As Bitcoin (BTC) hovers tantalizingly beneath the illustrious $120,000 mark, one can’t help but wonder if the triumphant fanfare of its bullish march is fading into a rather dull hum. Yet, some wise sages in the realm of crypto analysis insist that this odyssey of BTC has not yet painted its final strokes on the canvas of market history.

One particularly audacious observer, known by the moniker Darkfost on CryptoQuant, has posited that our dear Bitcoin is poised for further ascension. With a flourish, he wields the Short-Term Holder (STH) Market Value to Realized Value (MVRV) indicator as his talisman, proclaiming it as cryptographic evidence of impending fortune.

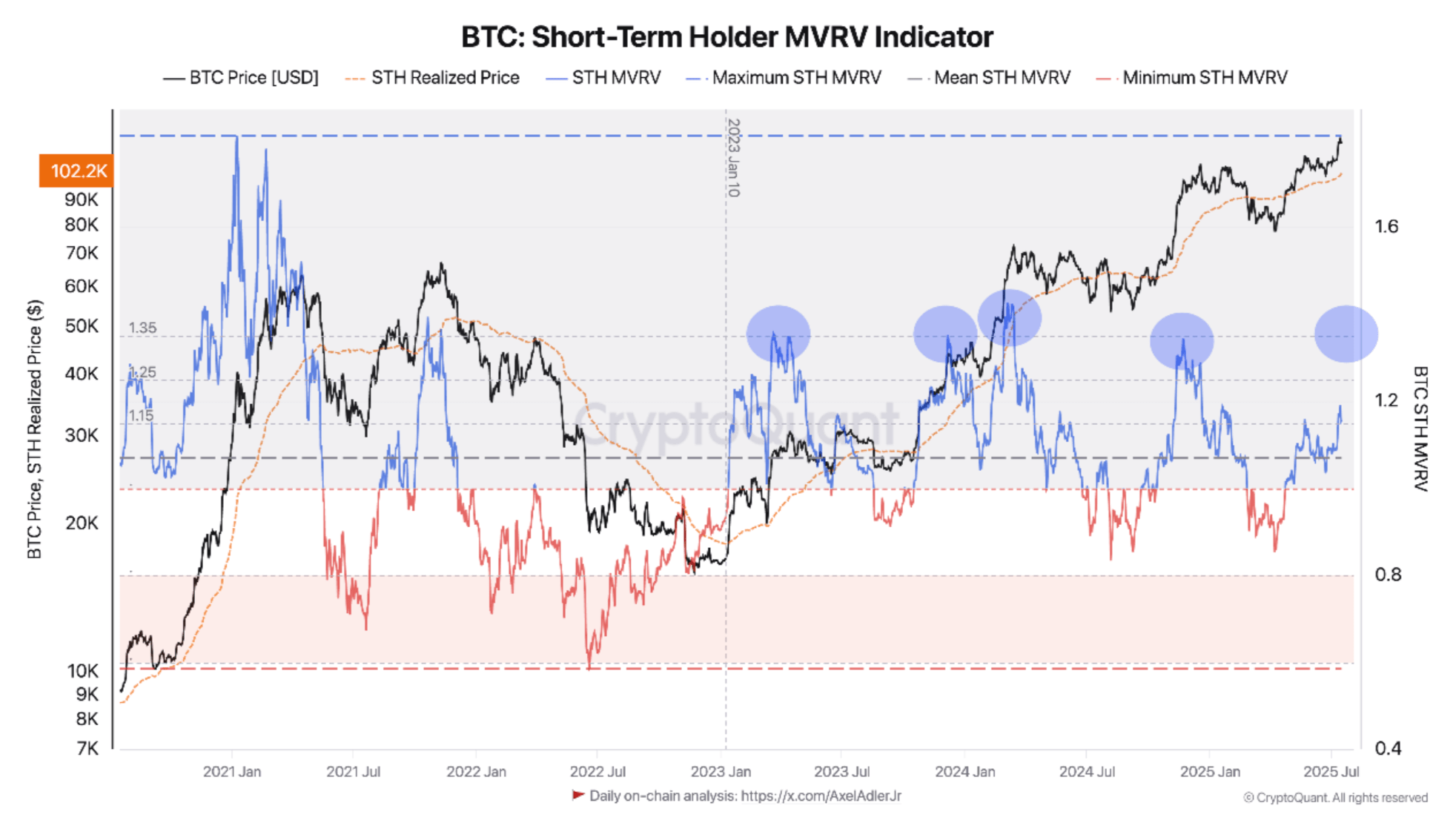

For those unacquainted, the STH MVRV concocts a fascinating brew measuring the profitability of Bitcoin nestled within the hands of our short-term speculators—individuals who have embraced BTC within the last 155 sunsets—by weighing the current market price against their original purchasing aspirations.

When the STH MVRV soars, it whispers sweet nothings of profits and suggests that holders may, in fact, make a dash for the exit. Conversely, when it languishes below the surface, it hints at undervaluation, perhaps teasing us with the prospect of an exhilarating surge ahead.

Darkfost, in his musings, revealed that the sun has yet to shine on unrealized profits, which currently remain shy of the fabled 42% threshold. Historically, whenever the STH MVRV flirts with the 1.35 mark—suggesting an unrealized profit of 35%—it invariably incites a wave of profit-seeking, leaving a trail of price pullbacks in its wake. Oh, the melodramas of the marketplace!

At present, the STH MVRV languishes at a modest 1.15, a far cry from the manicured gardens of profit-taking. Darkfost postulates that this phenomenon is attributed to the happy occurrence of the STH realized price breaching the $100,000 milestone for the very first time on July 11. Now, this realized price has strutted past the $102,000 threshold, providing BTC with a sturdy cushion of support—oh, how a little stability can change the tone!

For clarity, the STH realized price denotes the average price at which all Bitcoin swaddled in the arms of short-term holders was acquired. When the market price struts confidently above this level, it is a delightful indicator of burgeoning confidence amongst fresh investors.

Darkfost further entertains the notion that BTC could very well rise an additional 20–25% before the STH MVRV again approaches its critical summit. Should this be the case, Bitcoin might just ascend to heights unheard of, perhaps even reaching the zenith of $150,000 before the next flurry of profit-taking descends upon us.

As for liquidity, fresh tides may well bolster Bitcoin’s prospects. The sharp-eyed analyst Amr Taha from CryptoQuant recently illuminated a dazzling $2 billion USDT deposit into significant derivatives platforms, suggesting a potential buildup of leverage that could bend the market to its will.

Add to this a sprinkle of favorable macroeconomic conditions, and one finds risk-hungry assets such as Bitcoin poised to bask in the glow of optimism. The USD’s recent meandering has sparked a dance of capital, swirling toward the enticing embrace of cryptocurrencies and other daring ventures ripe with risk and reward.

Yet, a word of caution dances lightly upon the breeze; BTC inflows to centralized exchanges are on an upward trajectory, whispering tales of an impending correction just over the horizon. As of now, BTC flirts with a price of $118,862, a mere 0.2% dip in the past 24 hours. The drama never ends, does it?

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- USD CNY PREDICTION

- Will the Bank of England’s Stablecoin Limits Stick? 🤯🤑

- JPMorgan: Bitcoin to Hit $170K-Gold’s New Rival?

- Bitcoin Plunges: Is $70K the New Rock Bottom? 🚀💸

- Chainlink’s 2025 Hype? It’s a Wild Ride! 🚀

- Why Is Everyone Suddenly So Bullish About Stellar? 🚀 You Won’t Believe These 5 Price Targets!

2025-07-18 12:06