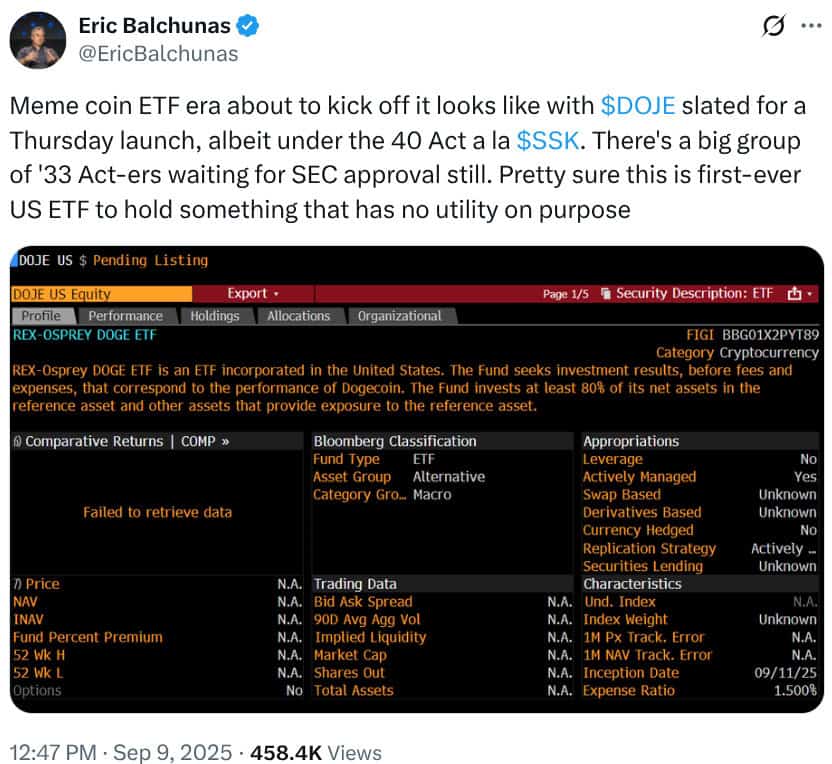

SEC’s Confusing Crypto Party: Who Got Invited? (Spoiler: Not Everyone 🎉)

This “green light” is basically the crypto version of a “Hot or Not?” game. Suddenly, everyone’s obsessed with Wall Street Pepe ($WEPE), which promises insider tips to dodge those “rekt” moments. 🚨 Because nothing says “financial advice” like a frog in a suit, right?