it’s now testing the support of 830 JPY after a 5.4% correction. The latest pressure? Well, it seems the company’s fundraising mechanism is feeling a bit like a deflated balloon. 😔

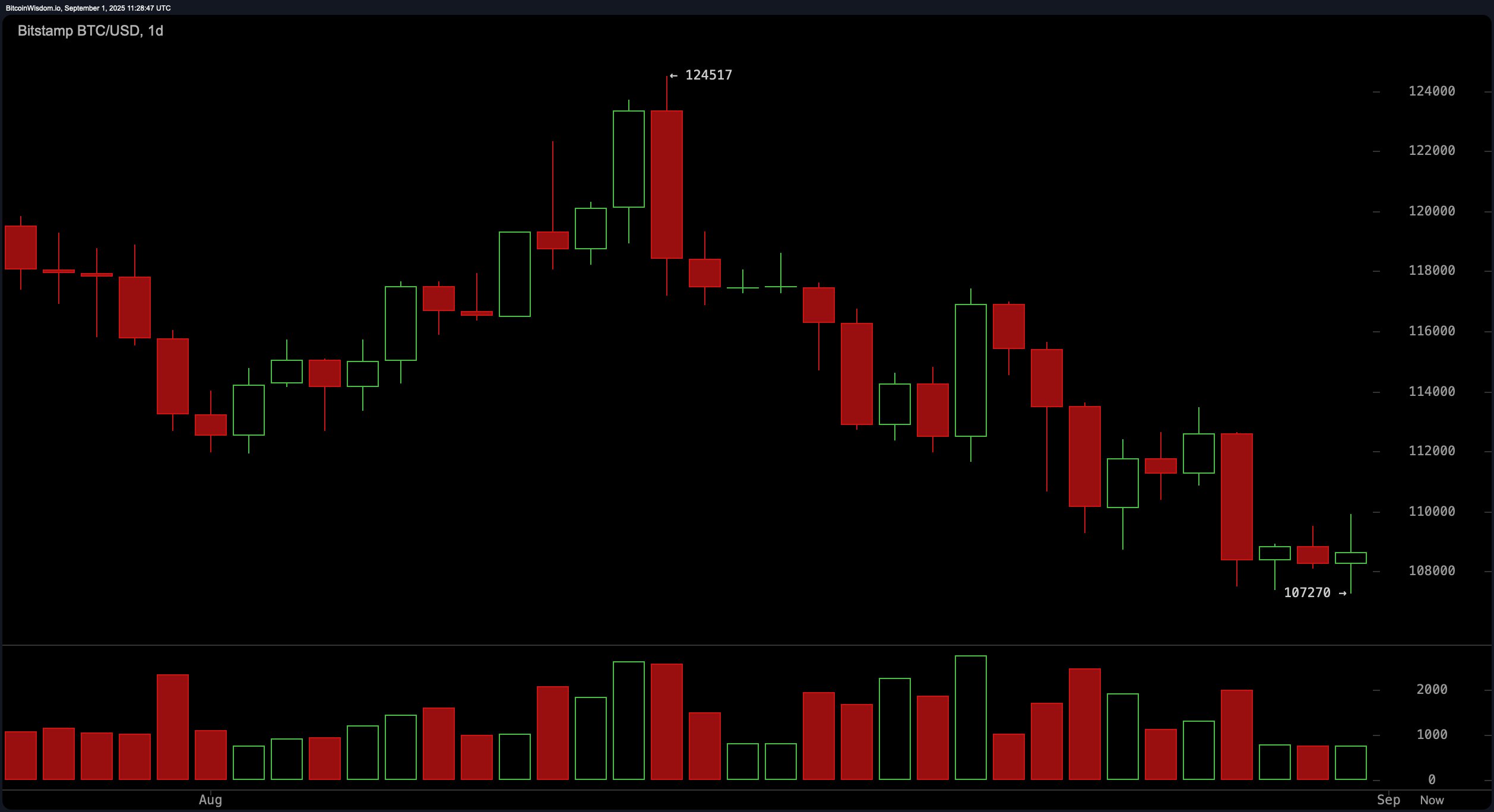

On the daily chart, bitcoin is like a knight on a quest, navigating a clear downtrend from a lofty peak of about $124,500 to a rather more modest $107,270. This journey has carved out a pattern of lower highs and lower lows, which, for those who speak the language of charts, confirms a short-term bearish trend. Despite a valiant effort to bounce back, the price stumbled near $112,000, making it clear that this level is a fortress of resistance. The red candles with elevated volume are a bit of a giveaway, showing that the bears are still in control. If the $107,000 area gives way, it might just be the gateway to a trip down to $104,000. But until we see a solid bounce above $110,000 with some serious volume, the mood remains cautiously skeptical. 🤔