So, GameSquare Holdings, Inc. has decided that buyouts are so last season and splurged $5.15 million on CryptoPunk #5577. Yep, you heard that right! They now have a digital pixel masterpiece as a strategic treasury asset. One can only hope it comes with a complimentary frame! 🖼️

Now, while NFTs have typically been the playground of clueless collectors, a new wave of daring companies is hoping to treat them like corporate cash—because who needs the boring green stuff when you can have a CryptoPunk, right? 🤑

NFT Insiders: ‘We’re Totally Serious About This’ 🤨

GameSquare’s daring decision places NFTs in the same realm as more traditional crypto reserves like Bitcoin and Ethereum. Someone get a fan, because it’s getting spicy!

Garga, the big guy over at Yuga Labs (you know, the masterminds behind the Bored Apes), has a crystal ball and predicts that NFT treasury companies will soon be the next big thing. “An APE-focused treasury sounds more fun than a boardroom meeting!” he mused. 🎉

“The world isn’t ready for NFT treasury companies, but they are coming anyway,” Garga boldly declared. 🦸♂️

Matt Medved from the Digital Art Council at Art Basel weighed in, casually reminding us that while the NFT market cap might seem pint-sized right now, it’s got room to grow—even if it might be more like a balloon animal than an actual balloon. 🎈

“But I think there’s way more to it. This won’t be just a cold finance strategy like what Michael Saylor is doing. It will involve real social dynamics,” said NFT investor Loki, channeling Professor Nerd. 🤓

Meanwhile, July’s NFT trading volume skyrocketed faster than a cat meme going viral! 🚀 A recent report from BeInCrypto noticed impressive surges in floor prices—CryptoPunks and Moonbirds are back, baby!

Holy NFTs! July Market is on Fire! 🔥

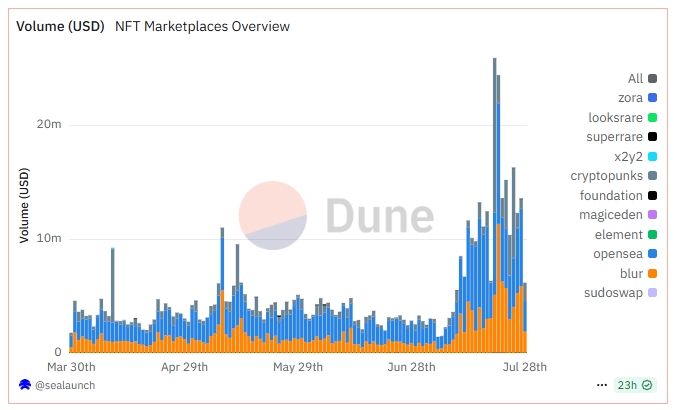

According to Dune data, NFT marketplace volumes exploded in July. One day, they hit a jaw-dropping $26 million. Talk about a 9 to 5 job! 🕒

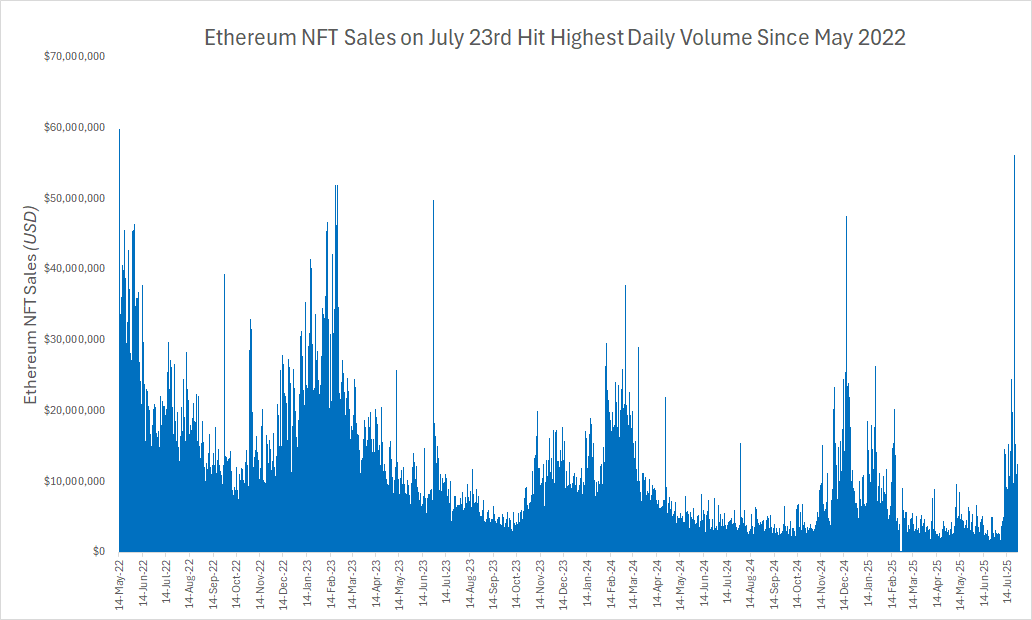

On the 23rd, Nathan Frankovitz from VanEck noticed Ethereum NFT trading volume spiked to its highest level since May 2022. Sounds like folks suddenly remembered that NFTs exist! 🤷♀️

This surge is the perfect excuse for businesses to consider these whimsical assets for their strategic reserves. GameSquare may be our trendsetting hero—but let’s not jump the shark just yet!

Should this trend gain traction, darling NFT collections like Pudgy Penguins, CryptoPunks, and Bored Apes will likely get all the cash flow love. Spoiler alert: according to OpenSea, these collections are the cool kids at the NFT lunch table. 🍕

Is NFT Value a Mirage? 🤔

Despite NFT industry leaders dreaming of a corporate finance revolution, the value of these digital trinkets is still hotly debated even among the crypto elite. 🥵

Anatoly Yakovenko, the co-founder of Solana, dropped some truth bombs recently, likening NFTs and memecoins to “digital slop” without any real cake—like a mobile game loot box, only less entertaining.

“I’ve said this for years. Memecoins and NFTs are digital slop and have no intrinsic value. Like a mobile game loot box. People spend $150B a year on mobile gaming,” Yakovenko slapped down. 🚫

Questions about using crypto as a strategic reserve remain. NFT treasury firms might issue bonds for their shiny digital baubles—but if the bubble bursts, who will be left holding the proverbial bag? 🎒

In the end, for assets to be considered solid gold (or at least something shiny), they need to show sustainable growth. But if history’s any indicator, NFTs might be more fairy dust than fortress. 🏰

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- XRP Staking: A Tale of Tension and Tokens 🚀

- Bitcoin’s Dramatic Fall Puts Strategy’s Holdings in Crisis Mode! What Happens Next?

- TAO PREDICTION. TAO cryptocurrency

- Silver Rate Forecast

2025-07-29 16:12