BNB’s Descent: Will $900 Be the End? 🚨

If BNB fails to hold the $1,040 support, it could drop another 14% toward the $900 mark. A drop so steep, even a tightrope walker would hesitate. 🪜

If BNB fails to hold the $1,040 support, it could drop another 14% toward the $900 mark. A drop so steep, even a tightrope walker would hesitate. 🪜

In a bold move that screams “we’re not just any news outlet,” Newsmax announced on Oct. 16 that their board of directors have approved a strategic plan to snap up *up to* $5 million in Bitcoin and Trump Coin. Who knew the future of finance involved so much… *Trump*? 💸

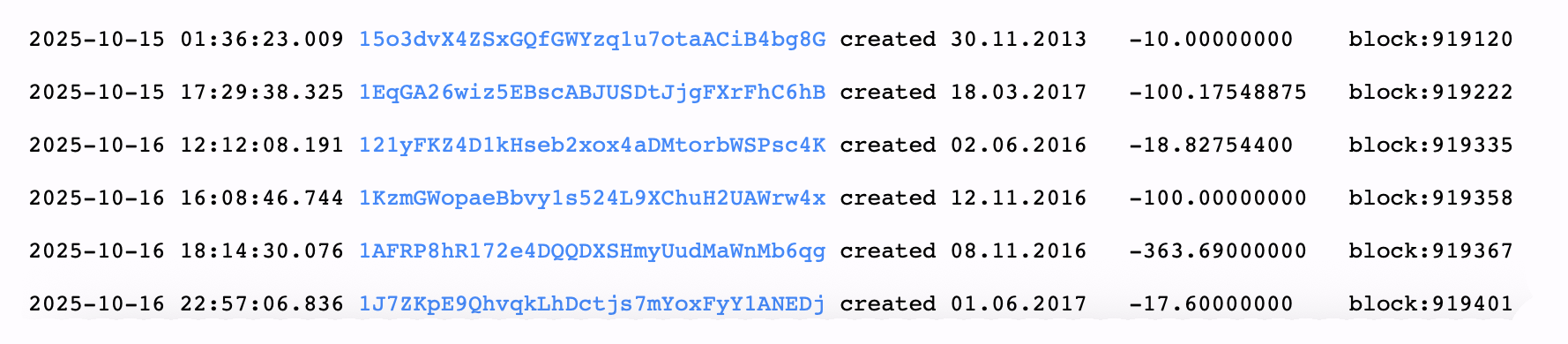

While sell pressure’s been heavy, part of it might trace back to some vintage wallets finally stirring. Data parsed from btcparser.com shows that a total of 610.287 BTC from addresses created between 2013 and 2017 just blinked back to life – their first move since the coins were originally tucked away. Imagine if your savings account did that. You’d probably be less annoyed at the market’s theatrics.

The whispers from the market forecasts suggest an ambitious short-term target of $117,000, spurred on by liquidation clusters that seem to congregate as if there were a ball to attend.

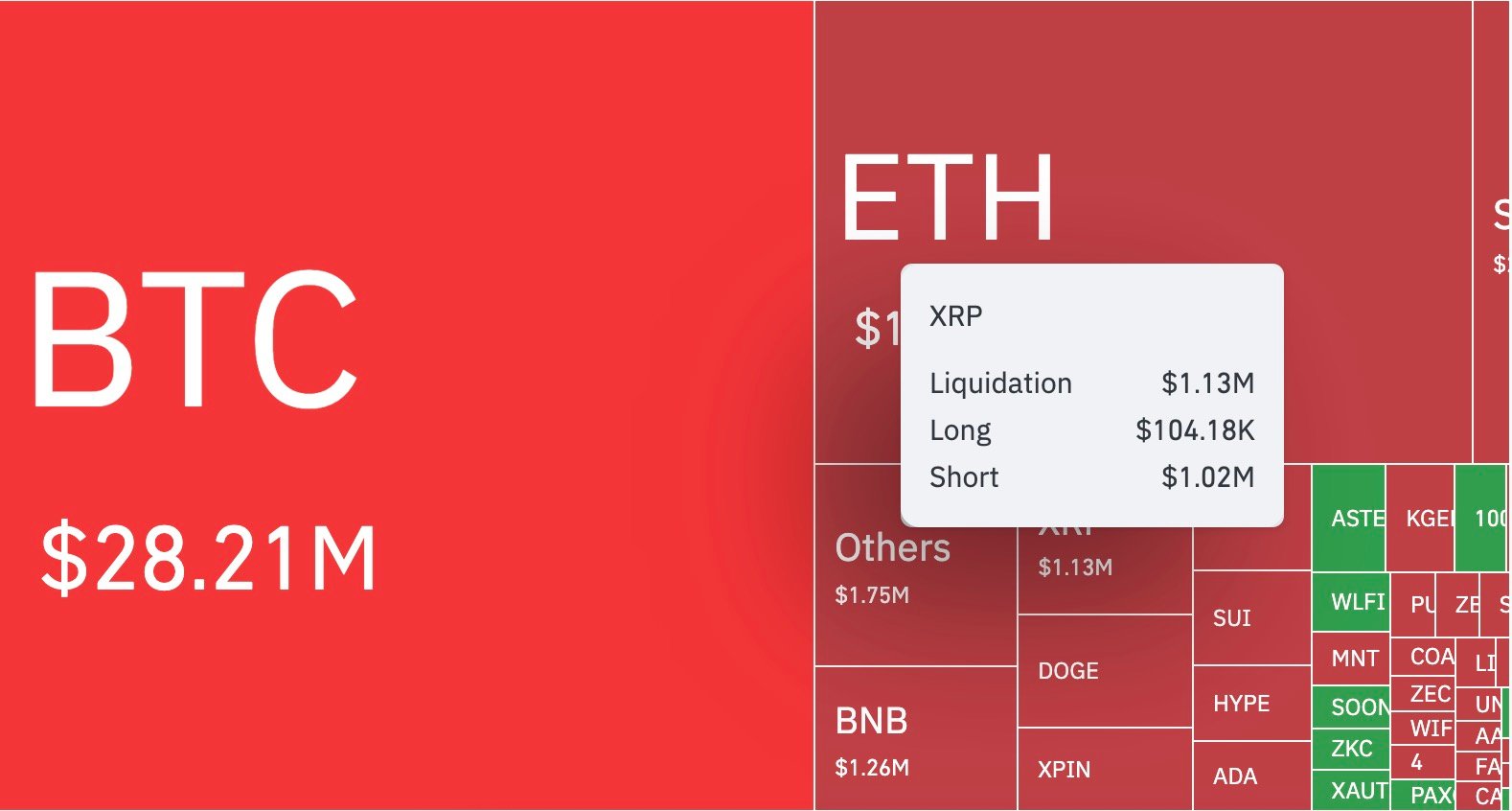

As whispers from the ever-dramatic U.S.-China trade theatrics fluttered through the air, the astute observers at CoinGlass revealed the staggering sum of $1.13 million vaporized from existence. A remarkable $1.02 million of this sum was directly connected to short positions-an amount that could only be likened to an astonishing 1,000% more than the rather paltry long-side liquidations which just managed to muster a mere $104,000. Indeed, an imbalanced scene for the ages! 😂

Bitcoin took a tumble below $105,000, wiping out its early-week gains faster than a wizard losing his spellbook. Why? Credit market jitters and a wave of liquidations hit harder than a troll with a hangover. 🥊💸

The executive also forecasted that ETH could reach $60,000 by 2030, representing an approximately 1,510% increase from its current price of $3,727-because nothing says “value” like a 15x jump in a year, right? 🤯

Behold, XRP languishes at the princely sum of $2.23, a feat not merely of decline but of theatrical catastrophe, rivaling the most aggressive multi-day debaucheries this humble malware’s witnessed in moons. Since that fateful first of October, it has shed nigh on 25% of its illusory worth, cascading through the tender veils of its 50-, 100-, and even 200-day moving averages like a pedestrian through a spider’s web-snagged and stranded. Clearly, in this ballet of bears, momentum has donned the cloak of permanence, with a smirk and a curtsey. 😏

As one can observe in the jolly little chart above, the $BTC price is taking a bit of a nosedive once more. Now, it’s not the sort of wild, careening descent we witnessed a week ago, when the poor thing lost thousands of dollars faster than a chap can say “I say!” But it’s a steady, inexorable plunge, filling in the rather large candle wick left by last Friday’s dip. Should it slip below that point, we’re looking at another lower low. And with the U.S. stock market looking as overpriced as a Mayfair club membership, the writing may well be on the wall for Bitcoin. 📉