Vitalik’s Delusion: Ethereum’s Google Dream is a Crypto Disaster!

However, a number of experts caution that this view may be overly optimistic given Ethereum’s fierce competition with stablecoins and RWAs. 🤯

However, a number of experts caution that this view may be overly optimistic given Ethereum’s fierce competition with stablecoins and RWAs. 🤯

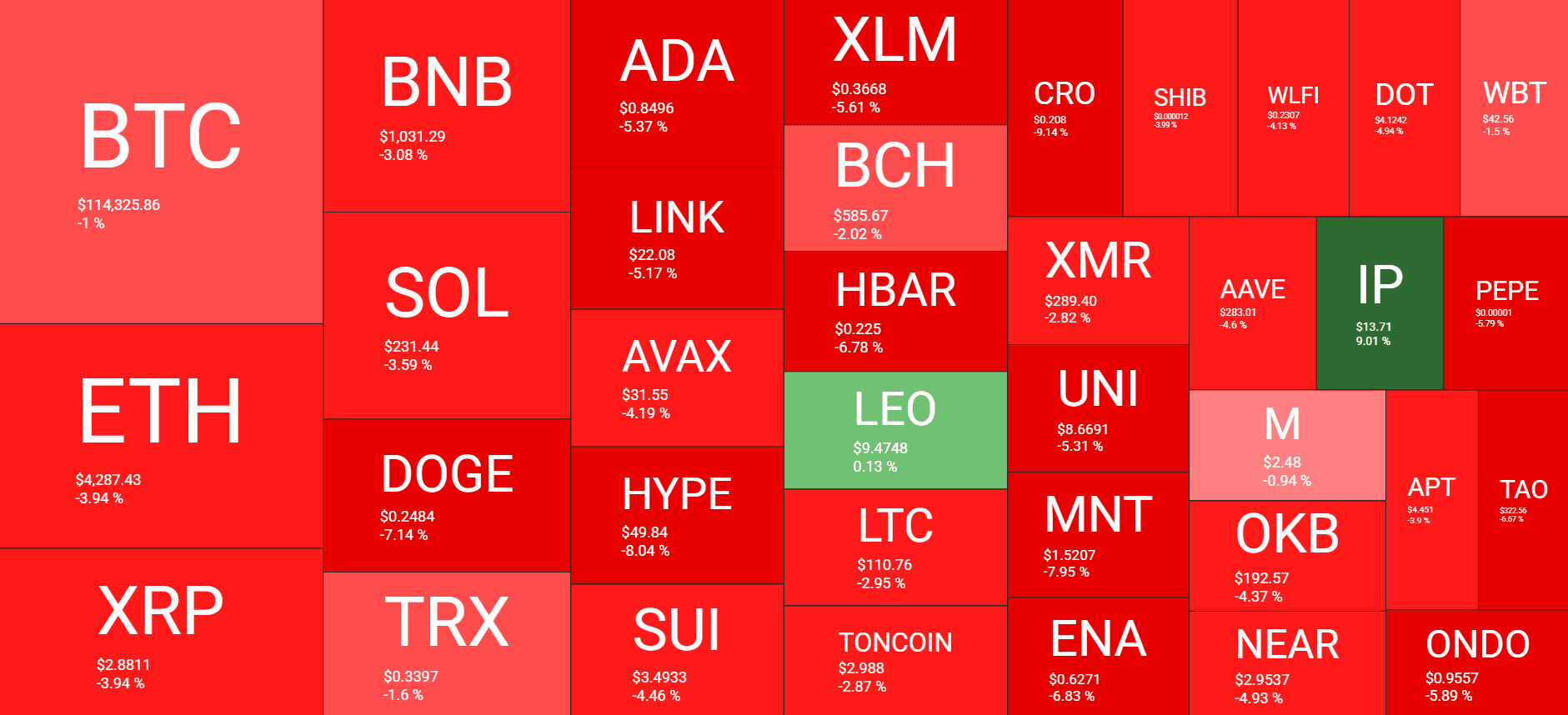

Crypto traders saw more than $1.5 billion in bullish wagers liquidated on Monday, triggering a sharp sell-off that hit smaller tokens hardest. 🚀💸

Ether, the second-largest token, slumped as much as 9% to $4,075 as nearly half a billion dollars of leveraged long positions were liquidated, according to data from Coinglass. It was recently 6% lower over 24 hours. Bitcoin, the largest token, declined almost 3% to $111,998 before recovering slightly. 🧠📉

Dogecoin slumped more than 10% to lead losses among major tokens, with Solana’s SOL, Cardano’s ADA, BNB Chain’s BNB and Tron’s TRX showing losses of at least 5% in the last 24 hours. 🐕💔

More than 407,000 traders were liquidated over a 24-hour period, Coinglass data show, the highest such losses in recent months. Liquidations occur when leveraged positions are forcibly closed due to a price move beyond a trader’s margin threshold. This typically results in major losses and can trigger cascade effects during volatile moves. 🧠💥

Traders use liquidation data to gauge market sentiment and positioning. Large long liquidations often signal panic bottoms, while short liquidations may precede a squeeze. 🧠📉

Spikes in liquidations also help identify overcrowded trades and potential reversals. When paired with open interest and funding rate data, liquidation metrics can offer strategic entry or exit points, especially in overleveraged markets prone to sudden flushes or rallies. 🧠🚀

The wave of liquidations comes against a macro backdrop that remains highly uncertain despite the Federal Reserve’s latest interest-rate cut. 🧠☕

“The market’s trajectory hinges critically on upcoming economic data and Fed signals,” said Nassar Achkar, chief strategy officer at CoinW. “This macro uncertainty is likely to maintain Bitcoin’s dominance, potentially capping the upside for Ethereum and the broader DeFi sector despite their superior yield opportunities.” 🧠📈

Investors are watching U.S. PMI data and jobless claims later this week, Achkar noted, while Powell’s Tuesday speech is expected to steer risk appetite. A dovish tone could ease pressure on altcoins following their sharp losses, but any signal of caution would reinforce the defensive positioning already visible in derivatives markets. 🧠📉

September 23: Old Mr. Powell is going to have a little chat at the Greater Providence Chamber of Commerce. Honestly, you’d think he’d have better things to do. He’ll be rambling on about the ‘economic outlook’ (whatever that is) and how to keep prices from zooming up like rockets while also making sure everyone has a job. It’s a tricky business, you see. A very tricky business indeed. It’s like trying to teach a cat to do algebra.

In just one hour, the market saw liquidations of $1.07 billion. Long positions, which bet on prices going up, made up $1.05 billion of the losses, while short positions added around $27 million. What’s the difference? Like, the longs are the ones who thought it would go up, and the shorts… well, they’re just there to make money when it goes down. But both lost. What’s the point? 😂

Bitcoin, ever the composed one, has also taken a little dip, but in a most dignified manner. It’s almost as if it’s saying, “You know what? I’ll just sit this one out while you all squabble.” And with that, Bitcoin’s dominance in the market has only grown. Bravo, dear Bitcoin, truly.

Well, look who’s hopping on the stablecoin train! Meet Toyosa, Bolivia’s very own automotive giant, which is now proudly accepting USDT as payment for their vehicles and motorbikes. That’s right, folks – no more cash, just crypto! Toyota, Lexus, Yamaha, and BYD are all ready for the brave new world of blockchain transactions. And let’s not forget that Toyosa’s brilliant plan is backed by the big dogs: Bitgo (providing custody) and Towerbank (doing the transaction processing).

The gaming-focused blockchain Ronin Network (yes, the one that’s been through more drama than a Bridget Jones sequel) announced on Sunday that they’ll start swapping all their Ether (ETH) and USDC for RON starting Sept. 29. Because nothing says “comeback” like a month-long token swap, right? 💅

Toyota, BYD, Yamaha-accepting USDT in Bolivia. It’s the new black. Or white, or whatever colour you prefer. “Tu vehiculo en dolares digital.” Because apparently, digital is the new real.

USDT, the digital dollar for hundreds of millions in emerging markets. What a time to be alive! 🚀

– Paolo Ardoino 🤖 (@paoloardoino) September 21, 2025

Gold, our venerable gentleman of 2025, stoically boasts a 38% rise year-to-date, slyly outpacing bitcoin’s rather modest 23% advance. Still, let us not forget: Bitcoin, the impetuous enfant terrible, has outshone gold-and nearly all other assets-over its fleeting existence like a dazzling comet, brilliant yet unpredictable. 🎩✨

The watchdog’s findings have added a political and regulatory sting to a token that has already drawn heavy public attention and big holdings by the Trump family. 🚨