The crypto world is abuzz, comrades! Exchange-traded funds (ETFs) are raking in cash like a babushka at a flea market, with a whopping $766 million flowing in on Friday, July 18th. And guess who’s stealing the show? Ether ETFs, of course! 🏆 They’re outpacing their bitcoin brethren, fueled by the unstoppable force that is Blackrock. It seems ether is finally getting the institutional love it deserves. 🥂

Blackrock Rules the Crypto Kingdom: $766M Flows In Daily

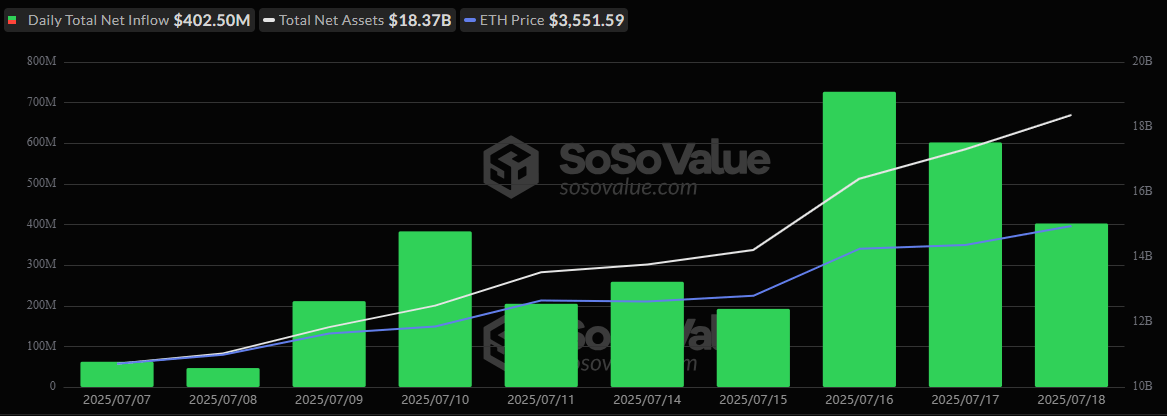

For the second day in a row, ether ETFs are leaving bitcoin ETFs in the dust. This isn’t just a coincidence, my friends, it’s a sign of the times! A combined $766 million poured into crypto ETFs, with ether funds capturing a cool $402.50 million while bitcoin products brought in a measly $363.45 million. Ouch! 😬

Out of that $402.50 million ether bonanza, Blackrock’s ETHA led the charge with a staggering $394.91 million inflow. Grayscale’s Ether Mini Trust chipped in $65.25 million, Bitwise’s ETHW added $13.03 million, and Vaneck’s ETHV threw in a paltry $2.61 million. Looks like some are still clinging to the old ways. 👴

There were a few brave souls who dared to sell, with Fidelity’s FETH (-$45.39 million) and Grayscale’s ETHE (-$27.92 million) seeing outflows. But the inflow tide was too strong, my friends, too strong! Ether ETF trading volume surged to $2.80 billion, and net assets reached a record $18.37 billion. Ether is on fire! 🔥

Meanwhile, over in the bitcoin ETF camp, Blackrock’s IBIT is still the king, raking in $496.75 million. It’s like a one-man show over there, swallowing up all the outflows from the other bitcoin ETFs. Only WisdomTree’s BTCW managed to join the party with a measly $3.11 million. Poor thing. 😔

Grayscale’s GBTC saw an $81.29 million outflow, followed by ARKB (-$33.61 million), FBTC (-$17.94 million), BITB (-$1.92 million), and HODL (-$1.66 million). Despite this, total bitcoin ETF trading volume hit $4.62 billion, and net assets remained a respectable $152.40 billion. Bitcoin is still holding its own, but the winds of change are blowing. 💨

As ether ETFs continue to steal the spotlight from bitcoin, the data tells a clear story: institutions are no longer seeing crypto as just bitcoin. Ether is finally getting its due, taking its rightful place at the institutional table. The future is looking bright for the little brother, comrades! 💫

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- Cristiano Ronaldo’s Meme Coin: A Scandalous 15-Minute Financial Farce 🤡💸

- Will the Bank of England’s Stablecoin Limits Stick? 🤯🤑

- Bitcoin Takes a Nosedive, Heads for Uplift? 😱📈

- ETH PREDICTION. ETH cryptocurrency

2025-07-19 21:57