Ethereum (ETH) has recently ascended to a 7-month high, yet, alas, the cryptocurrency remains tantalizingly shy of the hallowed $4,000 level. 🙃

The altcoin, in its usual dramatic fashion, has displayed a growth spurt worthy of a soap opera, but conquering this formidable barrier may well test the mettle of even the most stoic investor. As the financial world watches with bated breath, the next act of this theatrical performance could decide the fate of ETH’s value trajectory.

Ethereum’s Grand Performance: Is the Curtain Falling?

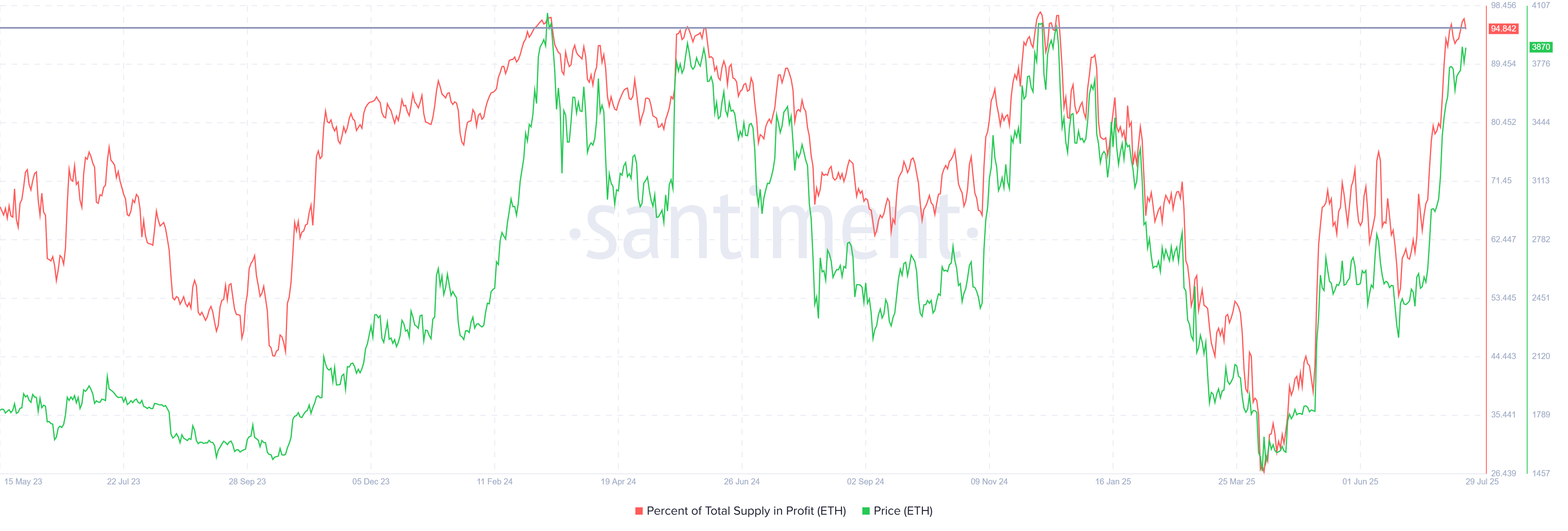

At present, a staggering 94% of Ethereum’s total supply is in the green. History, that great playwright, has shown us that when the profitable supply breaches 95%, it often heralds the end of the show—a market top, if you will. This has invariably been followed by a swift and sometimes brutal correction as investors rush to take their bows and exit stage left. If this trend persists, dear reader, Ethereum’s price may face a precipitous drop, threatening to erase the recent gains that have had everyone on the edge of their seats.

Market tops, much like the climax of a Shakespearean tragedy, often signal that the bull run has reached its zenith, and the audience begins to thin as investors sell off their shares. This exodus could dampen Ethereum’s upward momentum, as the market grapples with the reality of potential oversaturation.

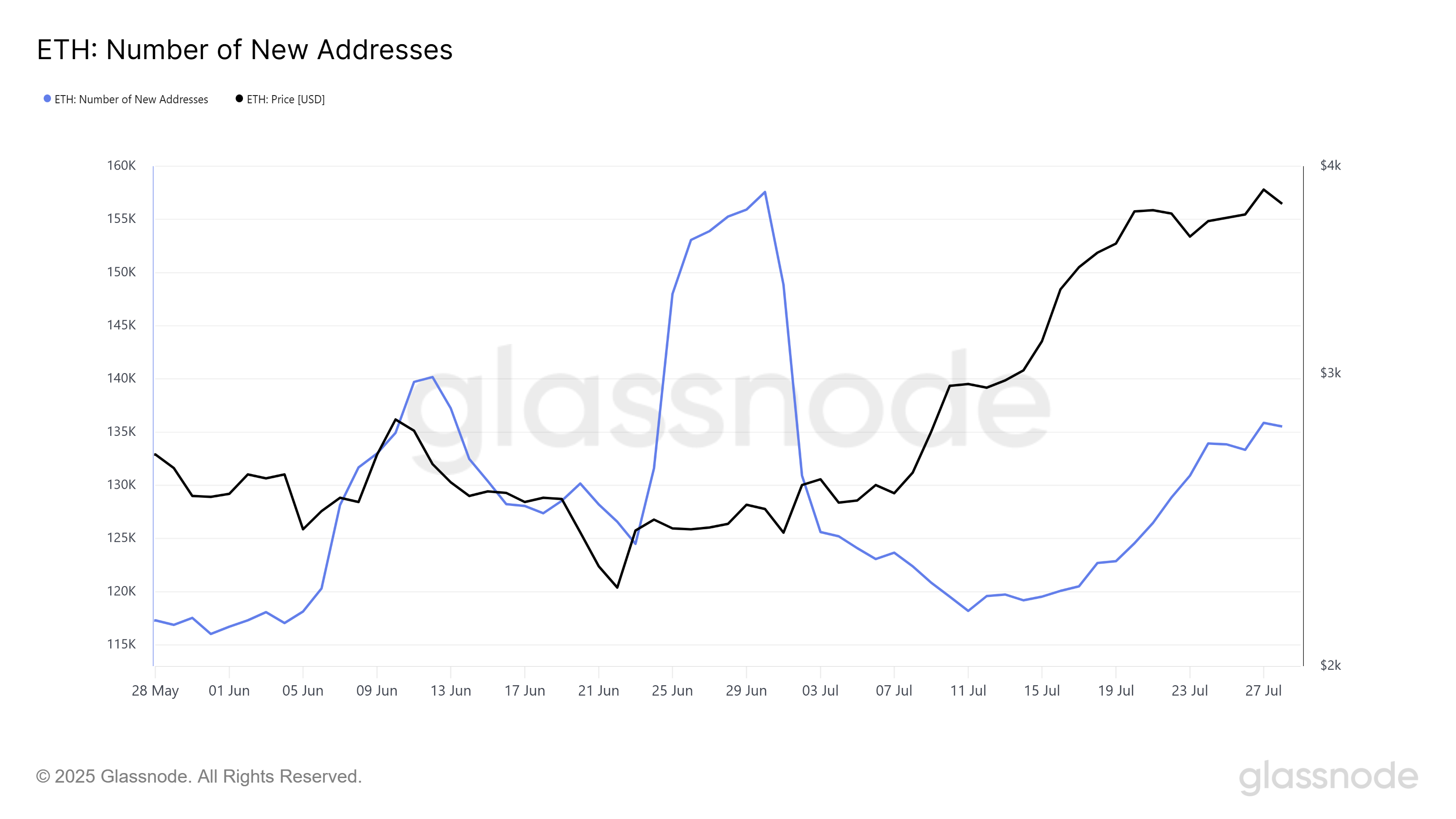

Ethereum’s macro momentum has been a tale of two halves, with the creation of new addresses playing a pivotal role. Earlier this month, the number of new addresses spiked dramatically before plummeting like a lead balloon. However, recent data suggests a modest 13% uptick in new addresses over the last 10 days, climbing from 119,184 to 135,532. If this trend continues, it might just provide the necessary support to keep Ethereum’s price afloat, buoyed by the fresh blood of new investors eager to join the fray.

ETH’s Quest for the Holy Grail

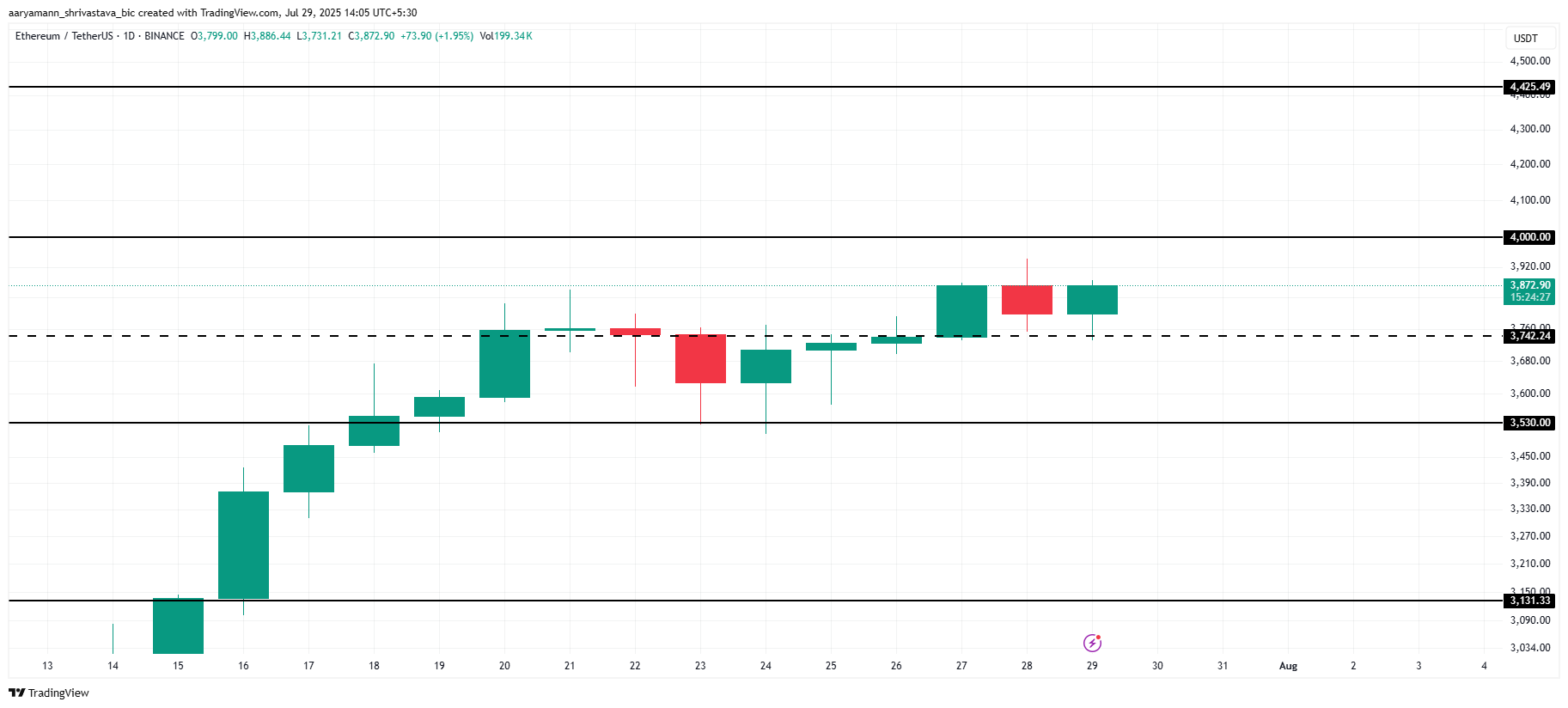

Ethereum’s current valuation stands at a respectable $3,872, comfortably above its local support level of $3,742. While the elusive $4,000 mark looms large on the horizon, ETH has yet to muster the strength to claim this coveted prize. This resistance could persist, acting as a formidable obstacle to any immediate aspirations of further gains.

Should the market top indeed signal a reversal, Ethereum’s price could tumble to $3,530 or even lower, perhaps as far as $3,131. Such a dramatic fall would not only erase the recent gains but also cast a pall over the bullish sentiment that has fueled Ethereum’s ascent. 🌪️

Conversely, if the influx of new addresses continues and gathers steam, Ethereum might finally breach the $4,000 barrier. In such a scenario, ETH could soar to $4,425, marking a triumphant return to form and invalidating the bearish narrative. This would usher in a new era of bullish optimism, much to the delight of those who have remained steadfast in their belief in Ethereum’s potential. 🎉

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- Bitcoin Takes a Nosedive, Heads for Uplift? 😱📈

- ETH PREDICTION. ETH cryptocurrency

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

- XRP Staking: A Tale of Tension and Tokens 🚀

- SHIB Price Drama: Will Shiba Inu Rise from the Ashes or Plummet into Oblivion?

2025-07-30 02:16