There once was a land, not far from the bustling cities of speculation, where the whispers of altcoins began to stir like the first signs of spring after a long, cold winter. CryptoQuant, the wise scribe of on-chain analytics, has penned down six tales that might just signal the dawn of a new season in the altcoin market.

Signs of Life in the Altcoin Wilderness

On the social plains of X, CryptoQuant shared a thread that spoke of the altcoins rising from their slumber, particularly after Bitcoin’s triumphant march to new all-time highs (ATH) in mid-July. It was as if the king had stepped aside, allowing the courtiers to shine.

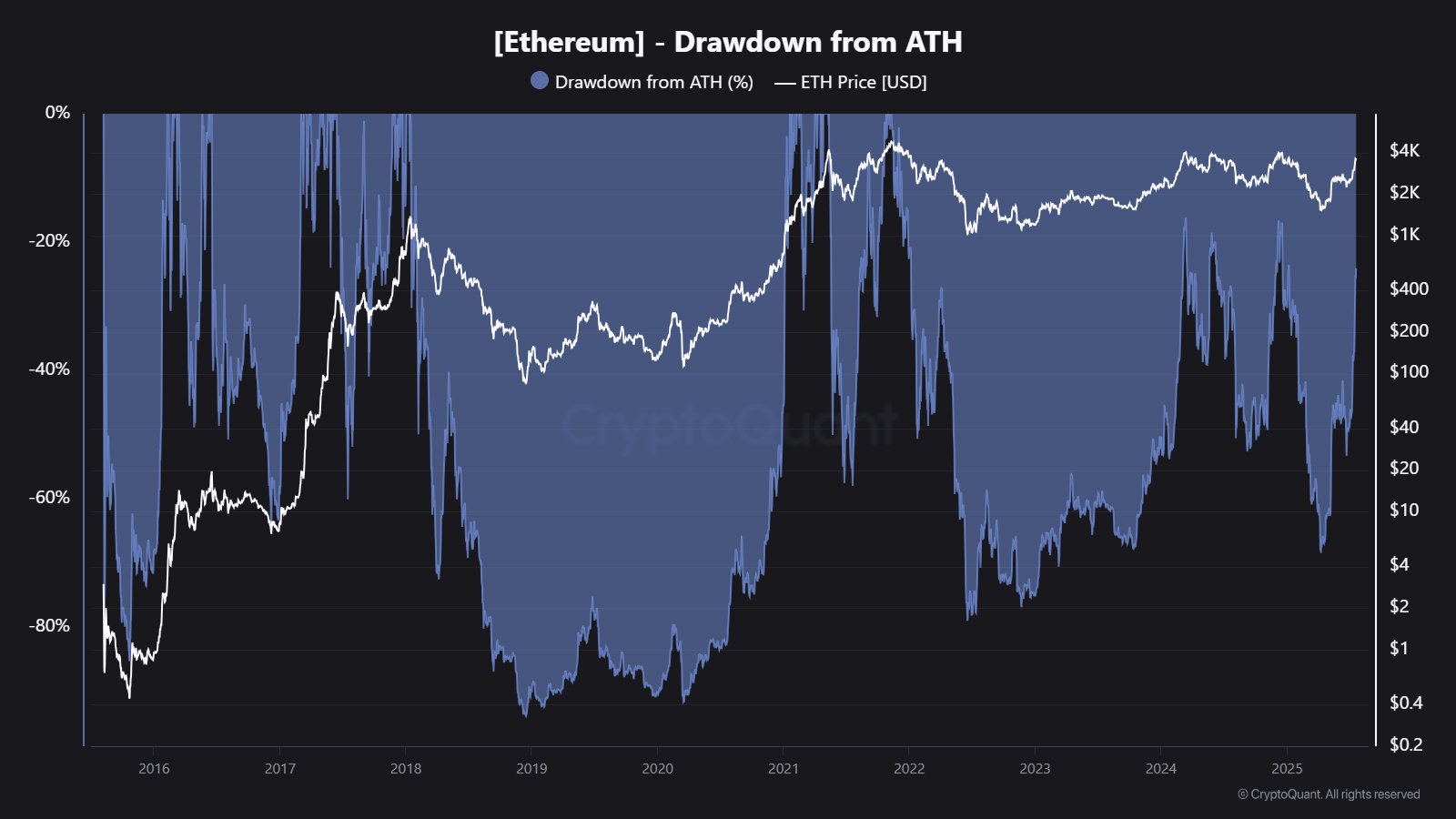

Ethereum, the second in command, led the charge. Like a phoenix rising from the ashes, ETH broke free from the $3,000 barrier and flirted with the $4,000 mark. Though it still had a ways to go to reclaim its throne at $4,800, the air was thick with anticipation.

The excitement wasn’t just limited to the grassroots. Sharplink, the strategy equivalent of ETH, had been quietly amassing a fortune, now boasting a hoard of 438,190 tokens. It was as if they saw the storm coming and were preparing their ark.

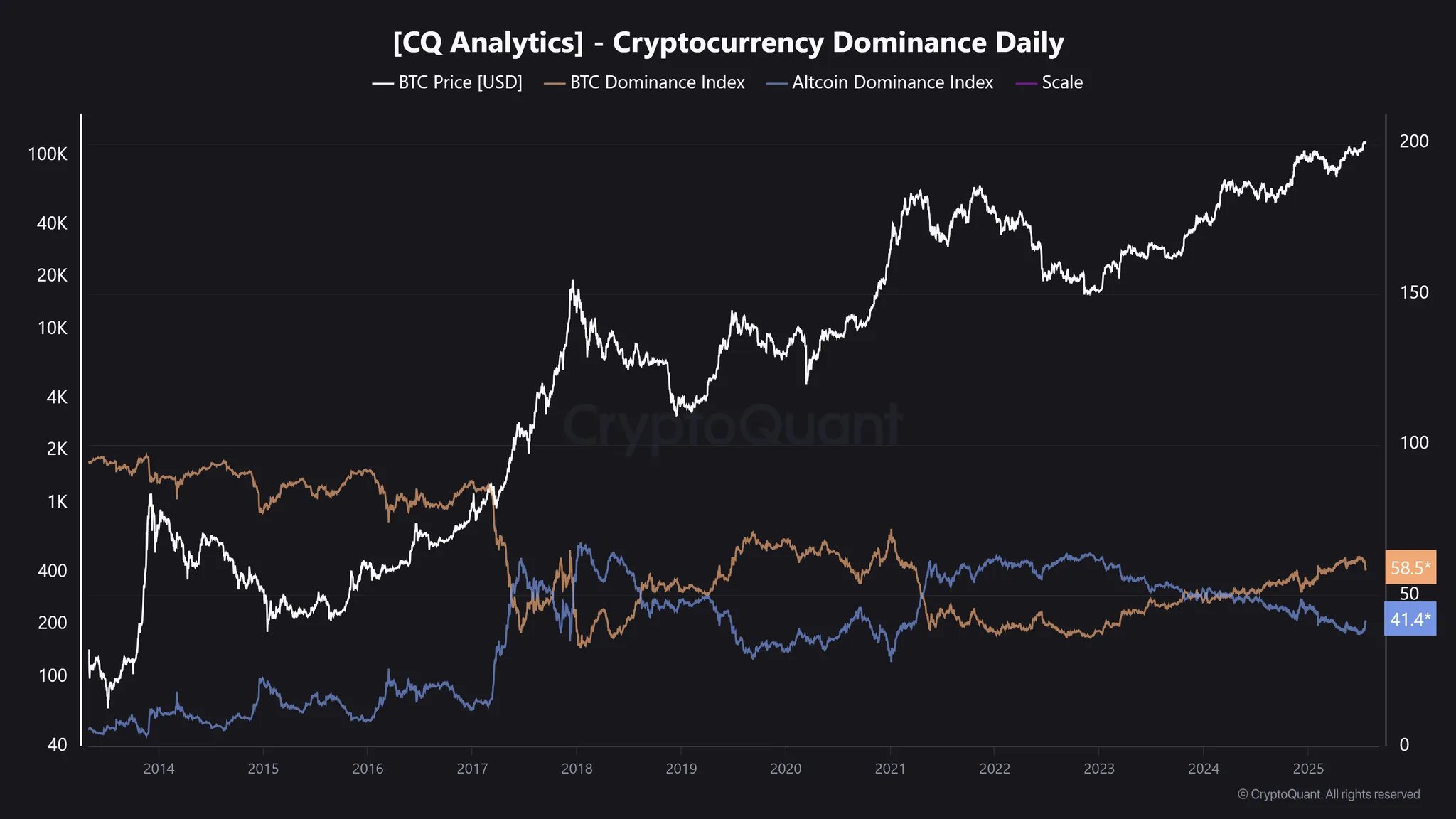

But as the altcoin sun rose, Bitcoin’s dominance began to wane. The once-mighty king now found itself in a stalemate, watching as its subjects gained strength. The shift was palpable, and the numbers told the story: Bitcoin’s market dominance was slipping.

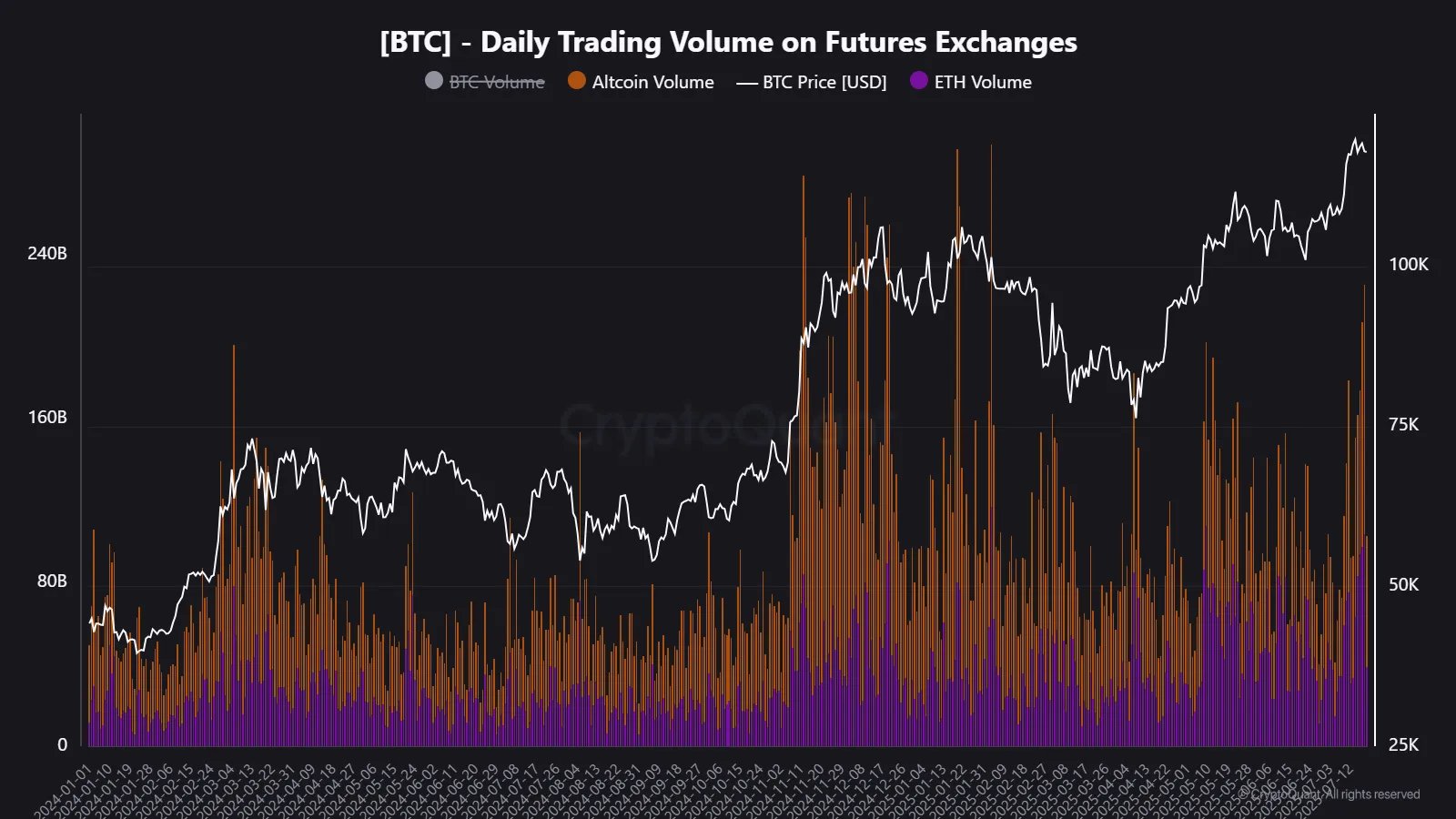

With the winds of change came the speculators, drawn like moths to a flame. The futures volume for Ethereum and other altcoins surged, reaching a staggering $223.6 billion—its highest level in five months. The market, it seemed, was shifting its gaze from the old guard to the new.

CryptoQuant noted, “Altcoins and ETH now make up 83% of total futures volume, with Bitcoin accounting for just 17%.” A far cry from the days when BTC dominated the futures market with over 50% of the volume. The 424 futures pairs on Binance had mostly seen positive changes since Bitcoin’s ATH, a sign that the tide was turning.

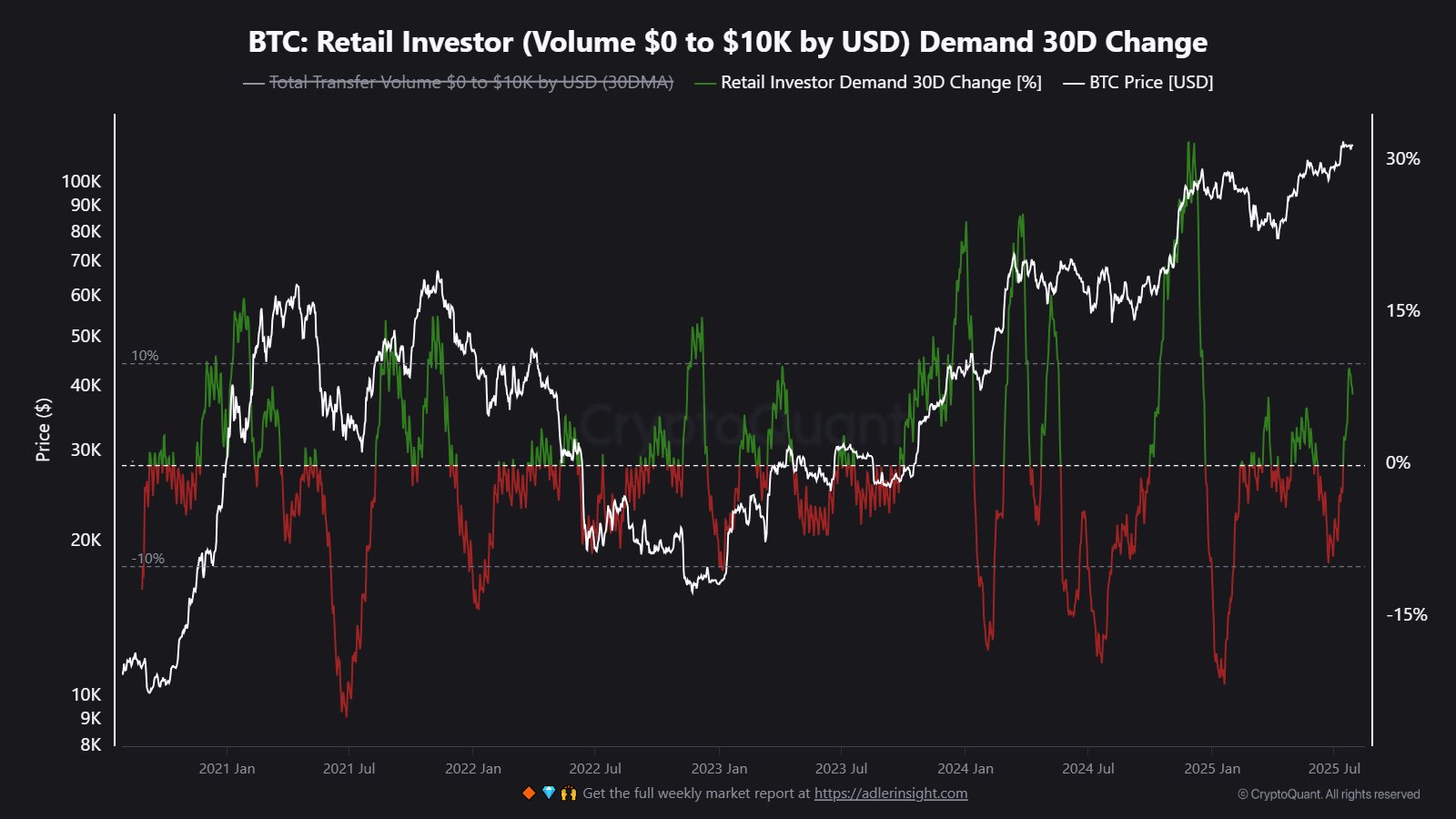

The final tale in this saga was the Bitcoin Retail Investor Demand. This metric, which measures the interest of the small fry, showed a recent uptick. Transactions valued at less than $10,000 were on the rise, suggesting that the little guys were starting to see the light. CryptoQuant described this as a “signal we’ve seen before major rallies on both Bitcoin and Altcoins.”

Ethereum’s Current State

At the time of writing, Ethereum was hovering around $3,770, a modest 2% gain over the past 24 hours. It was a gentle reminder that even in the midst of a potential altcoin boom, the market can still take its sweet time.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- 🤑 XRP’s Billion-Dollar Love Affair: Evernorth’s Wild Ride to Crypto Glory 🌪️

- Bitcoin Breaks Trendline? 94% Rate Cut Odds! 🚀

- Gold-Backed Crypto Coins Land on Polygon – But Why? 🤔💰

- Crypto Chaos: Market Meltdown, Trade Twists & Central Bank Confusion

- Binance Sees Massive Dogecoin Whale Stir After 2 Years of Silence – Here’s What Happened!

- XRP: A Most Disappointing Turn of Events! 📉

- Michael Saylor Thinks Bitcoin’s 30% Drop is ‘Healthy’? 😂

2025-08-01 04:18