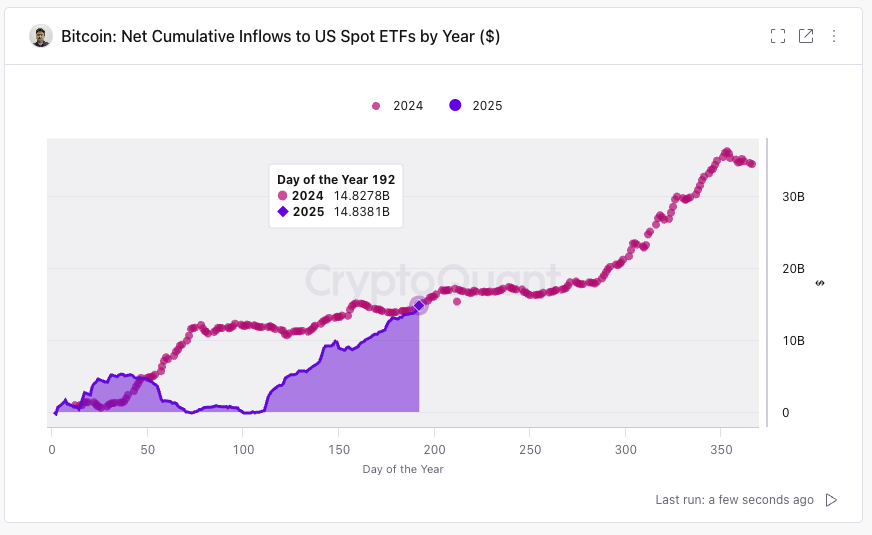

According to CryptoQuant’s Head of Research, Julio Moreno, cumulative inflows into these ETFs have reached a staggering $14.84 billion so far this year, just barely surpassing the $14.83 billion recorded by the same point in 2024. 📈💰

The insight was shared via a chart on X, highlighting a late surge in ETF demand that coincided with Bitcoin‘s climb to new all-time highs. 🚀🌕

After a slow start to the year marked by waning momentum and market uncertainty, interest in spot ETFs rebounded mid-year. 😴📈

The resurgence suggests growing confidence among traditional investors, who favor ETFs for their ease of access and custodial simplicity. 🏦💸

Approved in January 2024, Bitcoin spot ETFs quickly became a pillar of institutional crypto exposure in the U.S. Now, their 2025 inflow trajectory points to another strong year—even as the broader market faces macro headwinds. 🌪️🏦

Read More

- Gold Rate Forecast

- BNB PREDICTION. BNB cryptocurrency

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- Bitcoin’s September Doom: Will the Fed Save the Day? 🤔💸

- Bitcoin’s Agony and Ecstasy: A Tale of Two Coins and a Doomed ETF Massacre 🚀💔

- Brent Oil Forecast

- Crypto Heists: $142M Vanishes! 😱

- L1s Imploded in 2025… Except the Party Never Stopped? 😏

- 🤯 Korean Banks in Crypto Tryst! Stablecoin Scandal Revealed!

- Brazil’s Drex CBDC: Just Kidding, We Still Love Blockchain! 🤪

2025-07-17 07:52