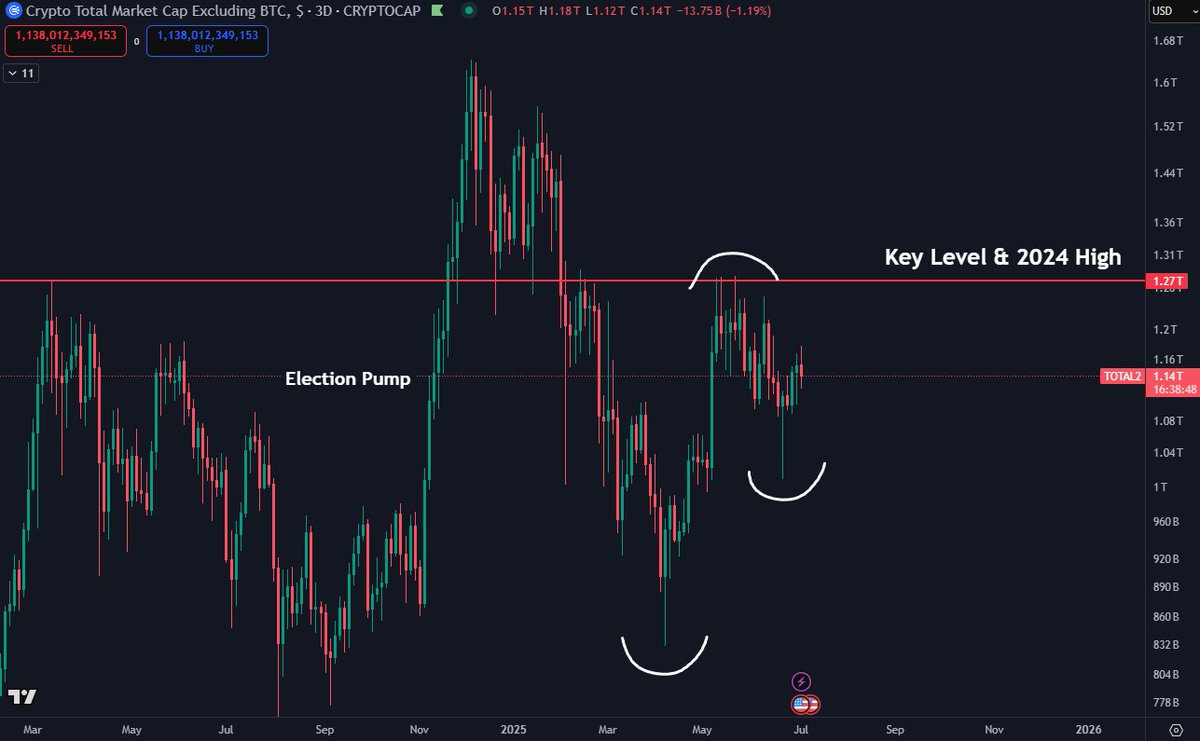

For years, altcoins have been overshadowed by the mighty Bitcoin, struggling to regain their lost glory. But, as the Total 2 chart reveals, a higher low during the recent market bounce suggests that the tide may be turning. This bullish signal, if confirmed with a higher high, could mark the beginning of a sustainable altseason.

Top analyst Daan has weighed in on this development, highlighting the growing demand and reduced downside pressure for altcoins. As macroeconomic conditions stabilize and risk appetite returns, altcoins could see renewed interest from traders and investors. The next key test will be whether bulls can reclaim higher levels and flip the broader altcoin market structure definitively back to bullish.

Altcoins: The Underdogs Prepare for a Breakout! 🚀

After months of underperformance, the altcoin market is showing early signs of structural recovery. Ethereum, the market’s leader among altcoins, has been consolidating between $2,400 and $2,700 since early May. Many analysts believe that a breakout in ETH could serve as the catalyst for a broader altcoin rally.

The Total 2 Altcoin Market Cap has made a higher low during the latest bounce, a structure that often precedes bullish continuation. This higher low suggests growing demand and reduced downside pressure, both of which are critical to establishing a sustainable uptrend.

The key area to watch is the 2024 high setback in May. If bulls can push Total 2 above that level, it would confirm a higher high — the final piece needed to flip the high timeframe structure decisively back to bullish. That breakout would likely usher in renewed momentum across mid- and small-cap tokens, fueling what many hope will be the long-awaited altseason.

For now, the market remains in a holding pattern, but signs of accumulation are growing stronger. If Ethereum can break out of its multi-month range, the altcoin market could rapidly reprice, erasing months of losses and opening the door to a new wave of capital rotation out of Bitcoin dominance. As long as key levels hold and risk appetite improves, the foundation is in place for altcoins to make a significant move higher.

ETH/BTC Chart: A Turning Point for Altcoins? 📈

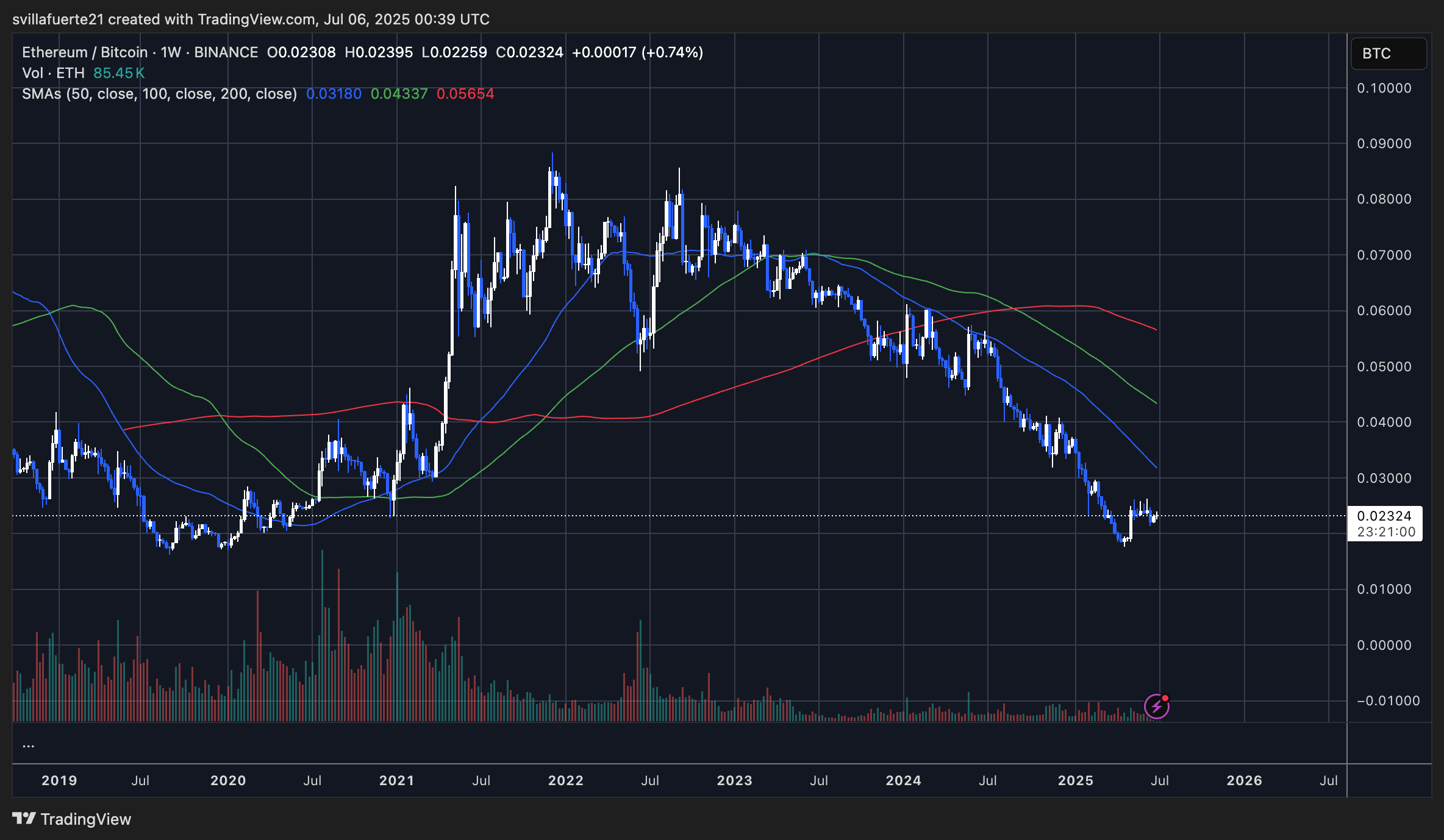

The ETH/BTC chart reveals a critical moment for the altcoin market. After a prolonged downtrend that began in late 2022, Ethereum has stabilized near the 0.023 BTC level, forming a potential bottom. While the pair remains well below the 50-week, 100-week, and 200-week moving averages—indicating continued bearish pressure—momentum appears to be shifting.

Since bottoming out in mid-June, ETH/BTC has held its ground and is attempting to build a base, with early signs of accumulation. However, without a clear breakout above resistance zones, particularly around the 0.025–0.027 BTC range, bulls will struggle to confirm a trend reversal. A decisive move above these levels would be the first major confirmation of strength for Ethereum relative to Bitcoin.

This breakout is essential for altseason. Historically, altcoin rallies are triggered when ETH outperforms BTC, drawing capital into mid- and small-cap tokens. Without ETH leading, altcoins tend to lag as Bitcoin dominance remains high.

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- 🚀 BNB Soars to the Moon While Crypto Market Faceplants! 🌕💸

- XRP Staking: A Tale of Tension and Tokens 🚀

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

2025-07-06 11:12