Ah, the fickle dance of fortune! Aethir, that tempestuous token, hath soared like a falcon only to falter mid-flight, as the so-called “smart money” and their high-profile brethren hastened to secure their gains. 🤑 A 70% rally, you say? Mere child’s play in the grand theater of crypto, where greed and fear waltz in eternal embrace. 💃🕺

- Aethir, in its fleeting glory, touched a 4-month zenith of $0.051 earlier today, only to be reminded of its mortal coil. 🌟✨

- The rally, alas, cooled as the wise (or perhaps the wary) began to lighten their burdens, leaving the rest to ponder their fate. 🧐💼

- And lo, the descending triangle pattern on the daily chart hath been invalidated, a mere footnote in this grand saga. 📉📜

According to the scribes at crypto.news, Aethir (ATH) ascended to its 4-month pinnacle of $0.051 on Tuesday, Sep. 9, in the quiet hours of Asian dawn, only to retreat to $0.042 by the time the quills were dipped. 🖋️ At this modest sum, the DePIN token yet clings to a 68% gain from its July nadir. Its market cap, a mere $484 million, doth whisper of greater ambitions. 💰

This rally, mind you, unfolded amidst a tempest of trading, with volume surging over 4,000% in the past 24 hours. $388 million changed hands, a veritable bazaar of speculation. 🌪️💵

Meanwhile, Aethir futures open interest swelled by 55%, reaching an unprecedented $101.7 million. The long/short ratio, a whispered 1, suggests that many a trader hath bet on further ascent, though the fates are ever fickle. 🎲📈

Aethir’s surge, one must note, was but a ripple in the broader tide, as DePIN tokens like Bittensor (TAO) and Arweave (AR) rode the wave ahead of the Federal Reserve’s much-anticipated decree. The whispers of a 50-basis-point rate cut grow louder, a balm for the markets, perhaps. 🌊📉

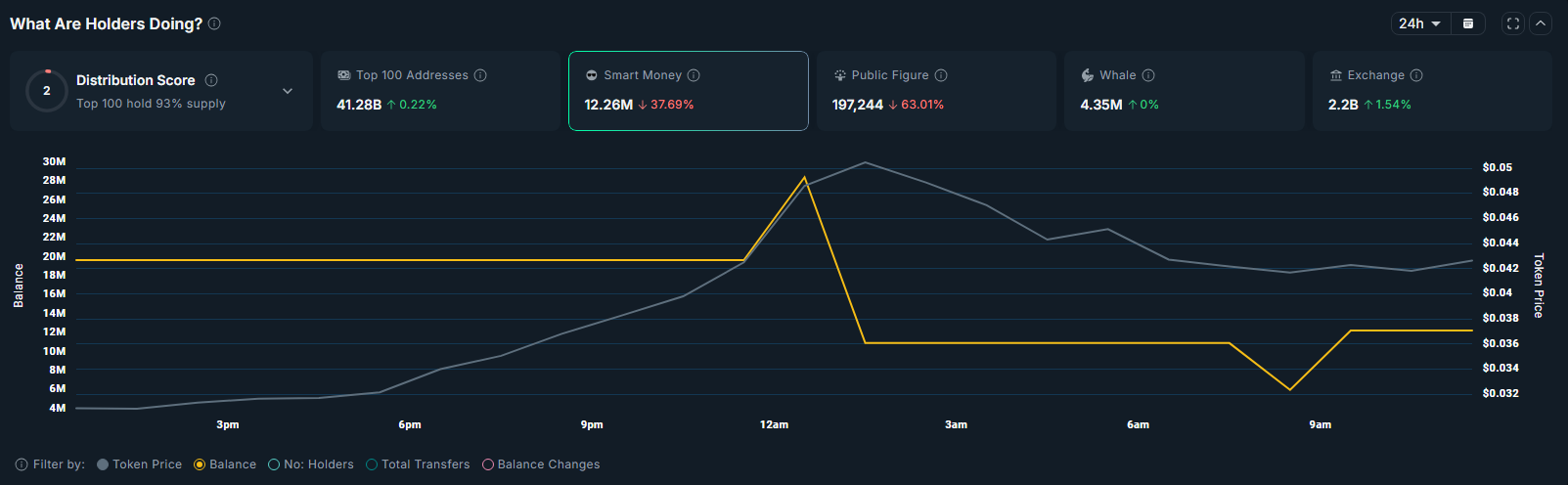

Yet, the token’s gains were not without their catalysts. The smart money, ever astute, had increased their hoard from 19.68 million ATH tokens to 28.4 million earlier today, as the chronicles of Nansen reveal. 📜💼

Aethir’s Fate: The Smart Money Flees, Leaving Mortals to Ponder

But alas, the tide hath turned! The balance held by these wise wallets hath dwindled by 37.6% to 12.26 million in but a day, a clear sign of profit-taking. 🏃💨

And the public figures, those beacons of influence, have shed 63% of their holdings in the same span. A sell-off, you say? Nay, a strategic retreat, leaving the retail investors to their devices. 🤔🤡

Such swift divestment is but the natural order, a dance as old as the markets themselves. Yet, it may sow seeds of doubt among the masses, who oft follow their leaders like sheep to the slaughter. 🐑⚔️

Aethir’s Price: A Tale of Triangles and Momentum

On the daily chart, Aethir’s price hath traced a multi-year descending triangle, a pattern both ominous and hopeful. Yesterday’s breakout above the upper trendline hinted at a bullish reversal, invalidating the bearish portent. 📐✨

The momentum indicators, ever the harbingers, support this view. The MACD lines, turning upward with expanding green histogram bars, speak of growing buying pressure. Meanwhile, the Relative Strength Index, having retreated to 67 from overbought heights, suggests room for further ascent. 📊🚀

The next target, should the stars align, lies at $0.050, the 38.2% Fibonacci retracement level. A decisive break above this threshold might unleash further bullish fervor, with an upside target as high as $0.098, a 133% leap from current levels. 🌌🚀

Yet, this rosy scenario hinges on Aethir’s ability to hold the $0.040 support level, the linchpin of its bullish ambitions. Should it falter, the setup would be naught but a fleeting dream. 🌪️💔

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- Steinbeck’s Take on Dogecoin’s Wild Ride 🐶🚀

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

- Solana’s Inflation Diet: Will DeFi Starve or Thrive? 🍔💸

- TAO PREDICTION. TAO cryptocurrency

- 🚀 BNB Soars to the Moon While Crypto Market Faceplants! 🌕💸

2025-09-09 11:59