Oh, what a lark! As the market froths with excitement, those delightful analysts are now wagering that Ethereum might gallop to $8,000 quicker than a tipsy lord at a country fête. 😂

Ethereum Clears Resistance, Bulls Set Eyes on $4,950 Next

Ethereum (ETH) is staging a positively riotous rally this July, surging over 44% in the last month and a cheeky 5% in the past day, scaling peaks at $3,640 before a modest retreat to $3,570. This frenzy owes much to the largesse of institutions, the buzz around ETFs, and the insatiable appetite for DeFi playgrounds and Layer 2 escapades like Arbitrum and Optimism. How very modern! 🚀

The recent vault over the tiresome $3,200–$3,400 barrier has shattered the old bearish patterns, heralding a bullish frolic. Per TradingView’s scribblings, Ethereum now lounges above critical moving averages, with the 200 EMA acting as a sturdy cushion around $2,944. Charming, isn’t it? 😏

Derivatives and Liquidations Fuel Momentum

Ethereum’s escapades extend to the derivatives den, where open interest puffed up by 4.09% to $52.13 billion, and trading volume exploded to $168.08 billion. Meanwhile, a whopping $136 million in short positions were unceremoniously liquidated, sparking what the experts call a short squeeze—sending ETH soaring with barely a whimper of resistance. The long/short ratio on Binance hit 3.00, betraying the bulls’ growing ardor. Next stop? $4,100, with audacious aims at $4,950 if this charade persists. Bravo! 💥

Binance’s long/short ratio crossing 3.00 reveals growing bullish conviction among institutional traders. Analysts suggest the next key resistance sits at $4,100, with extended targets reaching $4,950 if momentum continues.

Keeping this paragraph as is since it’s repeated in the original, but I’ll integrate it smoothly

Ethereum ETF News Spurs Long-Term Bullish Outlook

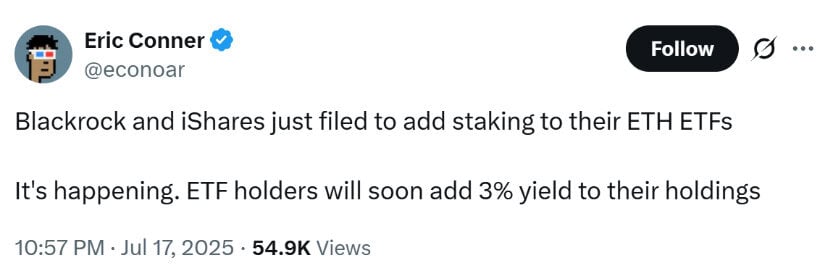

A major instigator of this hullabaloo is the ETF euphoria. BlackRock, that colossal financial behemoth, has filed to sprinkle staking magic on its Ethereum ETF, with iShares hot on its heels. It seems the institutions can’t get enough of ETH’s yield-bearing charms. 😌

This week, Ethereum ETFs raked in $990 million, ballooning total inflows to $5.5 billion since their debut, as per CoinShares. Ethereum’s underpinnings are supposedly ironclad—with ETFs opening the floodgates and staking adding a dash of profit, it’s being touted as the must-have bauble for serious investors. How quaint! 💰

Layer 2 Expansion and Ecosystem Strength

Beyond the price capers, Ethereum’s Layer 2 realms are buzzing like a beehive. Outfits like Arbitrum, Optimism, and zkSync are seeing transaction volumes and TVL skyrocket, a testament to their burgeoning popularity and clever scalability tweaks. Meanwhile, fresh DeFi and payment schemes are cropping up, bolstering Ethereum’s utilitarian facade. With whales hoarding more and innovation bubbling, Ethereum clings to its throne. “Ethereum’s role as the backbone of decentralized finance remains unmatched,” quips crypto analyst Michelle DG with a straight face. “We’re witnessing a renaissance in Ethereum-native applications!” One might almost believe it. 🎭

Could Ethereum Really Reach $8,000—or Even $20,000?

The rosiest forecasts now eye $8,000 by early 2026, with a few daredevils muttering about $20,000 in the next bull romp. Crypto sage Colin Talks Crypto is bandying about figures between $15,000 and $20,000, drawing on historical hysterics and bull market multipliers. Ethereum still languishes 25% below its zenith, but with this buoyant spirit and improving economic vibes, the party might just be warming up. If the current dash holds and ETF cash keeps flowing, that $8K target could be downright modest. Or a complete farce—who’s to say? 🤡

Ethereum RSI and Technical Signals

The charts, ever the faithful squires, underscore this surge but whisper of caution. Ethereum’s RSI has hit 80, screaming overbought, yet in these frenzied bull markets, such warnings often go unheeded for ages. The MACD is back to heights unseen since late 2023, a sign that’s historically heralded good times. If Ethereum clings to $3,400, advances to $4,100 and further seem plausible. A tumble below $3,200 might cramp the style, but it’s unlikely to derail the grand narrative. How droll! 📈

Final Thoughts: Ethereum’s $8K Dream Is Turning Into Reality

Ethereum’s quest for $8,000 is no longer the stuff of pipe dreams but a narrative propped up by ETF mania, staking shenanigans, ecosystem bloat, and a market structure that’s as solid as a house of cards in a gale. With big money piling in and the crypto crowd in high spirits, Ethereum is flaunting its resilience once more. Short-term stumbles may occur, but the overarching saga suggests Ethereum could spearhead the next crypto carnival. Cheers to that, or perhaps a sigh—depending on your disposition. 🍷

While short-term corrections are possible, the broader picture suggests Ethereum could lead the next major crypto bull run.

Retaining this as it’s a direct repeat in the original

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- OKB PREDICTION. OKB cryptocurrency

- Silver Rate Forecast

- Asia’s Financial Rampage: Stablecoins and the Race for Supremacy

- ETH PREDICTION. ETH cryptocurrency

- JPMorgan: Bitcoin to Hit $170K-Gold’s New Rival?

2025-07-18 22:54