Ah, the grand spectacle of what our dear President Donald Trump has christened “Crypto Week”! The air is thick with excitement, but let us not forget, my friends, that experts are wagging their fingers, cautioning against premature jubilation in the cryptocurrency realm. 😏

The House of Representatives, in a flurry of activity, has passed three monumental bills aimed at taming the wild beast that is digital assets. A pivotal moment, indeed, but do not hold your breath for immediate changes, for these legislative whims are likely to take their sweet time coming into effect.

Three Key Crypto Bills Passed

The three bills—the Genius Act, the Digital Asset Market Clarity Act, and the Anti-CBDC Surveillance State Act—are hailed as crucial steps toward establishing a regulatory framework for cryptocurrencies. 📜

This legislative fervor has been stoked by the relentless lobbying efforts of industry titans like Coinbase Global, who have successfully bent the ears of politicians, including our dear Trump. 💸

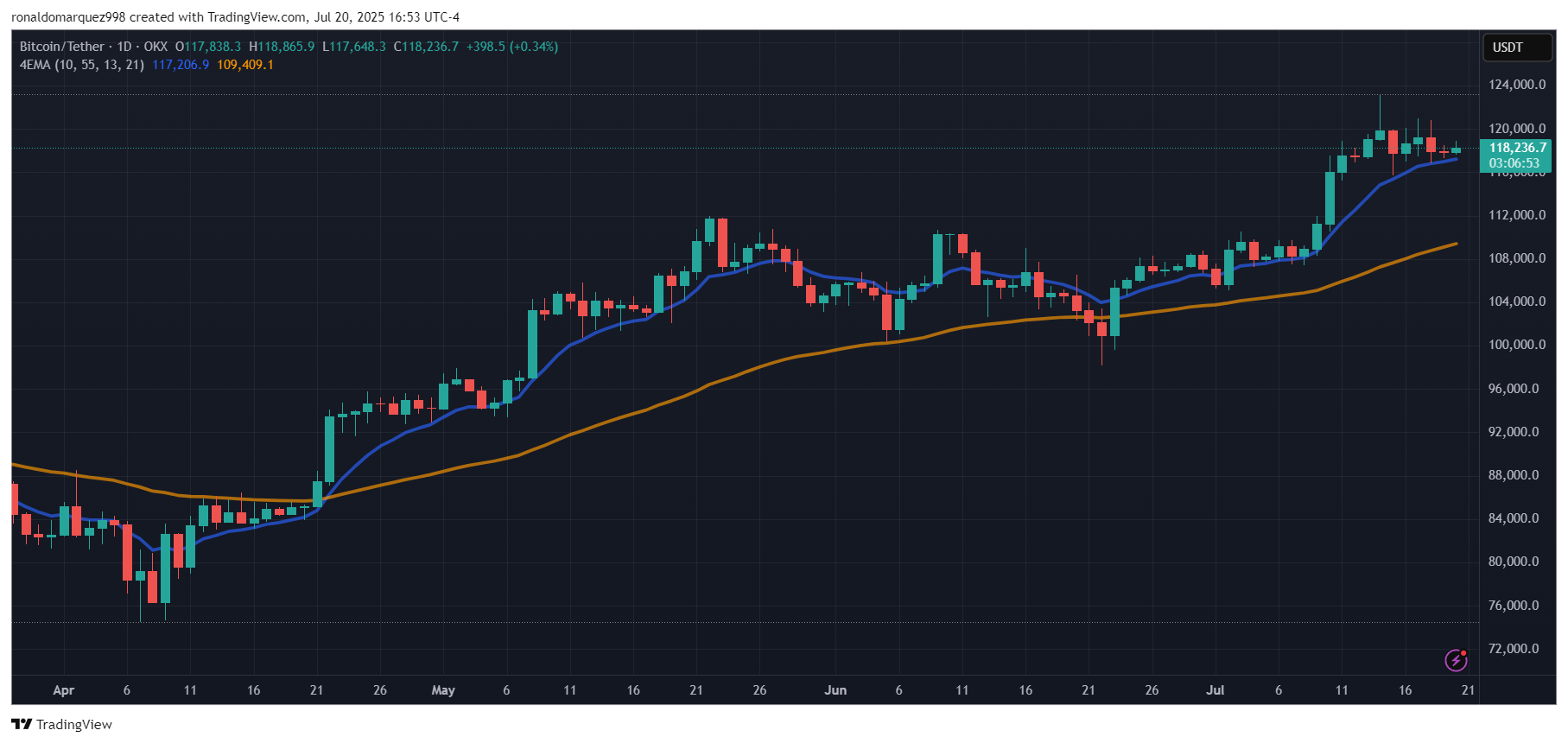

In anticipation of this grand week, Bitcoin prices soared to record highs, surpassing the $123,000 mark for the first time, with Ethereum (ETH) and XRP not far behind. However, TD Securities analyst Jaret Seiberg reminds us that it could take over a year for these new laws to see the light of day. 🕰️

Among the passed bills, only the Genius Act has also cleared the Senate, and Trump signed it into law with a flourish. This act establishes a framework for regulating payment stablecoins, requiring issuers to maintain one-to-one reserves in US dollars or Treasury securities. 🏦

Treasury Secretary Scott Bessent has grandly proclaimed that this law could generate an additional $3.7 trillion demand for T-bills. However, some analysts, like Raymond James’ Ed Mills, are rolling their eyes at such lofty projections. 🙄

Implementation Timeline Remains Uncertain

Despite the signing of the Genius Act, stablecoin issuers like Circle Internet Group and Tether can rest easy, for there will be no immediate impacts. 😌

The Treasury Department is expected to draft rules within a year, detailing the qualifications for issuing stablecoins and the conditions for foreign-pegged stablecoins entering the US market. This process will involve public commentary and could lead to litigation, suggesting a lengthy timeline before any real changes are felt. 📝

The Digital Asset Market Clarity Act, meanwhile, is particularly important as it delineates the regulatory oversight of crypto exchanges, brokers, and tokens between the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). 🏛️

With bipartisan support in the House, there is optimism that the Senate will pass its version before the upcoming August recess, potentially delivering a unified law for the president’s signature by September. 📅

The Anti-CBDC Surveillance State Act, the third piece of legislation, aims to prevent the Federal Reserve from issuing a central bank digital currency (CBDC). This bill, which passed with narrower margins, was attached to a national defense bill, and its future in the Senate will likely involve protracted negotiations, possibly extending until December. 🕵️♂️

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Crypto Market Madness 🚀

- SPX PREDICTION. SPX cryptocurrency

- HBAR PREDICTION. HBAR cryptocurrency

- UK Adopts a Quixotic Crypto Quandary with BoE’s Capri-cious Stablecoin Strategy

- USD PLN PREDICTION

- JPMorgan & Coinbase Join Forces: Crypto Gets Its Official Big Kid Pants

- Winners & Whiners: PUMP Tokens Soar After Pump.Fun Grabs Padre, But Not Everyone’s Happy!

2025-07-21 04:37