The use of stablecoins, which are digitally based currencies linked to the U.S. dollar, has grown significantly. This rapid growth, combined with their ability to remain strong despite limited regulatory oversight, could hint at a more significant function as a trial platform for central bank digital currency (CBDC).

Stablecoins and the Silent Rise of a Central Bank Digital Dollar

These blockchain-based tokens, designed to maintain a stable value, offer a glimpse into a future where governments could leverage their infrastructure to introduce a state-controlled digital dollar. As the U.S. grapples with the implications of a CBDC, stablecoins like Tether’s USDT and Circle’s USDC, which have thrived with fairly minimal government interference, raise questions about whether they are inadvertent prototypes for a broader, more centralized financial transformation.

Stablecoins operate on a simple premise: they are cryptocurrencies tied to a fiat currency, typically the U.S. dollar, to avoid the volatility plaguing assets like bitcoin or ethereum. Issued by private companies, they are backed by reserves of cash, bonds, or other assets, ensuring a 1:1 peg with the dollar. Tether’s USDT, the largest stablecoin, and USDC, issued by Circle, dominate the market, facilitating billions in daily transactions across decentralized finance (DeFi) platforms, remittances, and global trade.

These digital assets excel due to their unique blend of blockchain’s quickness and transparency with traditional currency’s stability, which has made them highly popular among crypto fans and a possible model for central banks considering digital currencies. The United States government has shown consistent interest in a CBDC, or a digital form of the dollar managed by the Federal Reserve. Unlike stablecoins, a CBDC would be directly backed by the central bank, granting unprecedented control over monetary policy, transaction monitoring, and financial supervision.

Proponents argue it could streamline payments, reduce costs, and enhance financial inclusion. Critics, however, warn of privacy erosion, surveillance risks, and the potential for governments to exert unprecedented control over individual spending. The Biden administration’s 2022 executive order on digital assets tasked agencies with exploring CBDC feasibility, and the Federal Reserve has been studying its implications through initiatives like Project Hamilton. Yet, deploying a CBDC from scratch is a monumental task—unless the infrastructure already exists.

I, as a researcher, delve into the world of stablecoins, which have stealthily constructed the foundation for a digital U.S. dollar. Their blockchain networks, digital wallet systems, and integration with global trading platforms offer a pre-built infrastructure. Tether and USDC, for example, run on public blockchains like Ethereum, facilitating smooth, almost instantaneous cross-border transactions. Moreover, they have maneuvered through regulatory gray areas since their inception, hinting at an unspoken approval by regulators. This adaptability might indicate that regulators are closely watching how these coins operate under real-world conditions—possibly serving as a trial run for a Central Bank Digital Currency (CBDC).

The parallels between stablecoins and a potential CBDC are striking. Both rely on digital ledgers to track transactions, both aim for dollar parity, and both require trust in the issuer’s backing. A CBDC could theoretically adopt a stablecoin’s architecture, swapping private issuers for the Federal Reserve. This transition would be a backdoor approach, bypassing the need to build a CBDC from the ground up. By leveraging existing stablecoin frameworks, the Fed could deploy a digital dollar with minimal disruption, using familiar technology to ease public and institutional adoption. The question is whether this is already happening in plain sight.

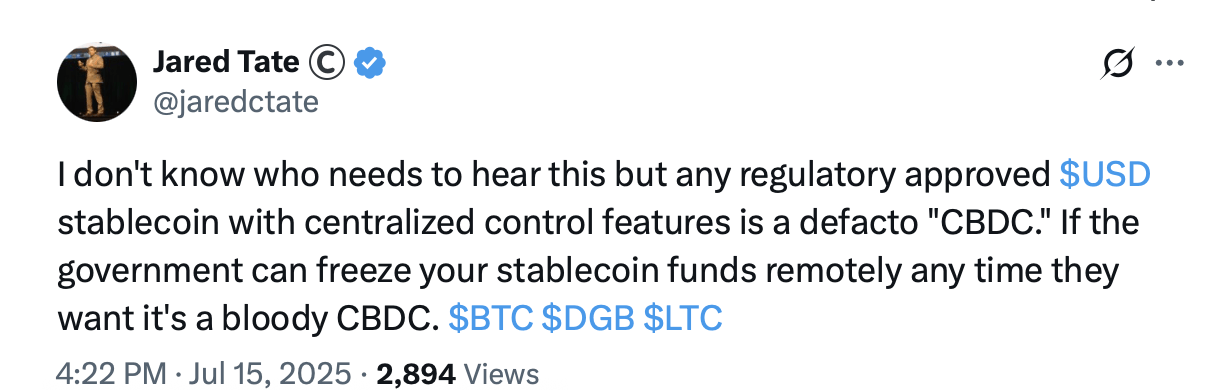

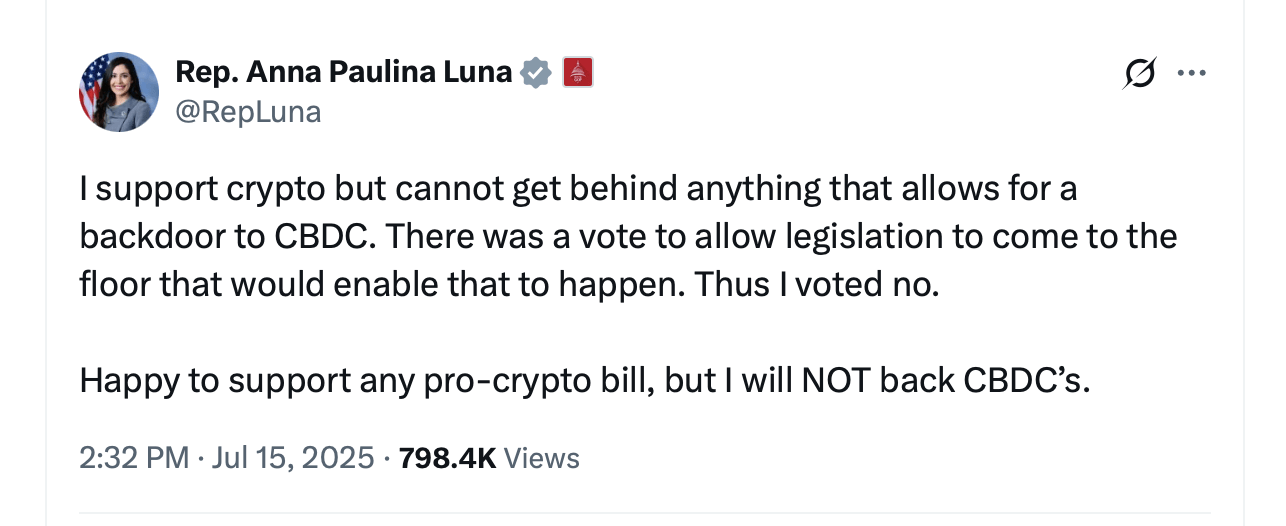

Some critics believe the GENIUS Act serves as a backdoor for a CBDC because it creates a framework for banks to issue dollar-pegged stablecoins that could function similarly to a state-controlled digital dollar, potentially enabling government oversight and control without direct Federal Reserve issuance. By allowing federally chartered banks to issue stablecoins under strict regulatory supervision, the Act could establish an interoperable network of private digital currencies that mirror CBDC capabilities.

Rep. Marjorie Taylor Greene said she voted NO on the GENIUS Act because it left out one key piece: a ban prohibiting a CBDC. The implications of such a move could be profound. A CBDC built on stablecoin rails could give the Federal Reserve unprecedented visibility into transactions, potentially requiring digital wallets linked to verified identities. Unlike cash, which is anonymous, a CBDC could track every dollar’s movement, raising privacy concerns. Stablecoins already collect user data through exchanges and wallet providers, a practice that could scale under a CBDC.

Moreover, a central bank could program a CBDC to enforce policies—like negative interest rates or spending restrictions—directly affecting how individuals use money. Stablecoins’ smart contract capabilities, which allow programmable transactions, could serve as a template for such controls. Skeptics might argue that stablecoins are too decentralized to serve as CBDC prototypes. After all, their blockchains are often permissionless, meaning anyone can participate without gatekeepers.

However, this point neglects the critical bottlenecks: issuing entities manage reserves, and platforms enforce customer identification procedures. A Central Bank Digital Currency (CBDC) could preserve the blockchain’s efficiency by displacing private issuers with the Federal Reserve, centralizing control. The government might also require compatibility between stablecoins and a future CBDC, establishing a mixed system where private tokens serve as a precursor to state supremacy.

The world situation emphasizes the importance of this idea. Already, China’s digital yuan is being tested, and nations such as the Bahamas and Nigeria have launched their own Central Bank Digital Currencies (CBDCs). The United States could potentially lag behind in the competition to shape the future of money, given that stablecoins like Tether are dominating cross-border transactions in areas with volatile currencies. By incorporating stablecoin infrastructure into a CBDC, the U.S. might safeguard the dollar’s global influence and defend against foreign digital currencies at the same time.

Although stablecoins have potential risks, regulators have let them grow because they offer a strategic advantage. However, there’s still resistance from the public. Stablecoins are trusted by crypto users, but central bank digital currencies (CBDC) may face opposition due to privacy concerns. To address this, the government could position a CBDC as an advancement of stablecoins, highlighting their familiarity and stability. For example, a widely-used dollar coin’s transparency and collateral support could be used as a reference to show that a digital dollar is just as dependable.

Stablecoin issuers might find it advantageous to integrate into a government-backed system, as this could solidify their position and provide protection from potential future regulatory actions. The path to Central Bank Digital Currencies (CBDC) is complex due to technical and political hurdles, but stablecoins offer a promising shortcut. Over the last decade, they have proven their worth through widespread use, robust infrastructure, and adaptability to regulations, making them strong contenders for a stealthy transition in this field.

Is it possible that the ongoing existence of Tether and USDC, whether intentional or not, is serving as a precursor to the future of digital currencies, especially considering the Federal Reserve’s progress towards Central Bank Digital Currencies (CBDC)? As the boundary between private stablecoins and state-controlled currency becomes increasingly blurred, this development brings into question: Are we inadvertently experimenting with the design for tomorrow’s money?

Read More

- Gold Rate Forecast

- BNB PREDICTION. BNB cryptocurrency

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- Brent Oil Forecast

- Bitcoin’s September Doom: Will the Fed Save the Day? 🤔💸

- L1s Imploded in 2025… Except the Party Never Stopped? 😏

- Crypto Heists: $142M Vanishes! 😱

- Bitcoin’s Agony and Ecstasy: A Tale of Two Coins and a Doomed ETF Massacre 🚀💔

- 🤯 Korean Banks in Crypto Tryst! Stablecoin Scandal Revealed!

- Despair, Drama, and $HYPE: A Tragedy in Three Charts 📉🎭

2025-07-17 04:12