Will Solana Dance at the Ball or Trip Over Its Own Wallet? 💃💸

Key Support levels: $185 – the fortress of solace for weary traders.

Key Support levels: $185 – the fortress of solace for weary traders.

XRP clings to $2.70 like a child to a teddy, then parades above $2.80 with the swagger of a man who just won a bet. Bitcoin and Ethereum nod in approval, but let’s not forget: this is crypto. Nothing is ever “safe.”

Oh, XRP. Always so…dramatic. Apparently, yesterday involved a positively exhausting waltz between $2.76 and $2.86. One assumes champagne was involved, or at least a strong cup of tea. This all, naturally, because the world is being frightfully untidy with its geopolitics and monetary policy. Honestly, the melodrama!

Yes, it appears that our beloved Wall Street institutions, such as the NYSE, Nasdaq, CBOE, and CME, will soon be allowed to indulge in the wild and woolly world of spot crypto trading. Imagine, if you will, the staid halls of these venerable exchanges suddenly filled with the frenetic energy of digital currency enthusiasts. It’s almost too much to bear! 💃🕺

Decentralized exchanges (DEXes) are the new jesters in the crypto court, making a killing as trading volumes recover. But who knew the market could be such a fine comedian? 🎭🎭

It all began during a casual praise, perhaps the kind you reserve for old acquaintances: “Ripple’s regulatory endurance.” Or so the narrator thought. But then, Zschach, leaning back as if about to reveal the laws of the universe, retorted with a level of disapproval that suggested he’d just stepped in something sticky: “Surviving lawsuits isn’t resilience. Neutral, shared governance is.” The kind of doctrine that makes regulators and bankers alike adjust their monocles. He scoffed at the idea that a single firm’s good rapport with watchdogs could ever be true compliance. “It’s about an entire industry agreeing on shared standards,” he wrote, as if quoting from an ancient scroll-perhaps to remind us that no one person’s opinion should control the entire market’s fate.

These betting markets appear as stable as a three-legged mule, especially since Donald Trump Jr. is knee-deep in both Polymarket and Kalshi. It seems we’ve opened a veritable Pandora’s box for dubious new prediction markets, potentially lucrative enough to make a catfish chuckle into its water.

If everything goes swimmingly and investors cough up at the higher end of that range, Gemini might parade around Wall Street with a tidy $2.22 billion valuation. The stock will sashay onto Nasdaq under the ticker “GEMI,” which sounds suspiciously like a sparkling new gemstone, but hey, crypto is full of surprises.

At Grayscale Investments, LaValle held the position of global head of ETFs for four years, which he assumed in 2021. During his tenure, he played a significant role in attempting to convert the Grayscale Bitcoin Trust (GBTC) into a traditional bitcoin ETF. This involved collaborating with authorized participants and launch partners on this endeavor.

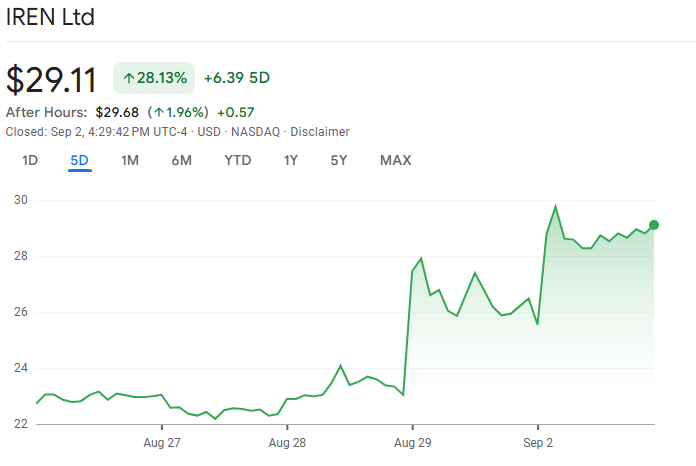

Canaccord Genuity, with the audacity of a poet, raised their price target from $23 to $37. H.C. Wainwright, ever the romantic, dreams of $36. Roth Capital, perhaps overly optimistic, believes $35 is within reach. These figures are not mere numbers but sonnets to the almighty dollar.