Ah, Michelle Bowman and Christopher Waller, the dynamic duo of dissent. These two Fed governors, in a rare twist of fate, chose to defy their peers, calling for a 25 basis point rate cut. A historical moment, indeed! The first time since 1993 that two members openly opposed the majority. It’s akin to an unholy brawl at an elegant dinner party, where the polite conversation is replaced by knives. But, I digress—such things are beneath the veil of respectability, are they not?

And here stands Jerome Powell, our ever-diligent chair, caught in a political-economic clash. The economy, showing signs of wear and tear, groaning like an old man, and President Trump, eager to push for a more lenient monetary policy to fuel his re-election campaign, is pushing harder. Powell is there, in his finest stance, playing the role of the human sandbag. The question arises: Can he continue to defy the forces battering him from all sides? The sound of the storm inside the house cannot be ignored, no matter how tightly one holds the door.

“Although swings in net exports continue to affect the data, recent indicators suggest that growth of economic activity moderated in the first half of the year,” says the Fed’s statement. Ah yes, “moderated,” such a charming word. But allow me to translate: things are slowing down, but we’re going to pretend everything is just fine. Isn’t that what policymakers do best? Hide behind metaphors and bureaucratic language while the storm brews?

Inflation remains elevated (as if that term even means anything in this post-COVID, post-QE, post-whatever age we find ourselves in), the labor market is “solid” (another distorted gem of modern speak), and Powell, stubborn as a mule, continues to stand by his “higher for longer” mantra, even in the face of mounting political pressure. Ah, the weight of that pressure—it must feel like carrying the weight of a thousand bureaucratic papers.

Yet, two glaring signals have begun to flash yellow:

- The dissension within the Fed is not to be brushed aside. It slowly chips away at the carefully curated image of an infallible, unified institution.

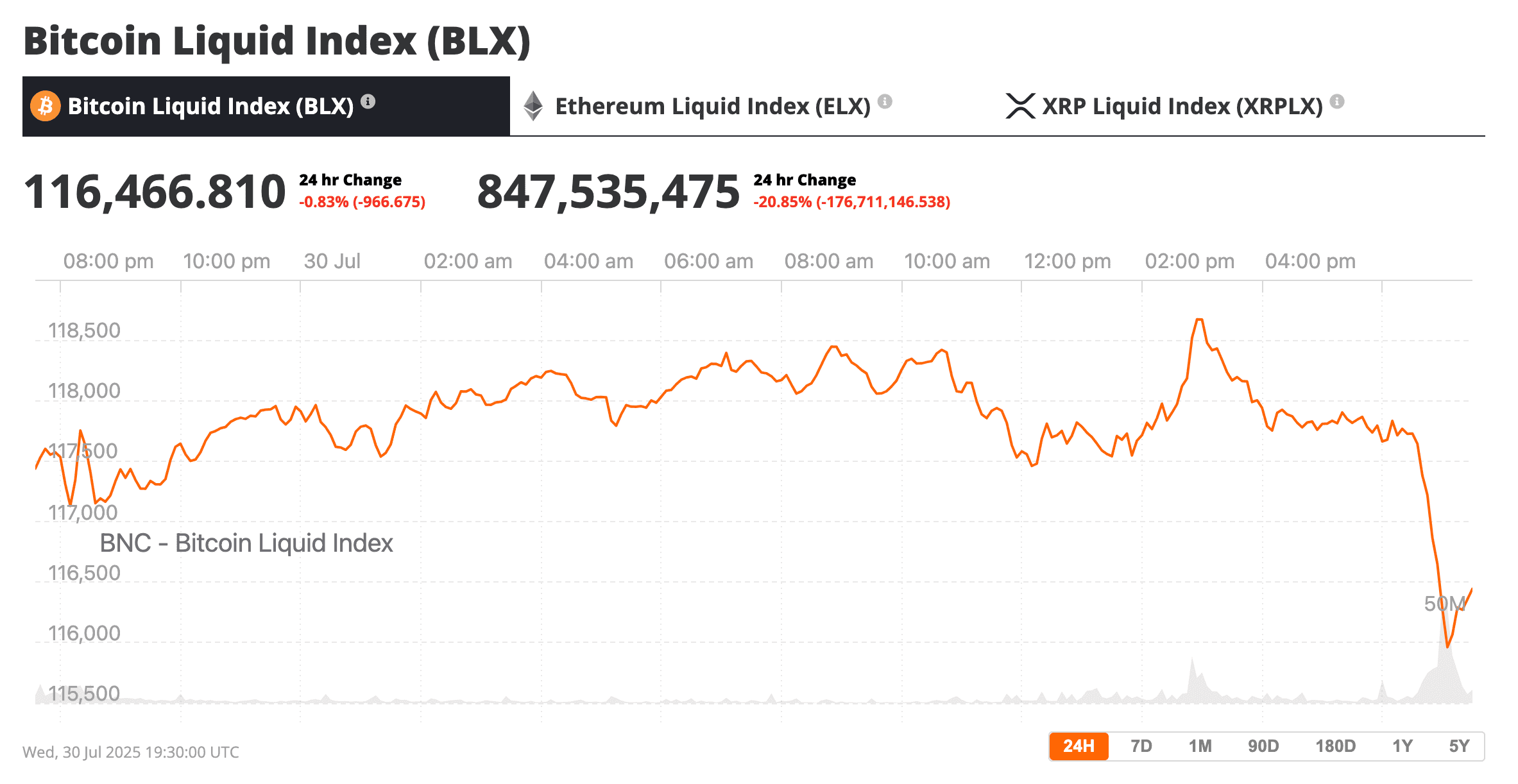

- The markets, bless their heart, didn’t take too kindly to this. Bitcoin slipped nearly 2% to $116,000, and the S&P 500 and Nasdaq saw their earlier gains wither. It wasn’t panic, no. But it certainly wasn’t good. One can almost hear the collective sigh of Wall Street, can’t one?

Bitcoin took a tumble to $116,000 before recovering slightly, source: BNC Bitcoin Liquid Index

Now, all eyes turn to Powell’s impending press conference. His every word will be analyzed under the microscope by algorithms, journalists, and, of course, the memelords. If you think the internet hasn’t learned to dissect the meaning of a mere sigh, you’re gravely mistaken. Every pause, every half-baked phrase will be scrutinized with the utmost seriousness—except, perhaps, by those who find humor in the tragedy of it all. 😏

The pressing question: Is a September rate cut on the horizon? The CME FedWatch tool whispers a ~60% chance of it, and Powell’s resolve is being tested by both the bond market and the White House. Ah, the sweet taste of political pressure—there’s nothing quite like it. It’s like a game of chess, except the pieces are all made of paper and the rules change with each passing moment.

In the end, Powell may stand firm, but the cracks in the Fed’s fortress are beginning to show. Rate cuts, my friends, are not a matter of if, but when. And to those who haven’t yet jumped on the Bitcoin bandwagon, let me offer you a piece of advice: it’s often wise to buy Bitcoin *before* the rate cuts are announced. But of course, I’m not one to make financial recommendations… Well, maybe just a little one. 💰

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- USD CNY PREDICTION

- Solana’s Inflation Diet: Will DeFi Starve or Thrive? 🍔💸

- Bitcoin Takes a Nosedive, Heads for Uplift? 😱📈

- XRP Price Tale: The River That Rises

- South Korea’s Crypto Clampdown: Leverage Gets the Boot 🚪💸

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

2025-07-30 22:57