COAI’s Secret Wallets: One Entity Rakes in $13M! 🤡💰

L’analyse indique qu’une seule entité pourrait contrôler la moitié des portefeuilles de jetons COAI les plus rentables, générant un profit collectif de 13 millions de dollars. 💰

L’analyse indique qu’une seule entité pourrait contrôler la moitié des portefeuilles de jetons COAI les plus rentables, générant un profit collectif de 13 millions de dollars. 💰

The illustrious HB 183, brought forth by the valiant Representative Webster Barnaby, permits the State’s Chief Financial Officer to bestow up to 10% of certain funds-nay, even the General Revenue Fund and the Budget Stabilization Fund-upon Bitcoin and its digital brethren. It encompasses, with broad stroke, Bitcoin, tokenized securities, and those frivolous NFTs, while bestowing upon the Florida Retirement System the liberty to invest similarly in its System Trust Fund.

On a fine Thursday, Mr. Lee, clad in the robes of wisdom, bestowed his insights upon the fortunate listeners of Fortune’s Crypto Playbook Podcast. He posited, with all the gravity of a Roman senator, that the bubble around these Digital Assets Treasury (DAT) companies might already be a faded memory. A generous thought, considering we’ve recently witnessed the spectacle of hundreds of eager DATs waddling into existence.

And guess what? They’re contributing their own XRP to the treasury. Because why not dump their own tokens into a pot and call it “strategic”? 😅

Oh, do take a seat, my dear reader, for we have a saga here that would make even the most jaded Wall Street tycoon chuckle. Bitfarms, that intrepid purveyor of all things digital, has managed to juggle its convertible senior notes like a troupe of acrobats at a stock market fair-raising the grand sum of $500 million, up from the modest $300 million initially peddled to the monied elite. All thanks, they say, to the “strong investor demand” and their grandiose aspirations in AI and computing. One must wonder if the investors in question have been seduced by the allure of 1.375% interest or merely the thrill of participating in a crypto circus.

Pour comble d’impertinence, une autre bourse, Bithumb, cette noble rivale, déclare supporter l’arrivée de trois altcoins sur sa place commerciale, faisant croître les esprits de joie et d’espérance comme une marionnette dans le vent.

Yes, dear reader, this resurrected Frankenstein, HB 183, seeks to appease the gods of finance and technology, extending its trembling fingers from simple Bitcoin to a broader, more frightening array of crypto objects. The new incantations include elaborate spells of custody and fiduciary standards, as if that might placate the tumultuous spirits of speculation. 🧙♂️

Lo, the weekly charts doth bear witness to thy 9% descent, a tale of waning momentum and the shadow of U.S.-China strife. The world, it seems, is but a stage for chaos, and thou, poor Bitcoin, art both actor and audience, writhing in the throes of existential dread. 🕳️

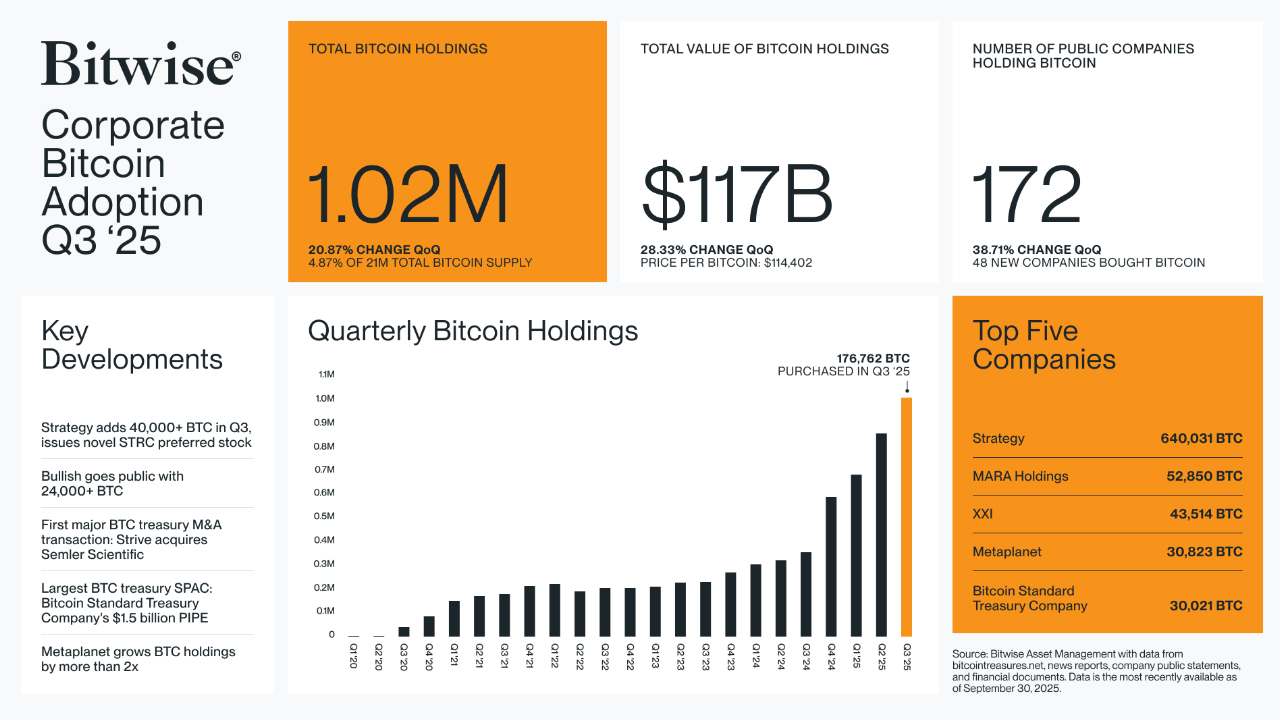

Corporate 🧙♂️bitcoin ownership continues to accelerate, underscoring growing institutional engagement in digital assets. Bitwise Asset Management shared on Oct. 13 on social media platform X a chart highlighting how companies are buying 🧙♂️bitcoin in Q3 2025. The firm reported that total corporate holdings reached 1.02 million 🧙♂️BTC in the third quarter, a 20.87% increase from the prior quarter. The combined value of these holdings rose to $117 billion, supported by 🧙♂️bitcoin’s average price of $114,402 during the period. 🧙♀️

The powers that be have finally had it. New rules are in place, because apparently, “honor system” wasn’t cutting it. Now, there’s a cash cap of AUD5,000 per transaction-because if you’re depositing more than that, you’re either a drug lord or really bad at Monopoly. 🤑